- United States

- /

- Professional Services

- /

- NasdaqGS:UPWK

Is AI-Driven Growth and Lifted’s Launch Altering the Investment Case for Upwork (UPWK)?

Reviewed by Sasha Jovanovic

- Upwork reported record quarterly revenue of US$201.7 million and all-time high adjusted EBITDA, driven by strong demand in AI-powered projects and robust client activity for the third quarter ended September 30, 2025.

- The launch of Upwork's new subsidiary, Lifted, aims to expand its reach in the US$650 billion contingent work market while AI-fueled hiring also spiked, with a 52% year-over-year rise in AI-related gross services volume.

- We will examine how Upwork's continued growth in AI-related projects and enterprise solutions may influence its investment narrative going forward.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Upwork Investment Narrative Recap

To be a shareholder in Upwork, you need to believe that the company can capture ongoing demand for flexible talent solutions, especially as AI adoption accelerates the shift to freelance and contingent workforces. The latest quarterly results, with record revenue and a spike in AI-related projects, likely reinforce confidence in Upwork’s platform improvements as a near-term catalyst, but do little to resolve the underlying risk around slow new client acquisition and macro uncertainty.

The recent launch of Lifted, Upwork’s new subsidiary targeting the US$650 billion contingent workforce market, directly ties into management’s strategy to strengthen enterprise offerings, a key catalyst underpinning longer-term revenue expansion amid AI-fueled hiring trends. This move speaks to Upwork’s efforts to diversify its business and capture larger contracts beyond its traditional client base.

However, while momentum is building in high-demand areas, investors should not overlook the continued pressure on active client growth and the risks tied to...

Read the full narrative on Upwork (it's free!)

Upwork's narrative projects $906.3 million revenue and $147.8 million earnings by 2028. This requires 5.5% yearly revenue growth and a $97.6 million decrease in earnings from $245.4 million today.

Uncover how Upwork's forecasts yield a $21.40 fair value, a 33% upside to its current price.

Exploring Other Perspectives

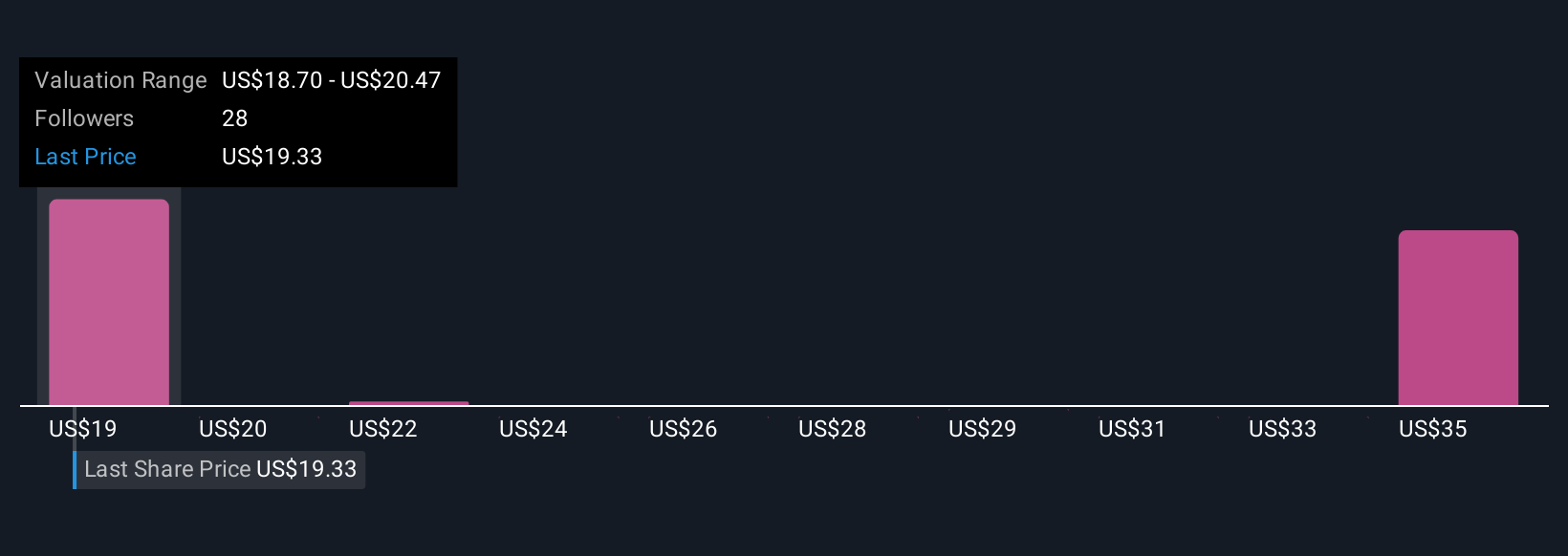

Four individual estimates from the Simply Wall St Community put Upwork’s fair value in a wide US$21.40 to US$43.80 range. While AI-driven project demand remains a catalyst, differences in opinion highlight how future client growth remains a central question for Upwork’s performance.

Explore 4 other fair value estimates on Upwork - why the stock might be worth over 2x more than the current price!

Build Your Own Upwork Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Upwork research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Upwork research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Upwork's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UPWK

Upwork

Operates a work marketplace that connects businesses with various independent professionals and agencies in the United States, India, the Philippines, and internationally.

Very undervalued with outstanding track record.

Similar Companies

Market Insights

Community Narratives