- United States

- /

- Professional Services

- /

- NasdaqGM:INOD

Innodata (INOD): Evaluating Valuation After Recent Share Price Volatility

Reviewed by Simply Wall St

Innodata (INOD) shares have attracted attention following recent moves in the data solutions space. Over the past month, the stock has experienced shifts in value. This has prompted investors to take a closer look at what might be driving the action.

See our latest analysis for Innodata.

While this month hasn’t been smooth sailing for Innodata, with a 21.83% drop in the 30-day share price return, the stock still shows major staying power. It has posted a 62.47% gain over the past 90 days and a one-year total shareholder return of 52.17%. Looking at a broader timeline, those who stuck with Innodata over the past three years have seen their total returns rise significantly, suggesting big-picture momentum is far from lost even after some recent bumps.

If you’re keeping an eye out for market standouts with fast growth and strong insider ownership, now’s the perfect opportunity to discover fast growing stocks with high insider ownership

With shares still trading below analyst price targets and strong gains over the longer term, the real question now is whether Innodata remains an undervalued gem or if the market has already factored in its future potential.

Most Popular Narrative: 24.3% Undervalued

Compared to its last close of $65.10, the most popular narrative tags Innodata with a fair value well above current levels. This highlights an optimistic outlook fueled by future enterprise AI opportunities.

Surging customer demand, especially from large tech and enterprise clients pursuing advanced AI and Agentic AI/robotics, is driving significant expansion in Innodata's high-value data annotation and evaluation services. This is likely resulting in sustained top-line revenue growth as digital transformation accelerates.

Want to know the secret behind this bullish calculation? Hint: it’s not just about industry trends. Revenue acceleration, margin shifts, and ambitious growth forecasts are at the core of this valuation. Curious what bold financial projections set the target so high? Dive in to see how these assumptions create a price tag that turns heads on Wall Street.

Result: Fair Value of $86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on large tech clients and the risk of rapidly rising costs could present challenges to Innodata's growth story if market conditions shift abruptly.

Find out about the key risks to this Innodata narrative.

Another View: What Do the Earnings Multiples Say?

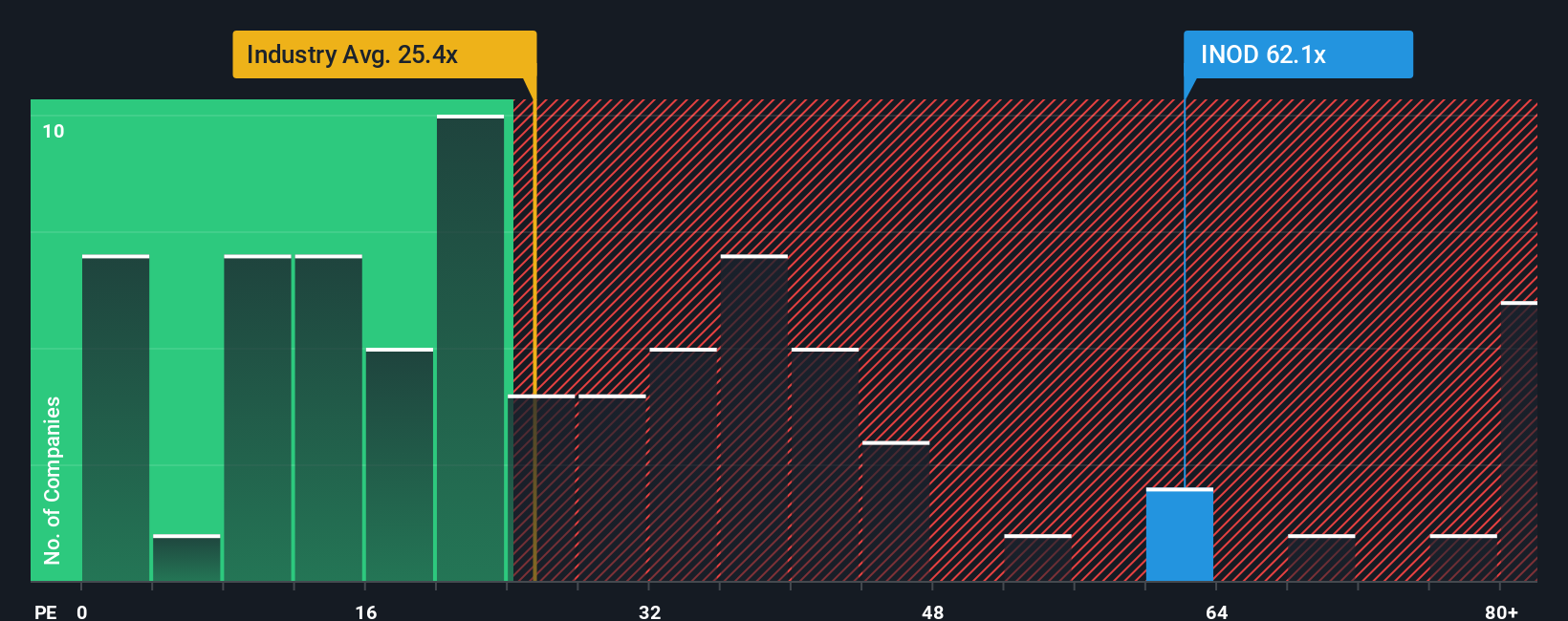

Shifting gears from fair value estimates, the current market price puts Innodata at a price-to-earnings ratio of 61.6x. That is well above both the US Professional Services industry average of 24.4x and the peer average of 41.1x. Our fair ratio analysis sits even lower at 26.5x, implying the market is pricing in aggressive future growth. These elevated multiples raise big questions: are investors right to pay such a premium, or is this a sign of heightened risk if growth expectations are missed?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Innodata Narrative

If you’re eager to dig deeper and think you see a different story, why not put your own view to the test in just a few minutes? Do it your way

A great starting point for your Innodata research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Winning Opportunities?

Don’t let unique investment trends slip by while you focus on just one stock. Use these tailored screeners to power your next smart move right now:

- Capture untapped value by targeting these 875 undervalued stocks based on cash flows and position yourself ahead of potential market rallies based on true fundamentals.

- Get strategic with income by checking out these 16 dividend stocks with yields > 3%, where you’ll spot yield-rich companies that are outpacing average returns.

- Ride the innovation wave as you pursue tomorrow’s leaders in tech breakthroughs by starting with these 24 AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:INOD

Innodata

Operates as a data engineering company in the United States, the United Kingdom, the Netherlands, Canada, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives