- United States

- /

- Chemicals

- /

- NasdaqCM:ASPI

Top Growth Stocks With High Insider Ownership Including ASP Isotopes

Reviewed by Simply Wall St

As U.S. markets navigate the complexities of new tariffs and fluctuating economic indicators, investors are closely monitoring sectors that may be resilient or poised for growth despite these challenges. In this environment, companies with strong insider ownership can often signal confidence in their long-term potential, making them attractive considerations for those seeking growth opportunities.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (NasdaqGS:SMCI) | 14.2% | 29.8% |

| Duolingo (NasdaqGS:DUOL) | 14.4% | 37.1% |

| Hims & Hers Health (NYSE:HIMS) | 13.2% | 21.8% |

| Corcept Therapeutics (NasdaqCM:CORT) | 11.7% | 36.7% |

| Coastal Financial (NasdaqGS:CCB) | 14.5% | 46.3% |

| Astera Labs (NasdaqGS:ALAB) | 15.9% | 61.3% |

| BBB Foods (NYSE:TBBB) | 16.2% | 41.1% |

| Clene (NasdaqCM:CLNN) | 20% | 63.1% |

| Upstart Holdings (NasdaqGS:UPST) | 12.7% | 100.1% |

| Credit Acceptance (NasdaqGS:CACC) | 14.4% | 33.6% |

Let's dive into some prime choices out of the screener.

ASP Isotopes (NasdaqCM:ASPI)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ASP Isotopes Inc. is a development stage advanced materials company that specializes in the production, distribution, marketing, and sale of isotopes, with a market cap of $299.12 million.

Operations: ASP Isotopes Inc. currently does not have any reported revenue segments in its financial disclosures.

Insider Ownership: 23.7%

Revenue Growth Forecast: 45% p.a.

ASP Isotopes, with a focus on enriched isotopes for next-gen semiconductors, is experiencing rapid revenue growth, forecasted at 45% annually. Recent commencement of Silicon-28 production in South Africa aligns with this trajectory. Despite past shareholder dilution and high share price volatility, the company is expected to become profitable within three years. Insider ownership remains significant, though recent trading activity data is unavailable. A multi-year contract guarantees US$2.4 million annually from Carbon-14 production despite initial delays.

- Unlock comprehensive insights into our analysis of ASP Isotopes stock in this growth report.

- Our valuation report unveils the possibility ASP Isotopes' shares may be trading at a premium.

TaskUs (NasdaqGS:TASK)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TaskUs, Inc. is a company that offers digital outsourcing services across the Philippines, the United States, India, and other international markets with a market cap of approximately $1.22 billion.

Operations: TaskUs generates revenue primarily from its digital outsourcing services, with the Direct Marketing segment contributing $994.99 million.

Insider Ownership: 28.0%

Revenue Growth Forecast: 10.5% p.a.

TaskUs is leveraging its expertise in AI to drive growth, with the recent launch of its Agentic AI Consulting practice. Despite a decline in quarterly net income, TaskUs forecasts significant annual earnings growth of 29%, outpacing the US market. Revenue is expected to grow at 10.5% annually, slightly above market average. Insider ownership remains high, though recent trading activity data is unavailable. The company trades at a substantial discount to fair value estimates and has filed a $23.60 million shelf registration for ESOP-related offerings.

- Dive into the specifics of TaskUs here with our thorough growth forecast report.

- Our expertly prepared valuation report TaskUs implies its share price may be lower than expected.

VNET Group (NasdaqGS:VNET)

Simply Wall St Growth Rating: ★★★★☆☆

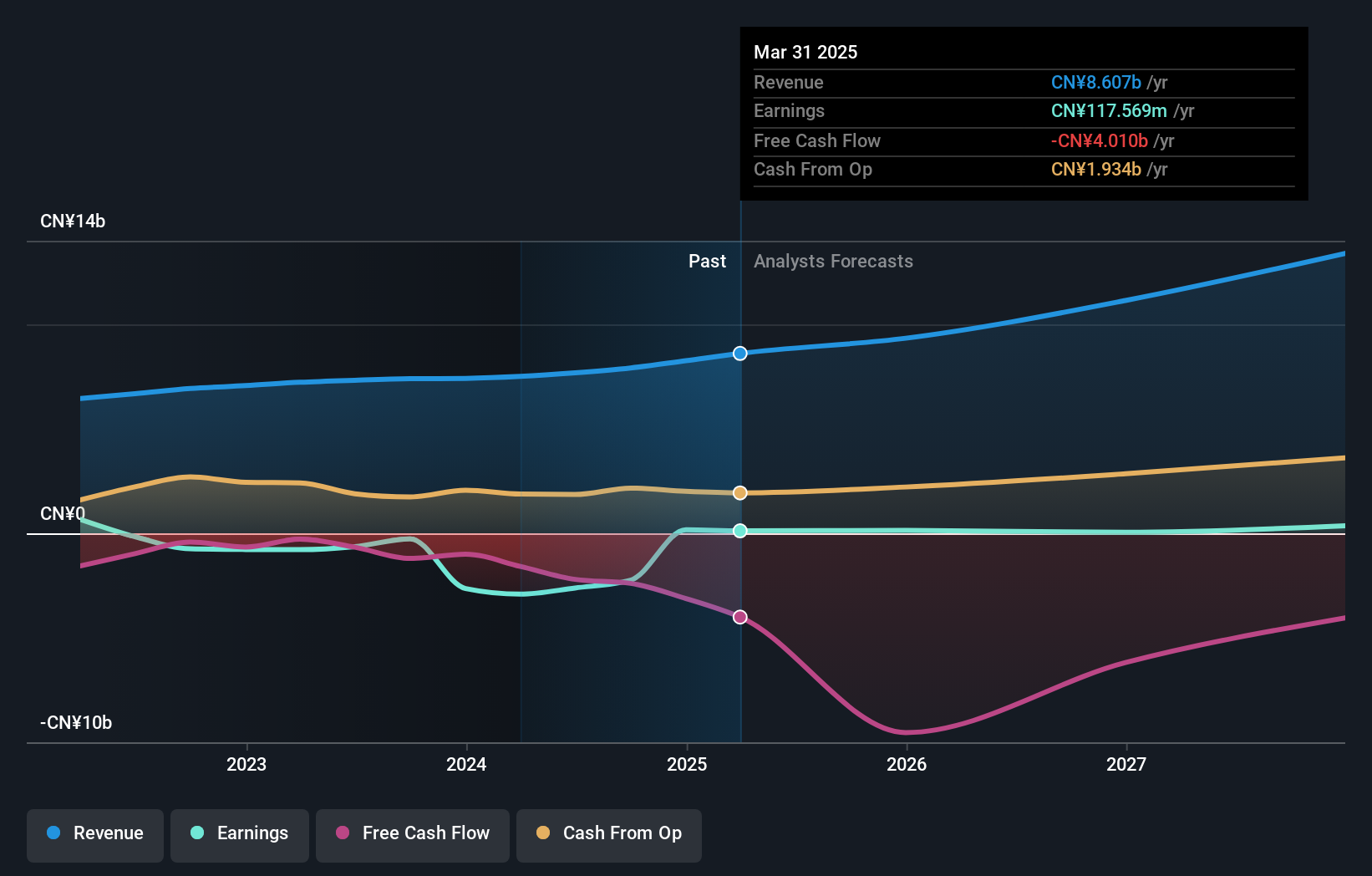

Overview: VNET Group, Inc. is an investment holding company that offers hosting and related services in China, with a market cap of approximately $2.38 billion.

Operations: The company generates revenue of CN¥8.26 billion from its hosting and related services in China.

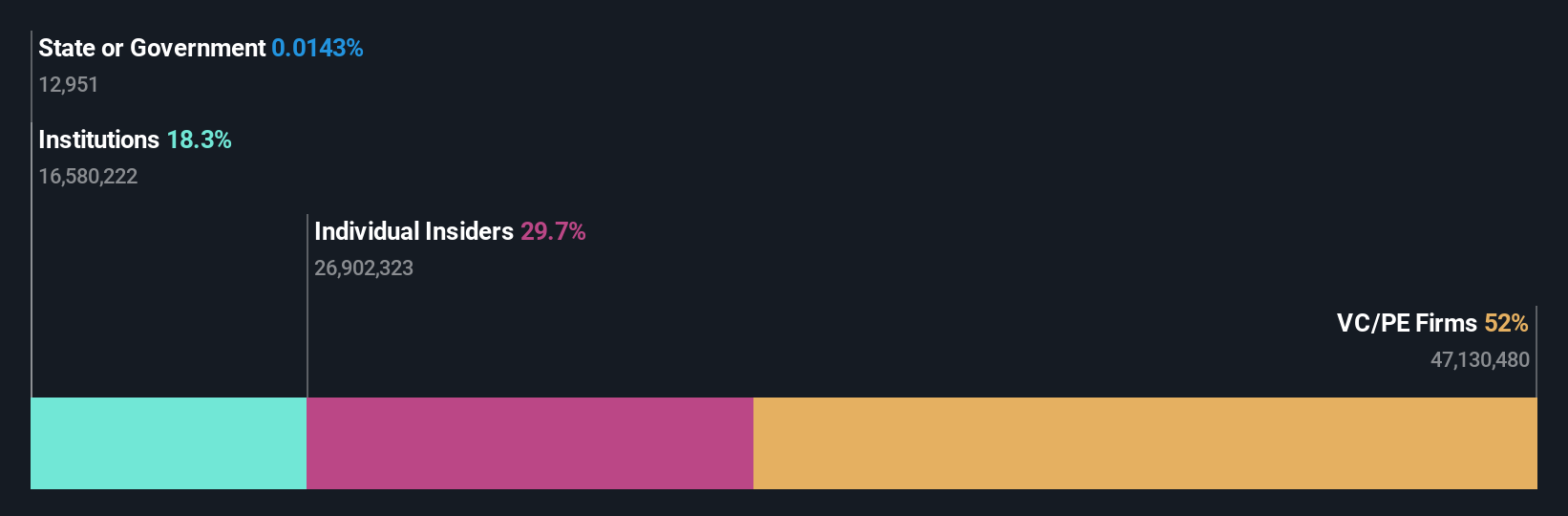

Insider Ownership: 10.6%

Revenue Growth Forecast: 13.8% p.a.

VNET Group's earnings are expected to grow significantly at 21.7% annually, surpassing the US market average of 14%, despite a forecasted slower revenue growth of 13.8%. The company recently became profitable, reporting a net income of CNY 183.2 million for 2024 compared to a significant loss the previous year. However, VNET faces challenges with low forecasted return on equity and interest payments not well covered by earnings, alongside high share price volatility.

- Get an in-depth perspective on VNET Group's performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, VNET Group's share price might be too optimistic.

Summing It All Up

- Explore the 203 names from our Fast Growing US Companies With High Insider Ownership screener here.

- Interested In Other Possibilities? Trump has pledged to "unleash" American oil and gas and these 20 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ASPI

ASP Isotopes

A development stage advanced materials company, engages in the production, distribution, marketing, and sale of isotopes.

Excellent balance sheet slight.

Market Insights

Community Narratives