- United States

- /

- Professional Services

- /

- NasdaqGS:SAIC

Can Interim Leadership at SAIC (SAIC) Sustain Its Government IT Momentum Amid Executive Changes?

Reviewed by Sasha Jovanovic

- Science Applications International Corporation announced on October 23, 2025, that Toni Townes-Whitley stepped down from her role as CEO and Board member, with James (Jim) Reagan appointed as Interim CEO effective immediately.

- This leadership change brings to the forefront questions about future corporate direction and operational consistency at a pivotal moment for the company's government IT services focus.

- We'll examine how the CEO transition and interim leadership impact Science Applications International's investment narrative and outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Science Applications International Investment Narrative Recap

Science Applications International’s investment thesis centers on its ability to secure and expand government IT contracts by differentiating its capabilities in mission integration, digital transformation, and modernization, despite a challenging federal spending environment. The recent CEO transition to James Reagan as interim leader is not expected to materially impact the short-term catalyst, which remains the effective execution of defense and intelligence contracts, but it does slightly heighten near-term uncertainty around continuity and execution, which could magnify risks tied to delayed contract awards or revenue slippage.

Among recent events, the September 2025 revision to fiscal guidance, lowering revenue expectations for fiscal 2026, stands out as most relevant, since it underscores the company’s near-term exposure to budgetary headwinds and decisions by key federal clients, an area that takes on even more significance with changes in executive leadership.

By contrast, investors should be aware that extended leadership transitions can amplify operational risk at the worst possible moment if...

Read the full narrative on Science Applications International (it's free!)

Science Applications International is expected to reach $7.7 billion in revenue and $344.8 million in earnings by 2028. This outlook assumes a modest 1.0% annual growth in revenue, but also a decrease in earnings of $54.2 million from the current $399.0 million.

Uncover how Science Applications International's forecasts yield a $116.00 fair value, a 27% upside to its current price.

Exploring Other Perspectives

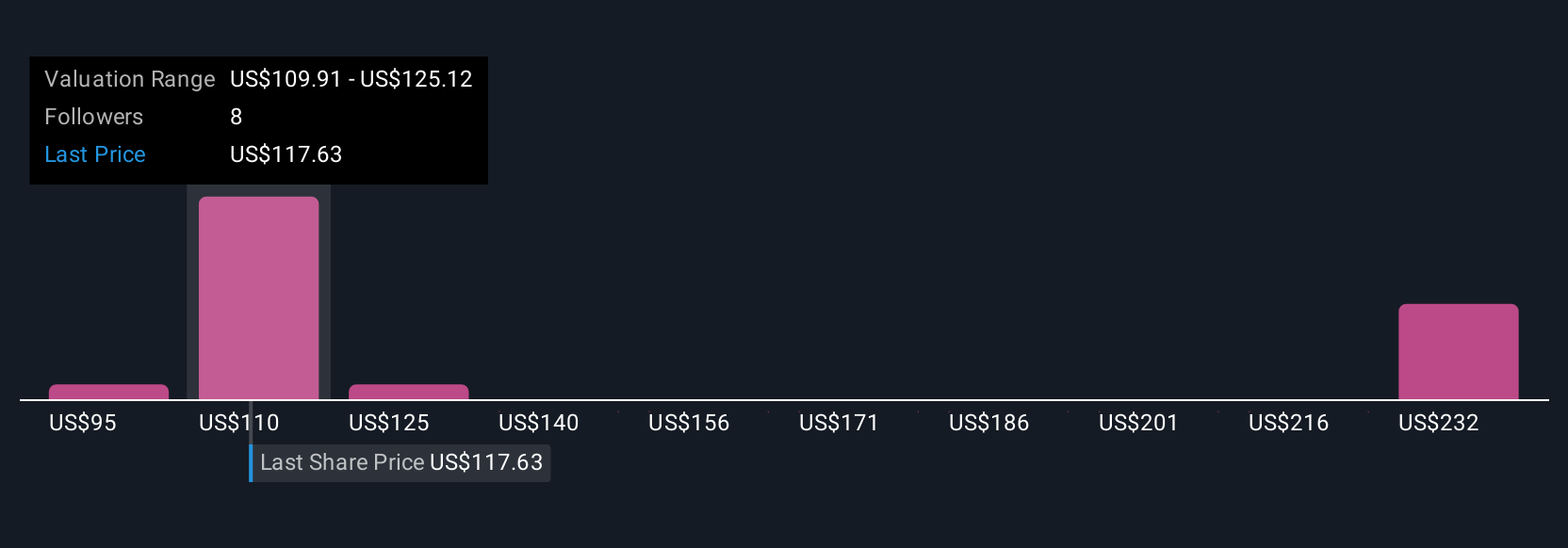

Four fair value estimates from the Simply Wall St Community span a wide range from US$94.71 to US$212.35 per share. With ongoing contract delays and tightened federal budgets, consider how varying outlooks reflect just how much uncertainty surrounds near-term cash flow and performance.

Explore 4 other fair value estimates on Science Applications International - why the stock might be worth just $94.71!

Build Your Own Science Applications International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Science Applications International research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Science Applications International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Science Applications International's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 24 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SAIC

Science Applications International

Provides technical, engineering, and enterprise information technology (IT) services in the United States.

Very undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives