- United States

- /

- Professional Services

- /

- NasdaqGS:SAIC

Is There Opportunity in SAIC After Recent 9.5% Drop and Analyst Upgrades?

Reviewed by Bailey Pemberton

- Ever ask yourself if Science Applications International is a hidden bargain, or if there is more risk than reward in its current stock price?

- The stock recently slipped by 2.2% over the past week and is down 9.5% for the past month, highlighting just how quickly investor sentiment can shift.

- Sector-wide jitters about government contract spending and shifts in the defense industry have been making headlines, and Science Applications International has been right in the middle of that conversation. After recent contract announcements and analyst upgrades, the market’s perception of the company’s future seems to be evolving.

- On the numbers front, Science Applications International scores a perfect 6 out of 6 on our undervaluation checks. However, valuation is never about just one number. Next, we will dig into the methods behind this rating and discuss why the real story sometimes requires reading between the lines.

Approach 1: Science Applications International Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's current value by projecting its expected future cash flows and then discounting those amounts back to today. This approach helps investors focus on the underlying business performance rather than just market sentiment.

For Science Applications International, the latest reported Free Cash Flow is $449.7 Million. Analysts have projected this figure to grow consistently, forecasting $595.2 Million by 2028. While direct analyst estimates are only available for the next five years, Simply Wall St extrapolates cash flows further and projects a generally steady trajectory through 2035.

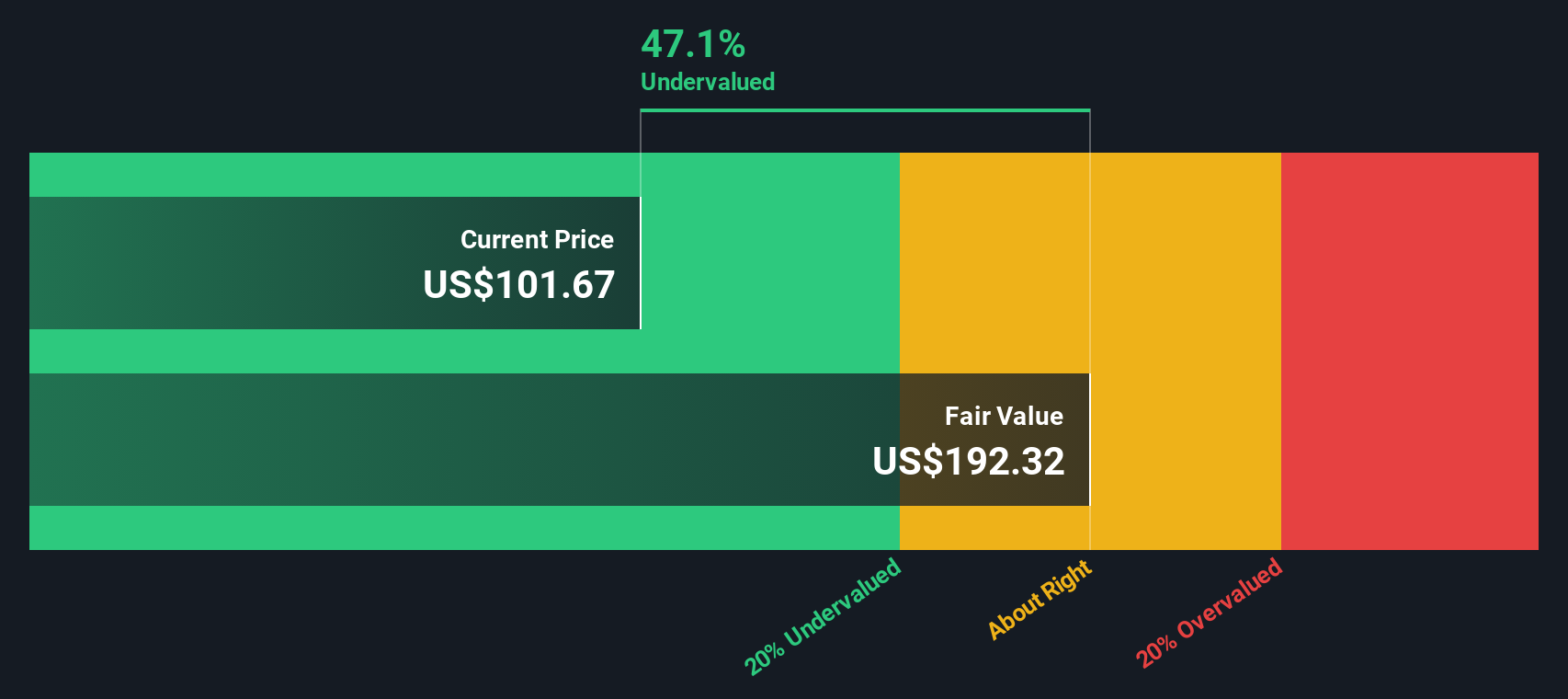

Applying the DCF method using a 2 Stage Free Cash Flow to Equity model yields an intrinsic value of $207.24 per share. This figure suggests the market is pricing Science Applications International at a 58.9% discount compared to its calculated fair value.

This sizable gap means the shares appear significantly undervalued based on the DCF approach, with future cash flows more than supporting today’s stock price. For investors seeking value backed by detailed cash generation forecasts, Science Applications International stands out as a compelling opportunity at present.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Science Applications International is undervalued by 58.9%. Track this in your watchlist or portfolio, or discover 917 more undervalued stocks based on cash flows.

Approach 2: Science Applications International Price vs Earnings

The Price-to-Earnings (PE) ratio is the go-to metric for valuing established, profitable companies like Science Applications International. It measures how much investors are willing to pay today for a dollar of the company’s earnings, making it a clear lens through which to view market sentiment around profitability and outlook.

What qualifies as a “normal” or “fair” PE ratio depends on a blend of growth expectations and risk. Companies set for above-average earnings growth, or those seen as low risk, tend to justify higher PE ratios. Meanwhile, those with slower growth or added risks usually trade at lower multiples.

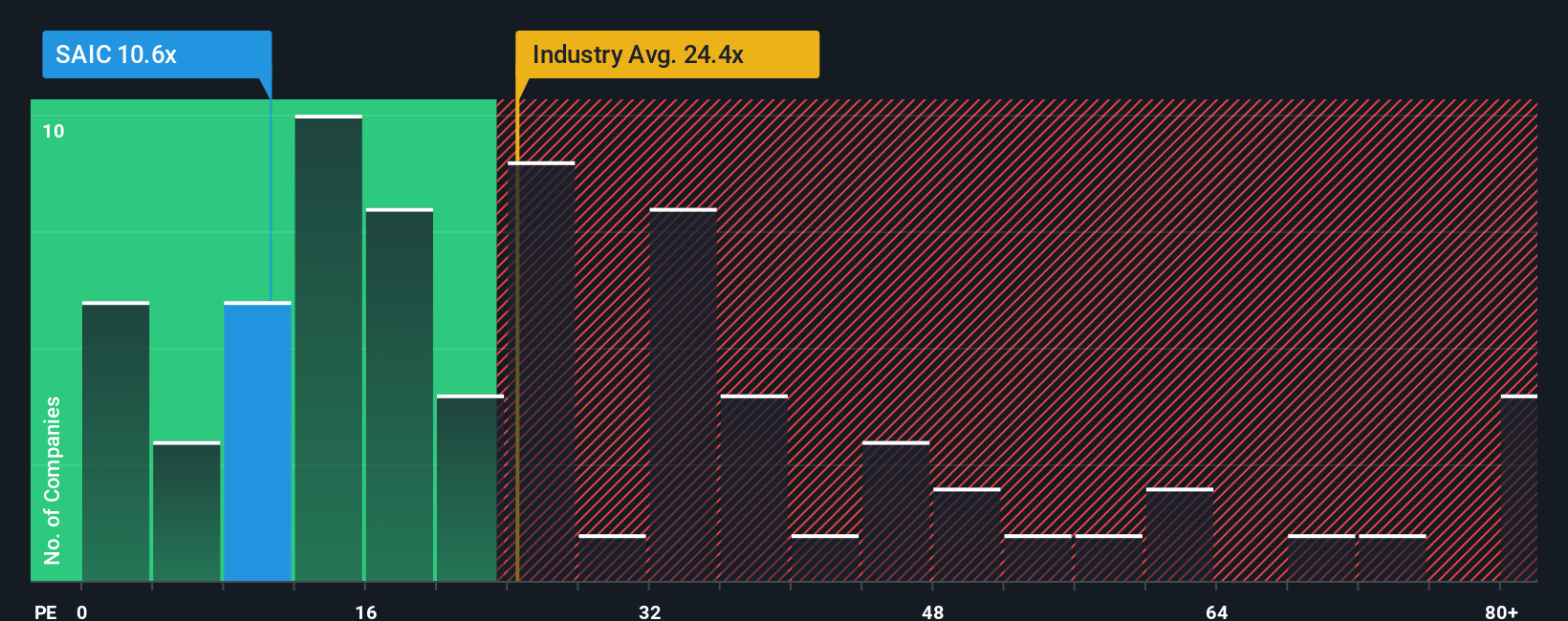

Currently, Science Applications International is priced at 9.8x, notably lower than both the Professional Services industry average of 24.0x and the average for its peers at 22.2x. Simply Wall St also calculates a Fair Ratio for SAIC at 18.6x. This is the multiple one might expect after considering the company’s historic growth, profit margins, market cap, and unique risk profile.

The Fair Ratio offers a more tailored benchmark than just the industry or peer averages because it accounts for specific company characteristics alongside broader market comparisons. By weighing SAIC’s actual PE of 9.8x against its Fair Ratio of 18.6x, there appears to be significant room for upside. This suggests the market may be undervaluing the company’s earnings potential.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1443 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Science Applications International Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a story that captures your unique perspective on a company, explaining what you believe about its future growth, challenges, and value. This approach combines those beliefs with your own fair value estimate and forecasts for revenue, earnings, and profit margins.

Narratives bridge the gap between a company's story and its financial forecast, helping you link your investment thesis directly to a tangible fair value. They are designed as an accessible, easy-to-use tool available on Simply Wall St’s Community page, used by millions of investors to share viewpoints and see how their convictions stack up against the market.

With Narratives, you can make informed buy or sell decisions by comparing a company’s current share price with the fair value that your personal story and numbers produce. Best of all, Narratives update automatically when new events, such as earnings results or industry news, shift the outlook, letting you adjust your view quickly and transparently.

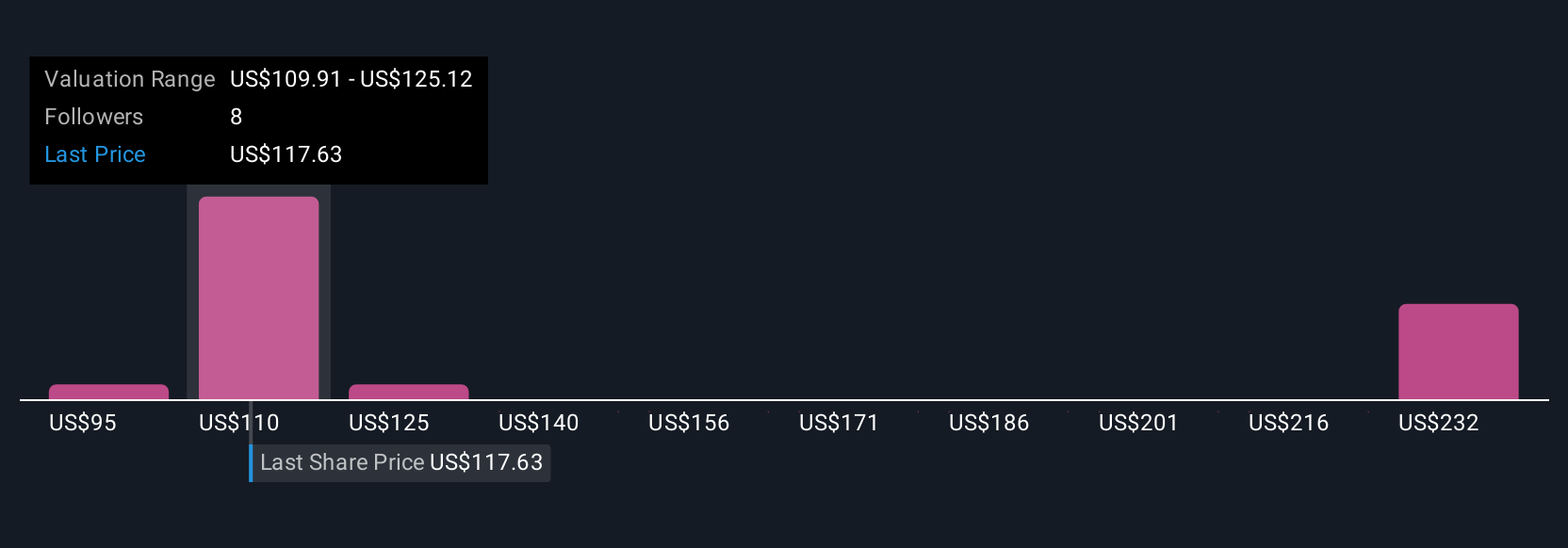

For example, some investors see Science Applications International comfortably reaching $130 per share as government modernization boosts margins and revenue, while others believe $91 is more realistic due to budget uncertainty and competitive risks.

Do you think there's more to the story for Science Applications International? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SAIC

Science Applications International

Provides technical, engineering, and enterprise information technology (IT) services in the United States.

Very undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives