- United States

- /

- Professional Services

- /

- NasdaqGS:ICFI

Will ICFI’s Leadership Shift and Updated Guidance Reveal a New Chapter for Its Growth Ambitions?

Reviewed by Sasha Jovanovic

- ICF International recently reported mixed third-quarter 2025 financial results, reaffirmed its quarterly dividend, announced ongoing executive leadership transitions including a new president and CFO, and provided updated guidance in light of federal government client headwinds and a government shutdown impact.

- Anne Choate, who has helped expand ICF's commercial energy business to account for about 30% of revenues, will take over as president in early 2026 and will focus on leveraging technology and AI to enhance company growth and operations.

- We'll review how ICF's executive changes, especially the incoming president's growth focus, may influence its investment outlook.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

ICF International Investment Narrative Recap

If you’re considering ICF International, the key investment thesis centers on its ability to shift from reliance on federal government contracts toward a greater focus on commercial energy and technology-driven growth. The latest results and outlook underscore that the biggest short-term catalyst, commercial client expansion, remains intact, while the primary risk is still persistent federal government headwinds, which recent news confirms are ongoing but not materially worsened by current events.

Among recent developments, ICF confirmed its Q4 and annual 2025 guidance, factoring in government shutdown impacts yet maintaining expectations for performance within the prior risk framework. This update suggests that while federal funding remains a challenge, management believes commercial and technology initiatives can help offset those pressures in the near term.

However, unlike commercial growth tailwinds, the scale and duration of federal funding delays remain a risk that investors must pay close attention to...

Read the full narrative on ICF International (it's free!)

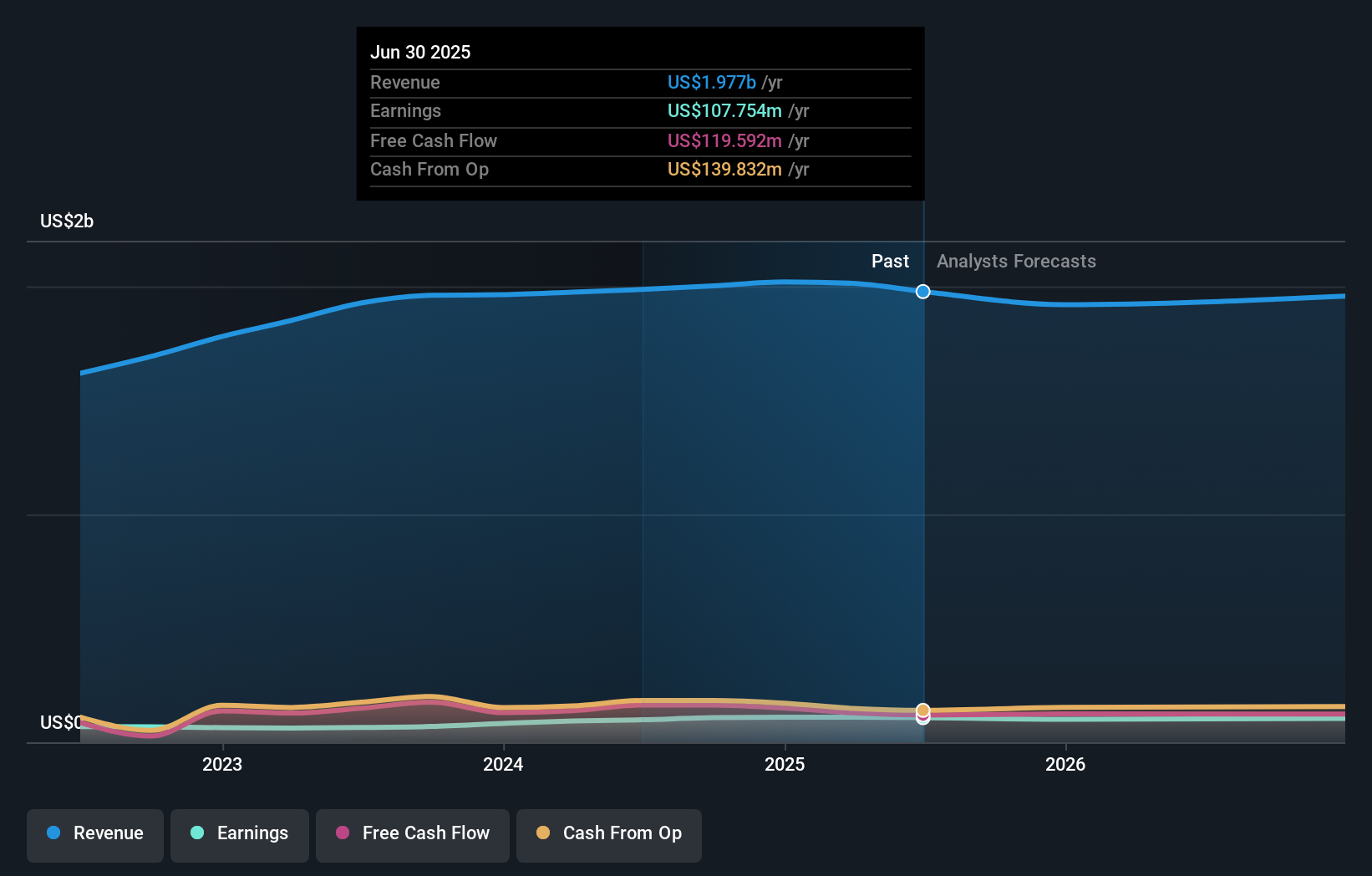

ICF International's outlook anticipates $1.9 billion in revenue and $97.8 million in earnings by 2028. This is based on an annual revenue decline of 0.9% and a $10 million decrease in earnings from the current $107.8 million.

Uncover how ICF International's forecasts yield a $103.25 fair value, a 27% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have shared fair value estimates for ICF International ranging from US$103.25 to US$128.48, reflecting a spread of private perspectives. Against these contrasts, the challenge of ongoing federal contract delays could continue to influence the company’s path, so you may want to examine several viewpoints before making a decision.

Explore 2 other fair value estimates on ICF International - why the stock might be worth just $103.25!

Build Your Own ICF International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ICF International research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ICF International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ICF International's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ICFI

ICF International

Provides management, technology, and policy consulting and implementation services to government and commercial clients in the United States and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives