- United States

- /

- Commercial Services

- /

- NasdaqGM:VIRC

We Think The Compensation For Virco Mfg. Corporation's (NASDAQ:VIRC) CEO Looks About Right

Performance at Virco Mfg. Corporation (NASDAQ:VIRC) has been rather uninspiring recently and shareholders may be wondering how CEO Robert Virtue plans to fix this. At the next AGM coming up on 22 June 2021, they can influence managerial decision making through voting on resolutions, including executive remuneration. It has been shown that setting appropriate executive remuneration incentivises the management to act in the interests of shareholders. We think CEO compensation looks appropriate given the data we have put together.

See our latest analysis for Virco Mfg

How Does Total Compensation For Robert Virtue Compare With Other Companies In The Industry?

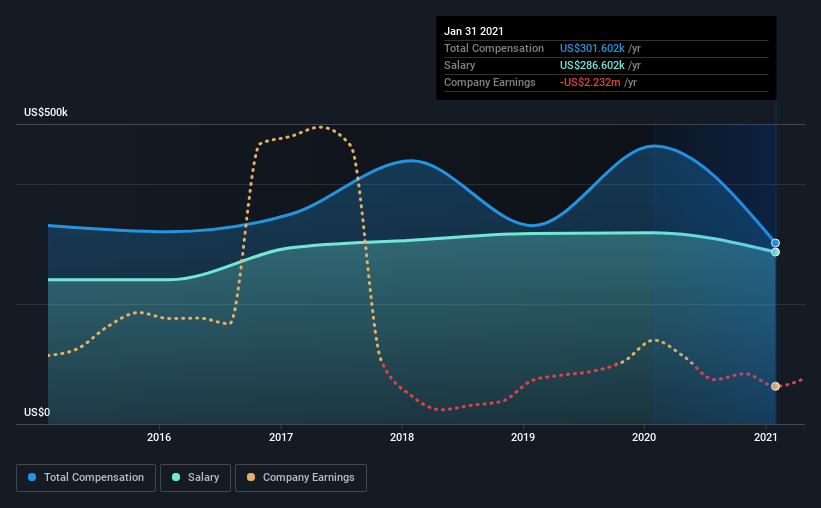

Our data indicates that Virco Mfg. Corporation has a market capitalization of US$58m, and total annual CEO compensation was reported as US$302k for the year to January 2021. That's a notable decrease of 35% on last year. We note that the salary portion, which stands at US$286.6k constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the industry with market capitalizations below US$200m, reported a median total CEO compensation of US$534k. In other words, Virco Mfg pays its CEO lower than the industry median. Furthermore, Robert Virtue directly owns US$16m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | US$287k | US$319k | 95% |

| Other | US$15k | US$145k | 5% |

| Total Compensation | US$302k | US$463k | 100% |

On an industry level, roughly 24% of total compensation represents salary and 76% is other remuneration. Investors will find it interesting that Virco Mfg pays the bulk of its rewards through a traditional salary, instead of non-salary benefits. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Virco Mfg. Corporation's Growth

Virco Mfg. Corporation's earnings per share (EPS) grew 53% per year over the last three years. Its revenue is down 11% over the previous year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's always a tough situation when revenues are not growing, but ultimately profits are more important. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Virco Mfg. Corporation Been A Good Investment?

Since shareholders would have lost about 18% over three years, some Virco Mfg. Corporation investors would surely be feeling negative emotions. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Virco Mfg pays its CEO a majority of compensation through a salary. The fact that shareholders are sitting on a loss is certainly disheartening. This contrasts to the strong EPS growth recently however, and suggests that there may be other factors at play driving down the share price. There needs to be more focus by management and the board to examine why the share price has diverged from fundamentals. In the upcoming AGM, shareholders will get the opportunity to discuss these concerns with the board and assess if the board's plan is likely to improve company performance.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We identified 2 warning signs for Virco Mfg (1 can't be ignored!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading Virco Mfg or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:VIRC

Virco Mfg

Engages in the design, production, and distribution of furniture in the United States and Canada.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives