- United States

- /

- Commercial Services

- /

- NasdaqGS:TTEK

Could Tetra Tech's (TTEK) Critical Minerals Push Reshape Its Role in U.S. Supply Chains?

Reviewed by Sasha Jovanovic

- American Rare Earths recently announced an expanded partnership with Tetra Tech to seek U.S. Government funding for the Halleck Creek critical minerals project, building on their work together since 2023.

- This collaboration leverages Tetra Tech's federal expertise and deep project knowledge to pursue funding aligned with U.S. supply chain security and national defense objectives.

- We'll explore how Tetra Tech's role in advancing critical minerals supply chains could impact its investment narrative and future prospects.

Find companies with promising cash flow potential yet trading below their fair value.

Tetra Tech Investment Narrative Recap

Investors in Tetra Tech need to believe in the company’s ability to secure new federal and defense-related contracts to offset recent declines in other government work and stabilize revenue. The expanded partnership with American Rare Earths may offer incremental growth opportunities within the critical minerals sector, but this news is not likely to materially shift the most important short-term catalyst or address the biggest risk, ongoing revenue uncertainty from the loss of USAID and Department of State contracts.

One of the most relevant recent announcements is Tetra Tech’s $249 million global contract with the U.S. Army Corps of Engineers, reinforcing its presence in large federal projects. While this aligns with the key catalyst of expanding the public sector pipeline, it also highlights the risk that future success is increasingly tied to winning and executing major government projects as sector priorities shift.

However, investors should also be aware that, despite positive developments, the risk of persistent backlog stagnation remains, especially if contracting activity…

Read the full narrative on Tetra Tech (it's free!)

Tetra Tech's outlook suggests revenues of $4.7 billion and earnings of $559.6 million by 2028. This implies an annual revenue decline of 0.8% and an earnings increase of $343.5 million from the current $216.1 million.

Uncover how Tetra Tech's forecasts yield a $42.17 fair value, a 21% upside to its current price.

Exploring Other Perspectives

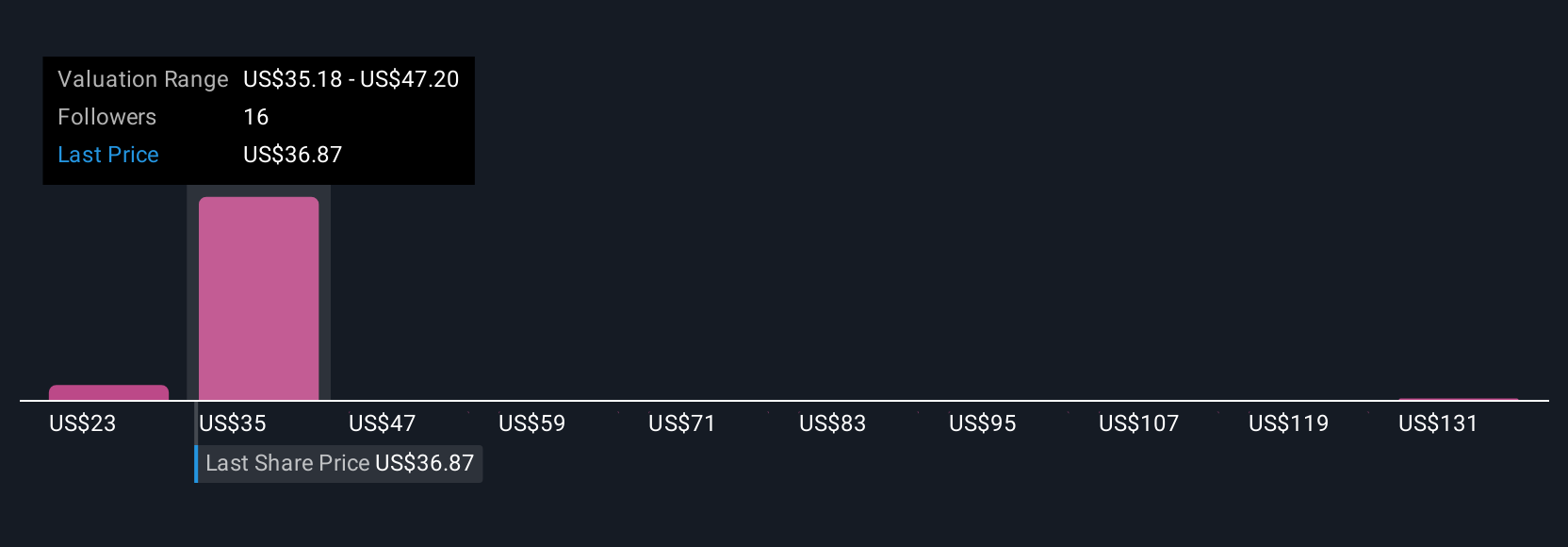

Four different fair value estimates from the Simply Wall St Community range from US$23.16 to US$42.17 per share. While retail investor opinions vary widely, the company’s exposure to shifting federal contract budgets remains a focus for future performance and is worth contrasting with the consensus narrative.

Explore 4 other fair value estimates on Tetra Tech - why the stock might be worth as much as 21% more than the current price!

Build Your Own Tetra Tech Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tetra Tech research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Tetra Tech research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tetra Tech's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tetra Tech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TTEK

Tetra Tech

Provides consulting and engineering services focusing on water, environment, and sustainable infrastructure in the United States and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026