- United States

- /

- Commercial Services

- /

- NasdaqGS:TTEK

Tetra Tech (TTEK): Is There More Value Left After Recent Upward Momentum?

Reviewed by Simply Wall St

See our latest analysis for Tetra Tech.

Momentum has picked up for Tetra Tech recently, with the stock’s 1-month share price return at a strong 11.4%, even after a brief dip today. Looking at the bigger picture, however, total shareholder return for the past year is still down over 11%, reflecting the impact of earlier headwinds. At the same time, its 5-year total shareholder return stands at an impressive 53%, which demonstrates the company’s longer-term resilience and growth potential.

If you’re scouting for more companies showing compelling growth trends, now’s a smart moment to discover fast growing stocks with high insider ownership.

The key question now is whether Tetra Tech’s recent momentum signals a bargain entry point, or if the market has already factored in its future growth prospects. Is there still value left on the table for investors?

Most Popular Narrative: 15% Undervalued

Tetra Tech's narrative-implied fair value sits materially higher than its most recent close, painting an intriguing opportunity for investors if the narrative's assumptions hold. The premium arises from strong growth projections and robust margin targets mapped out through 2030.

Ongoing expansion of advanced digital automation and analytics offerings, catalyzed by rising adoption of AI and recent strategic acquisitions, positions Tetra Tech for higher-margin, tech-driven consulting services and recurring revenue streams. This supports long-term net margin and earnings growth.

Want to know the secret sauce driving this premium valuation? The narrative hinges on a dramatic transformation of Tetra Tech’s earnings mix, bold margin expansion, and game-changing revenue assumptions. Curious which future financial leaps back up that fair value? Only the full narrative reveals the specifics.

Result: Fair Value of $42.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifts in U.S. government funding priorities and the loss of certain federal contracts could present challenges for Tetra Tech’s path to consistent long-term growth.

Find out about the key risks to this Tetra Tech narrative.

Another View: The Earnings Multiple Tells a Different Story

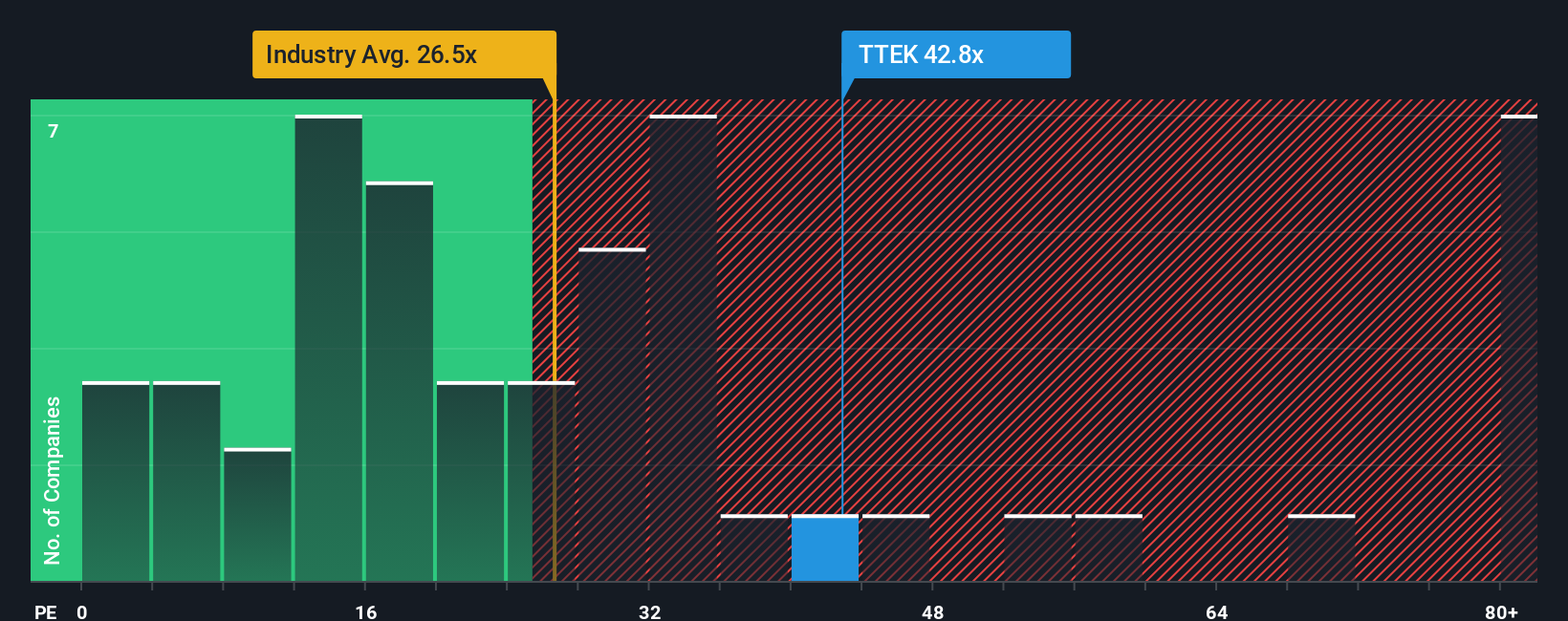

Looking at Tetra Tech’s valuation through the lens of the market’s common earnings yardstick adds some caution. The company trades on a price-to-earnings ratio of 43.8 times, noticeably higher than the US Commercial Services industry average of 23.3 times and its peer group at 32.9 times. It is also well above the fair ratio of 36 times that the market could eventually converge toward. This premium suggests investors are pricing in strong growth well ahead of its sector, but it also heightens downside risk if expectations are not met. Will this premium endure, or might the market demand evidence before sustaining such lofty multiples?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tetra Tech Narrative

If you see the story unfolding differently or want to run your own numbers, it takes less than three minutes to build your own perspective. Do it your way.

A great starting point for your Tetra Tech research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investing Moves?

Ready to broaden your strategy? Don’t let these market opportunities pass you by. Here are three powerful stock ideas you can act on today:

- Capitalize on sector innovation by tapping into these 25 AI penny stocks, shaping tomorrow’s industries and benefiting from rapid advances in artificial intelligence.

- Boost your future returns and secure your portfolio with these 16 dividend stocks with yields > 3% that offer strong yields and consistent cash payouts above 3%.

- Ride the next wave of financial evolution by exploring these 82 cryptocurrency and blockchain stocks, set to transform digital payments and blockchain applications worldwide.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tetra Tech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TTEK

Tetra Tech

Provides consulting and engineering services that focuses on water, environment, and sustainable infrastructure.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives