- United States

- /

- Professional Services

- /

- NasdaqGS:LZ

LegalZoom (LZ): Exploring Valuation After Upbeat Earnings, Revenue Outlook Raise, and Share Buybacks

Reviewed by Simply Wall St

LegalZoom.com (LZ) just announced its third quarter earnings, revealing year-over-year sales growth with a dip in net income. The company also raised its revenue outlook for the full year, signaling business momentum.

See our latest analysis for LegalZoom.com.

LegalZoom.com has stepped up its pace in recent weeks, raising its full-year and Q4 revenue outlooks on the back of robust sales growth, rolling out new AI-powered branding features through a partnership with Design.com, and pushing forward with a major share buyback that has repurchased over 12% of its shares since late 2023. Despite a slight post-earnings pullback, the stock’s 33.6% year-to-date share price return and 20.4% total shareholder return over the past year highlight both growing investor optimism and the momentum LegalZoom has built in 2025.

If LegalZoom’s progress has you thinking about what else is out there, this is a great moment to broaden your search and discover fast growing stocks with high insider ownership

Yet with the stock still trading roughly 24% below analyst price targets and with LegalZoom’s recent growth moves accelerating, investors must decide if the current valuation leaves room for upside or if future gains are already priced in.

Most Popular Narrative: 17.3% Undervalued

LegalZoom.com’s most popular narrative places its fair value at $12.21, over a dollar above the last close of $10.10. This viewpoint reflects confidence in the company’s emerging strengths and future profit potential as judged by market watchers.

Growth in high-margin subscription products, bundled solutions, and successful acquisitions is increasing predictable revenues, customer retention, and driving strategic investment flexibility. Enhanced automation and AI deployment throughout the business is driving operating efficiency gains and enabling scalable delivery of higher-touch services. These changes are supporting continued EBITDA margin expansion and a reduced cost structure.

Want to know what’s fueling this premium valuation? The most popular narrative is built around a set of bold forecasts for revenue, profit margins, and future earnings per share. What underlying assumptions make this price target stand out? Click through to unpack the numbers and discover what most followers think LegalZoom’s future is really worth.

Result: Fair Value of $12.21 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying price competition and the rapid advancement of AI tools could erode LegalZoom’s market share and pressure profits. This could potentially shift the current outlook.

Find out about the key risks to this LegalZoom.com narrative.

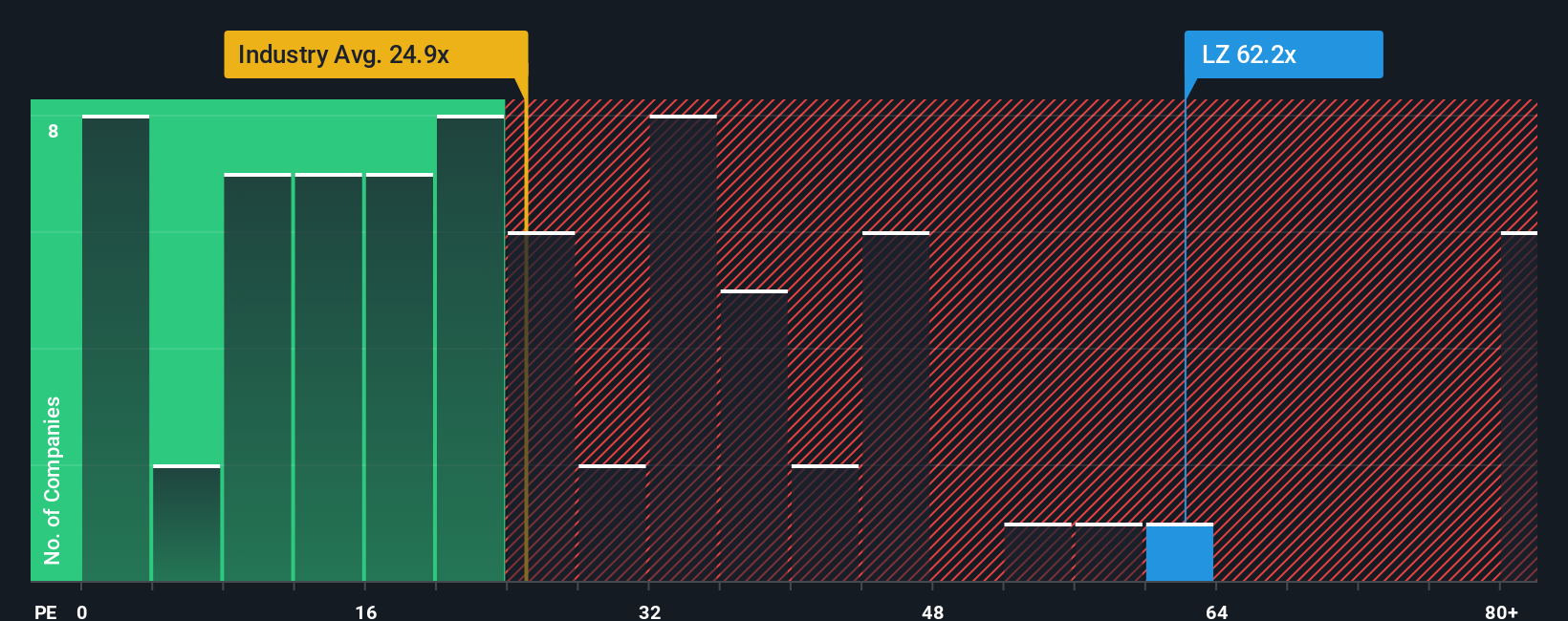

Another View: Comparing Earnings Multiples

Looking through a different lens, LegalZoom.com trades at an earnings multiple of 80.6 times, well above both its industry's average of 24.4 and a peer average of 18.7. Even when compared to a fair ratio of 46.9, the current price implies real valuation risk. Does this premium signal quality, or is the market too optimistic?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own LegalZoom.com Narrative

If you’d like to challenge these perspectives or have your own view on what LegalZoom.com is worth, you can dive in and shape a full narrative yourself in just a few minutes. Do it your way

A great starting point for your LegalZoom.com research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Level up your portfolio by tapping into the hottest trends. Simply Wall Street’s Screener helps you spot opportunities you don’t want to miss out on.

- Capture steady income by reviewing these 16 dividend stocks with yields > 3% that offer high yields and robust payout track records.

- Fuel your strategy with rapid innovation by tracking these 25 AI penny stocks at the forefront of artificial intelligence advancements.

- Supercharge your search for bargains and maximize potential gains through these 881 undervalued stocks based on cash flows with strong underlying financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LZ

LegalZoom.com

Operates an online platform that supports the legal, compliance, and business management needs of small businesses and consumers in the United States.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives