- United States

- /

- Commercial Services

- /

- NasdaqCM:QRHC

With EPS Growth And More, Quest Resource Holding (NASDAQ:QRHC) Is Interesting

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

So if you're like me, you might be more interested in profitable, growing companies, like Quest Resource Holding (NASDAQ:QRHC). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Quest Resource Holding

Quest Resource Holding's Improving Profits

Over the last three years, Quest Resource Holding has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. As a result, I'll zoom in on growth over the last year, instead. Like the last firework on New Year's Eve accelerating into the sky, Quest Resource Holding's EPS shot from US$0.047 to US$0.12, over the last year. You don't see 166% year-on-year growth like that, very often. That could be a sign that the business has reached a true inflection point.

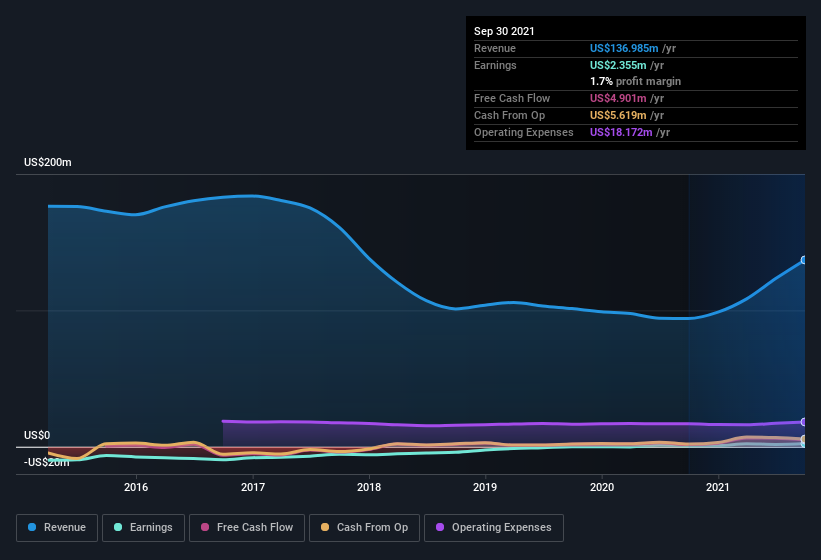

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Quest Resource Holding shareholders can take confidence from the fact that EBIT margins are up from 0.2% to 4.3%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Quest Resource Holding's forecast profits?

Are Quest Resource Holding Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We haven't seen any insiders selling Quest Resource Holding shares, in the last year. With that in mind, it's heartening that S. Hatch, the President of the company, paid US$5.0k for shares at around US$3.90 each.

Is Quest Resource Holding Worth Keeping An Eye On?

Quest Resource Holding's earnings per share have taken off like a rocket aimed right at the moon. Growth investors should find it difficult to look past that strong EPS move. And indeed, it could be a sign that the business is at an inflection point. If that's the case, you may regret neglecting to put Quest Resource Holding on your watchlist. What about risks? Every company has them, and we've spotted 3 warning signs for Quest Resource Holding you should know about.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Quest Resource Holding, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Quest Resource Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:QRHC

Quest Resource Holding

Provides solutions for the reuse, recycling, and disposal of various waste streams and recyclables in the United States.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives