- United States

- /

- Commercial Services

- /

- NasdaqGS:TTEK

Tetra Tech (NASDAQ:TTEK) Could Easily Take On More Debt

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Tetra Tech, Inc. (NASDAQ:TTEK) does use debt in its business. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Tetra Tech

How Much Debt Does Tetra Tech Carry?

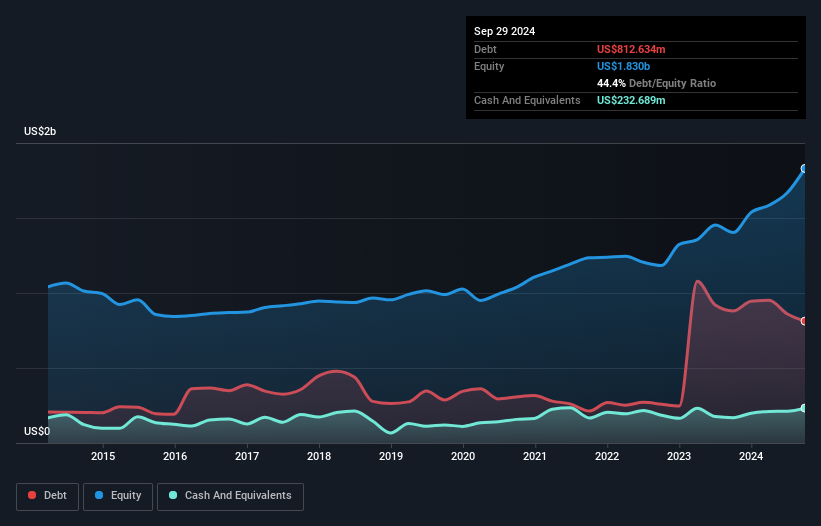

You can click the graphic below for the historical numbers, but it shows that Tetra Tech had US$812.6m of debt in September 2024, down from US$879.5m, one year before. However, it also had US$232.7m in cash, and so its net debt is US$579.9m.

A Look At Tetra Tech's Liabilities

According to the last reported balance sheet, Tetra Tech had liabilities of US$1.22b due within 12 months, and liabilities of US$1.14b due beyond 12 months. Offsetting this, it had US$232.7m in cash and US$1.20b in receivables that were due within 12 months. So its liabilities total US$926.5m more than the combination of its cash and short-term receivables.

Of course, Tetra Tech has a titanic market capitalization of US$10.7b, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Tetra Tech's net debt is only 0.99 times its EBITDA. And its EBIT easily covers its interest expense, being 13.7 times the size. So you could argue it is no more threatened by its debt than an elephant is by a mouse. Also positive, Tetra Tech grew its EBIT by 22% in the last year, and that should make it easier to pay down debt, going forward. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Tetra Tech's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Tetra Tech produced sturdy free cash flow equating to 79% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

Tetra Tech's interest cover suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. And the good news does not stop there, as its conversion of EBIT to free cash flow also supports that impression! Considering this range of factors, it seems to us that Tetra Tech is quite prudent with its debt, and the risks seem well managed. So the balance sheet looks pretty healthy, to us. Another factor that would give us confidence in Tetra Tech would be if insiders have been buying shares: if you're conscious of that signal too, you can find out instantly by clicking this link.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if Tetra Tech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:TTEK

Tetra Tech

Provides consulting and engineering services focusing on water, environment, and sustainable infrastructure in the United States and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026