- United States

- /

- Commercial Services

- /

- NasdaqCM:QRHC

Increases to CEO Compensation Might Be Put On Hold For Now at Quest Resource Holding Corporation (NASDAQ:QRHC)

CEO S. Hatch has done a decent job of delivering relatively good performance at Quest Resource Holding Corporation (NASDAQ:QRHC) recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 01 July 2021. However, some shareholders may still be hesitant of being overly generous with CEO compensation.

View our latest analysis for Quest Resource Holding

Comparing Quest Resource Holding Corporation's CEO Compensation With the industry

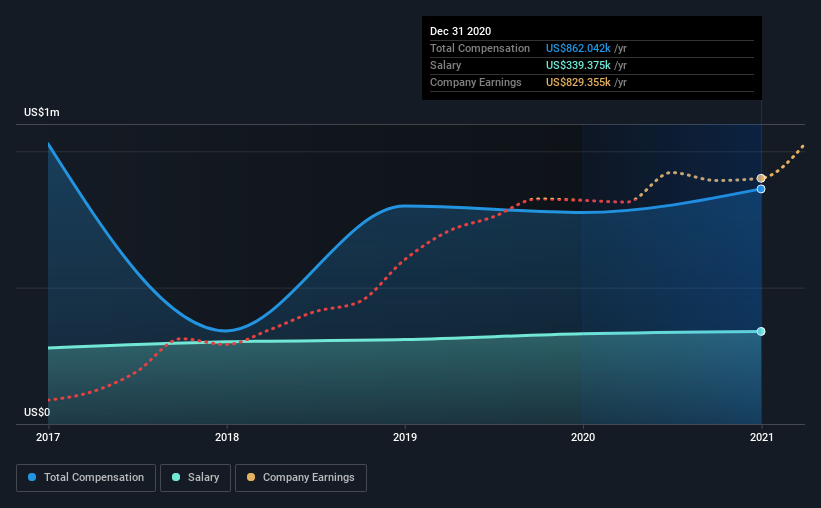

Our data indicates that Quest Resource Holding Corporation has a market capitalization of US$115m, and total annual CEO compensation was reported as US$862k for the year to December 2020. Notably, that's an increase of 11% over the year before. We think total compensation is more important but our data shows that the CEO salary is lower, at US$339k.

For comparison, other companies in the industry with market capitalizations below US$200m, reported a median total CEO compensation of US$508k. Accordingly, our analysis reveals that Quest Resource Holding Corporation pays S. Hatch north of the industry median. Furthermore, S. Hatch directly owns US$130k worth of shares in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$339k | US$331k | 39% |

| Other | US$523k | US$445k | 61% |

| Total Compensation | US$862k | US$775k | 100% |

On an industry level, around 24% of total compensation represents salary and 76% is other remuneration. Quest Resource Holding is paying a higher share of its remuneration through a salary in comparison to the overall industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Quest Resource Holding Corporation's Growth

Quest Resource Holding Corporation's earnings per share (EPS) grew 127% per year over the last three years. In the last year, its revenue is up 11%.

Shareholders would be glad to know that the company has improved itself over the last few years. It's a real positive to see this sort of revenue growth in a single year. That suggests a healthy and growing business. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Quest Resource Holding Corporation Been A Good Investment?

Most shareholders would probably be pleased with Quest Resource Holding Corporation for providing a total return of 209% over three years. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. However, if the board proposes to increase the compensation, some shareholders might have questions given that the CEO is already being paid higher than the industry.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 2 warning signs for Quest Resource Holding that you should be aware of before investing.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you decide to trade Quest Resource Holding, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Quest Resource Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:QRHC

Quest Resource Holding

Provides solutions for the reuse, recycling, and disposal of various waste streams and recyclables in the United States.

Undervalued with low risk.

Similar Companies

Market Insights

Community Narratives