- United States

- /

- Commercial Services

- /

- NasdaqGS:TILE

How Investors Are Reacting To Interface (TILE) Redeeming $300M in Senior Notes Pending Refinancing

Reviewed by Sasha Jovanovic

- On November 18, 2025, Interface, Inc. delivered a notice of conditional redemption for all US$300,000,000 outstanding principal amount of its 5.50% Senior Notes due 2028, with the redemption set for December 3, 2025, contingent on securing suitable new financing or sufficient funds.

- This planned debt redemption highlights Interface's efforts to potentially lower interest expenses or strengthen its balance sheet flexibility depending on the outcome of its refinancing activities.

- To assess how this possible debt redemption could affect Interface’s future performance, we’ll explore its implications on margin growth and investment capacity.

Find companies with promising cash flow potential yet trading below their fair value.

Interface Investment Narrative Recap

Being a shareholder in Interface today means believing in the company’s ability to capture rising demand for sustainable commercial flooring, while managing its exposure to regional economic shifts, competition, and cost pressures. The recent announcement of a conditional redemption of US$300,000,000 in senior notes could, if completed on favorable terms, support margin improvement and investment flexibility; however, its immediate impact on the main short-term catalyst, growing backlog and retrofit demand, appears limited. The biggest near-term risk remains concentrated reliance on the US market for growth and revenue stability.

Among Interface’s recent announcements, the regular quarterly cash dividend of US$0.02 per share, declared just days before the debt redemption notice, stands out. This continued dividend is relevant in the context of the company’s liquidity and financial discipline, which are key for funding margin expansion and expansion into new growth segments.

By contrast, investors should also be aware that growing competition from lower-priced global manufacturers remains a significant risk to Interface’s ability to sustain price premiums and margin growth…

Read the full narrative on Interface (it's free!)

Interface's outlook forecasts $1.6 billion in revenue and $133.7 million in earnings by 2028. Achieving this would require 5.3% annual revenue growth and a $37.7 million earnings increase from the current $96.0 million.

Uncover how Interface's forecasts yield a $35.00 fair value, a 36% upside to its current price.

Exploring Other Perspectives

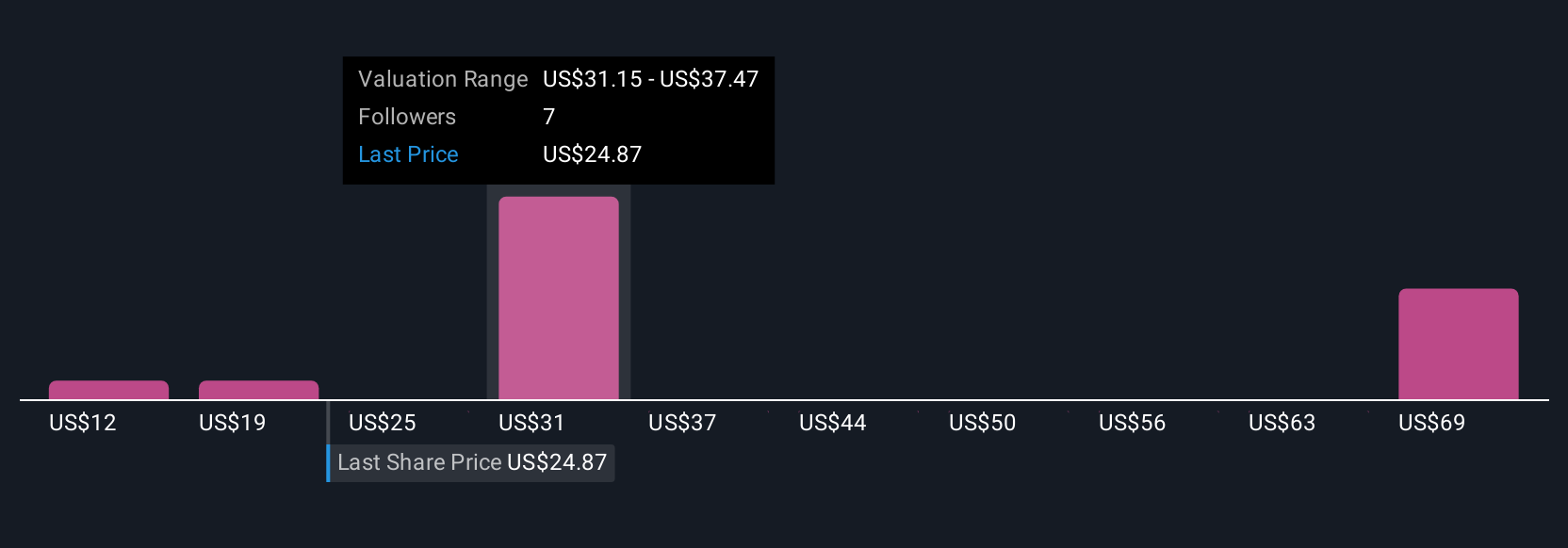

Four retail investors in the Simply Wall St Community assigned Interface fair value estimates ranging widely from US$19.82 to US$56.48 per share. Against these varied opinions, ongoing competition from global flooring manufacturers may exert pressure on future profitability, highlighting the importance of considering multiple perspectives on Interface’s prospects.

Explore 4 other fair value estimates on Interface - why the stock might be worth over 2x more than the current price!

Build Your Own Interface Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Interface research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Interface research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Interface's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TILE

Interface

Designs, produces, and sells modular carpet products in the United States, Canada, Latin America, Europe, Africa, Asia, and Australia.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives