- United States

- /

- Commercial Services

- /

- NasdaqCM:PESI

Market Participants Recognise Perma-Fix Environmental Services, Inc.'s (NASDAQ:PESI) Revenues Pushing Shares 30% Higher

The Perma-Fix Environmental Services, Inc. (NASDAQ:PESI) share price has done very well over the last month, posting an excellent gain of 30%. Unfortunately, despite the strong performance over the last month, the full year gain of 2.7% isn't as attractive.

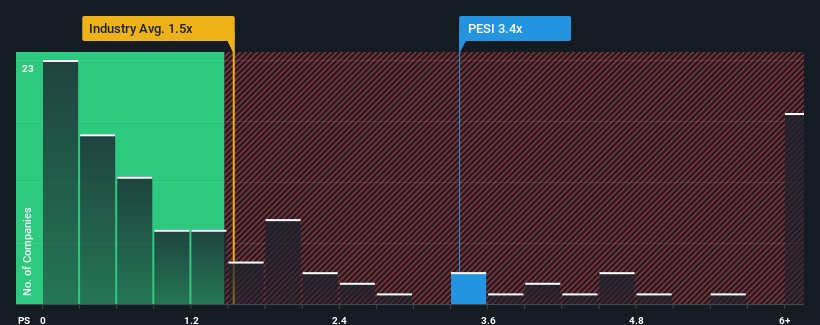

After such a large jump in price, given close to half the companies operating in the United States' Commercial Services industry have price-to-sales ratios (or "P/S") below 1.5x, you may consider Perma-Fix Environmental Services as a stock to potentially avoid with its 3.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

We've discovered 1 warning sign about Perma-Fix Environmental Services. View them for free.View our latest analysis for Perma-Fix Environmental Services

How Has Perma-Fix Environmental Services Performed Recently?

Perma-Fix Environmental Services hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Keen to find out how analysts think Perma-Fix Environmental Services' future stacks up against the industry? In that case, our free report is a great place to start.How Is Perma-Fix Environmental Services' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as Perma-Fix Environmental Services' is when the company's growth is on track to outshine the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 29%. This means it has also seen a slide in revenue over the longer-term as revenue is down 8.5% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 46% as estimated by the lone analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 7.6%, which is noticeably less attractive.

With this in mind, it's not hard to understand why Perma-Fix Environmental Services' P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Perma-Fix Environmental Services' P/S

The large bounce in Perma-Fix Environmental Services' shares has lifted the company's P/S handsomely. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Perma-Fix Environmental Services' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Plus, you should also learn about this 1 warning sign we've spotted with Perma-Fix Environmental Services.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:PESI

Perma-Fix Environmental Services

Through its subsidiaries, operates as an environmental and technology know-how company in the United States.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives