- United States

- /

- Professional Services

- /

- NasdaqGS:HURN

Should Huron Consulting Group's (HURN) AXIOM Acquisition and Insider Selling Prompt Investor Reassessment?

Reviewed by Sasha Jovanovic

- On November 19, 2025, Huron Consulting Group reported it had surpassed analyst expectations in its third quarter and completed the acquisition of AXIOM Systems' payor consulting services division to further strengthen its healthcare consulting portfolio.

- Additionally, regulatory filings revealed that Director John McCartney sold 6,500 shares, bringing his year-to-date disposals to 15,567 shares, amid a broader trend of insider selling with no reported insider purchases in the past year.

- We'll now explore how the AXIOM Systems acquisition could influence Huron's growth outlook and support its evolving investment narrative.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Huron Consulting Group Investment Narrative Recap

To be a Huron Consulting Group shareholder, you need confidence in the company's ability to leverage demand for specialized consulting in healthcare and education while navigating regulatory complexity and industry shifts. Recent Q3 results and the AXIOM Systems acquisition reinforce Huron’s momentum in broadening its healthcare services, but do not materially alter the primary catalyst: sustained client demand for cost efficiency and compliance advisory. However, integration costs and industry competition remain the key short-term risks for investors following these announcements.

Among the many announcements, the acquisition of AXIOM Systems’ payor consulting services division stands out for its potential to expand Huron’s healthcare reach, directly supporting the ongoing catalyst of increased client reliance on consulting amid sector complexity. As healthcare organizations continue to seek operational efficiencies, Huron’s enhanced capabilities could position the company to capture more business, though execution around integration and realizing synergies will be closely watched.

In contrast, investors should pay particular attention to the risk that rising compensation and integration expenses could strain margins if...

Read the full narrative on Huron Consulting Group (it's free!)

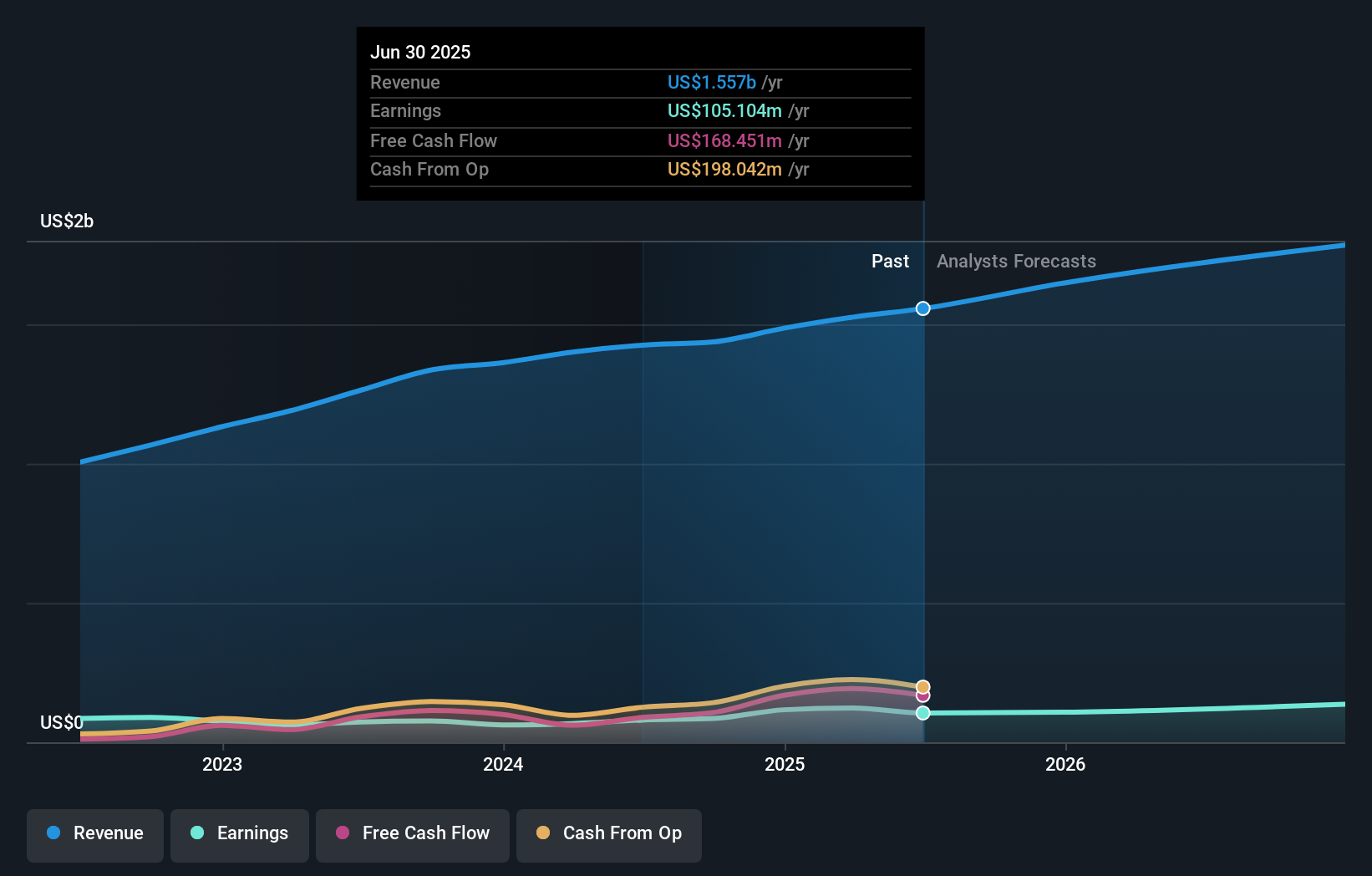

Huron Consulting Group's narrative projects $2.0 billion revenue and $172.9 million earnings by 2028. This requires 9.4% yearly revenue growth and a $67.8 million earnings increase from $105.1 million.

Uncover how Huron Consulting Group's forecasts yield a $178.75 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members put Huron’s fair value between US$178.75 and US$354.05, based on two user-generated models. Differing opinions abound, especially as rising labor and M&A costs prompt fresh questions about profit margins.

Explore 2 other fair value estimates on Huron Consulting Group - why the stock might be worth just $178.75!

Build Your Own Huron Consulting Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Huron Consulting Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Huron Consulting Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Huron Consulting Group's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Huron Consulting Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HURN

Huron Consulting Group

Provides consultancy and managed services in the United States and internationally.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives