- United States

- /

- Professional Services

- /

- NasdaqGS:PAYX

Paychex (PAYX): Exploring the Current Valuation After Recent Share Price Dip

Reviewed by Simply Wall St

Paychex (PAYX) shares have seen some swings recently, with the stock down around 6% over the past month and 16% over the past 3 months. Investors may be eyeing these moves for opportunities, especially given the company’s record of steady revenue growth and profitability.

See our latest analysis for Paychex.

While Paychex’s share price is down 16% over the past three months and has slipped 15.5% year-to-date, this follows a multi-year stretch in which long-term shareholders still enjoy a 51.6% total return over five years. The latest dip suggests momentum may be cooling, with investors reassessing the company’s premium after several years of strong gains.

If you’re interested in spotting what else might be building momentum, consider broadening your search and explore fast growing stocks with high insider ownership.

With Paychex trading at a notable discount to analyst targets despite consistent growth, investors may wonder if this recent drop is an opportunity to buy at a bargain or if the market is correctly pricing in the company’s future prospects.

Most Popular Narrative: 13.5% Undervalued

Paychex’s most widely followed valuation narrative places fair value at $135.23, comfortably above the last close price of $117.03. This gap has brought renewed attention to the story behind Paychex’s valuation, given recent price swings and its history of steady performance.

The acquisition of Paycor is expected to enhance Paychex's market position through an expanded customer base and improved revenue opportunities. Investments in technology and AI focus could boost efficiency, client retention, and revenue growth, strengthening the company’s overall performance.

What key projections power this valuation? The most popular narrative points to ambitious earnings growth and margin gains, all tied to significant new technology initiatives and major industry moves. Want to see the full assumptions and explore what could influence Paychex’s future? Dive in for the real story behind the numbers.

Result: Fair Value of $135.23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, potential integration challenges from the Paycor acquisition and headwinds from elevated employee costs could still reshape Paychex’s growth trajectory in the future.

Find out about the key risks to this Paychex narrative.

Another View: Multiple-Based Valuation Paints a Different Picture

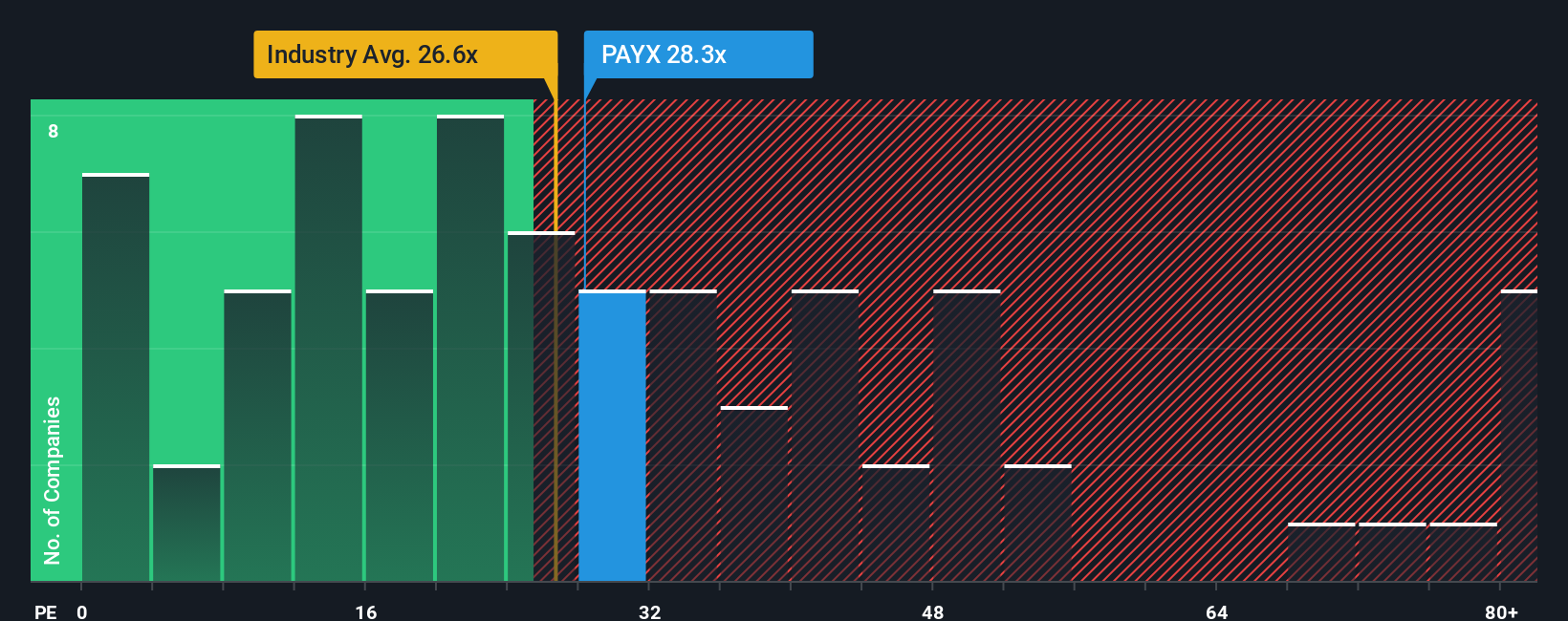

Looking at Paychex through the lens of its price-to-earnings ratio tells a more nuanced story. While it trades at 26.1x earnings, close to the US industry average of 25.4x, this is still below its fair ratio of 28.9x and noticeably below peers at 29.8x. The market's current pricing hints at both opportunity and risk. Could investor caution be holding the price back, or is it a signal that the premium might be justified soon?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Paychex Narrative

If you see the story differently or want to dig deeper on your own terms, you can put together your perspective in just a few minutes. So why not Do it your way?

A great starting point for your Paychex research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Act quickly and level up your portfolio. Don’t miss out on unique opportunities that major investors are tracking using the Simply Wall Street Screener right now.

- Supercharge your search for stocks with strong financials by scanning through these 3588 penny stocks with strong financials that show growth potential you won't want to overlook.

- Capitalize on trends in healthcare technology by spotting companies redefining medicine and innovation via these 33 healthcare AI stocks.

- Boost your income potential by filtering for reliable businesses offering market-beating payouts using these 22 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PAYX

Paychex

Provides human capital management solutions (HCM) for payroll, employee benefits, human resources (HR), and insurance services for small to medium-sized businesses in the United States, Europe, and India.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives