- United States

- /

- Professional Services

- /

- NasdaqGS:PAYX

Investors Shouldn't Overlook The Favourable Returns On Capital At Paychex (NASDAQ:PAYX)

If you're looking for a multi-bagger, there's a few things to keep an eye out for. Ideally, a business will show two trends; firstly a growing return on capital employed (ROCE) and secondly, an increasing amount of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. Ergo, when we looked at the ROCE trends at Paychex (NASDAQ:PAYX), we liked what we saw.

What Is Return On Capital Employed (ROCE)?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. To calculate this metric for Paychex, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.42 = US$2.2b ÷ (US$11b - US$5.3b) (Based on the trailing twelve months to November 2024).

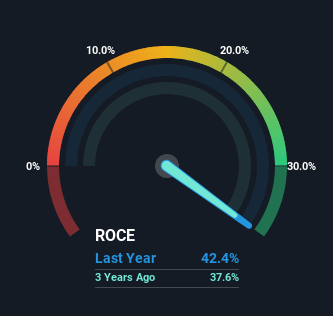

Therefore, Paychex has an ROCE of 42%. That's a fantastic return and not only that, it outpaces the average of 15% earned by companies in a similar industry.

See our latest analysis for Paychex

Above you can see how the current ROCE for Paychex compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like to see what analysts are forecasting going forward, you should check out our free analyst report for Paychex .

What Can We Tell From Paychex's ROCE Trend?

It's hard not to be impressed by Paychex's returns on capital. The company has consistently earned 42% for the last five years, and the capital employed within the business has risen 35% in that time. Now considering ROCE is an attractive 42%, this combination is actually pretty appealing because it means the business can consistently put money to work and generate these high returns. You'll see this when looking at well operated businesses or favorable business models.

On a separate but related note, it's important to know that Paychex has a current liabilities to total assets ratio of 50%, which we'd consider pretty high. This effectively means that suppliers (or short-term creditors) are funding a large portion of the business, so just be aware that this can introduce some elements of risk. Ideally we'd like to see this reduce as that would mean fewer obligations bearing risks.

The Key Takeaway

In the end, the company has proven it can reinvest it's capital at high rates of returns, which you'll remember is a trait of a multi-bagger. Therefore it's no surprise that shareholders have earned a respectable 84% return if they held over the last five years. So while investors seem to be recognizing these promising trends, we still believe the stock deserves further research.

While Paychex looks impressive, no company is worth an infinite price. The intrinsic value infographic for PAYX helps visualize whether it is currently trading for a fair price.

Paychex is not the only stock earning high returns. If you'd like to see more, check out our free list of companies earning high returns on equity with solid fundamentals.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PAYX

Paychex

Provides human capital management solutions (HCM) for payroll, employee benefits, human resources (HR), and insurance services for small to medium-sized businesses in the United States, Europe, and India.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Industrialist of the Skies – Scaling with "Automotive DNA

The "End-to-End" Space Prime – The Only Real Competitor to SpaceX

De-Risked Production Ramp with Exceptional Silver Price Leverage

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026