- United States

- /

- Professional Services

- /

- NasdaqGS:HSII

Heidrick & Struggles (HSII): A Fresh Look at Valuation After Recent Share Price Momentum

Reviewed by Simply Wall St

Heidrick & Struggles International (HSII) has been generating some interest lately given its recent performance numbers. With the stock posting steady returns over the past month, investors may be taking a closer look at what is driving the momentum.

See our latest analysis for Heidrick & Struggles International.

The momentum around Heidrick & Struggles International seems to be picking up, with the share price climbing more than 33% year to date and delivering a notable 27.9% total shareholder return over the past year. Both short- and long-term performance suggest that investors are increasingly optimistic about the company’s outlook in a shifting market environment.

If you’re keen to see which other companies are capturing investor interest lately, this is a great time to explore fast growing stocks with high insider ownership

With shares now trading near analyst price targets after such impressive gains, some are questioning whether Heidrick & Struggles International remains undervalued or if the market has already accounted for the company’s future growth potential.

Most Popular Narrative: 30% Undervalued

Heidrick & Struggles International’s fair value, according to the most widely followed narrative, is set at $59 per share, just above the recent closing price of $58.81. The stage is set for the next chapter as the company’s market value aligns closely with the new acquisition offer. Yet the narrative digs deeper into the underlying drivers and future growth assumptions shaping this estimate.

The company's expansion into consulting, interim/on-demand talent, and leadership development services is diversifying its revenue base beyond traditional executive search, which should reduce cyclicality in earnings and support durable long-term EBITDA growth. Management's focus on scaling consultant headcount and leveraging digital tools increases operational productivity, enabling broader market coverage and servicing untapped white space opportunities, with a likely positive impact on top-line growth and operating leverage.

Curious what projections push the fair value so high? This narrative banks on ambitious profit margins and a transformation that goes far beyond executive search. The real engine of value may surprise you. Want to see the detailed numbers and the bold assumptions that are re-rating this company? Only the full narrative reveals the logic behind the target price.

Result: Fair Value of $59 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent economic uncertainty or the rise of lower-cost, digital competitors could challenge growth expectations and put pressure on Heidrick & Struggles International's margins.

Find out about the key risks to this Heidrick & Struggles International narrative.

Another View: Is the Market Multiple Sending a Different Signal?

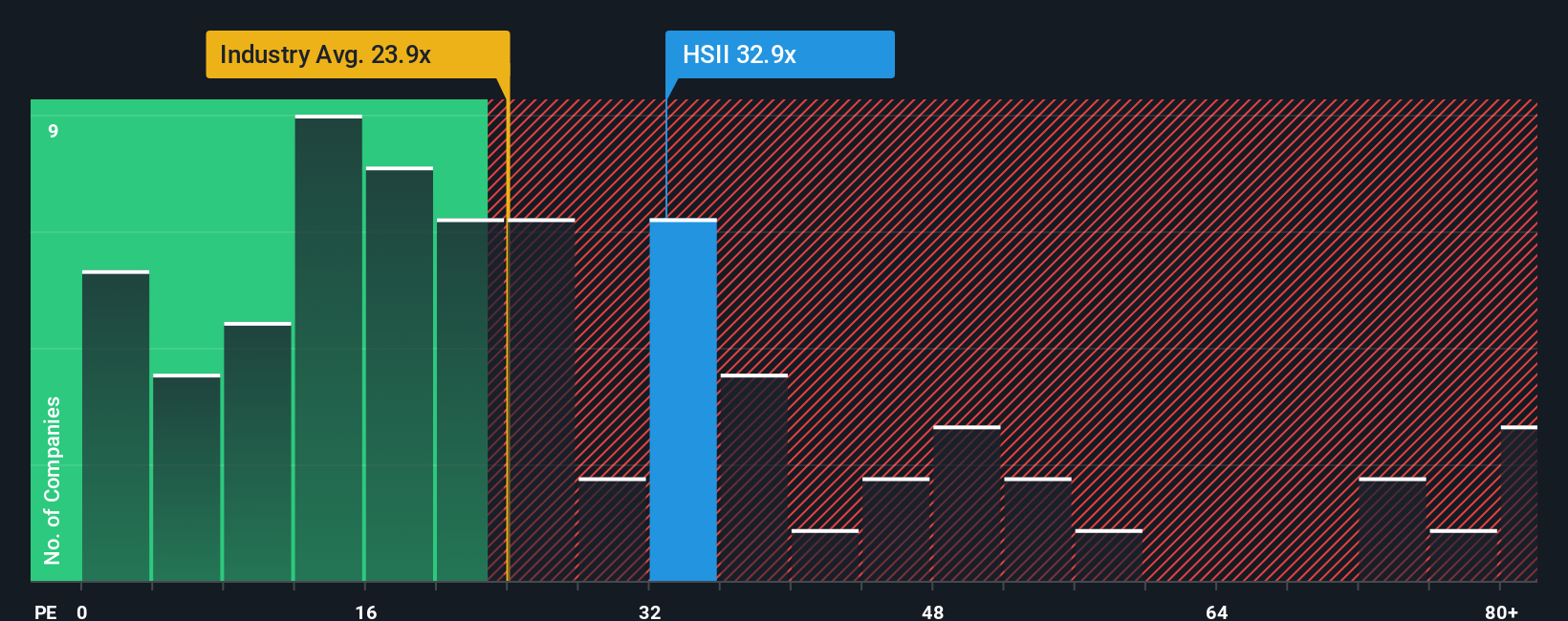

Looking beyond fair value, let’s see what HSII’s price-to-earnings ratio is telling us. At 33x, it is nearly identical to the peer average of 33.9x but well above the industry average of 24x and the fair ratio of 26.5x that the market could revert to. This gap means investors are paying a premium that may not last if industry norms take hold. Could this signal more risk, or just a market willing to reward the story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Heidrick & Struggles International Narrative

If you want to dig into the numbers yourself and craft your own interpretation, it’s easy to create a personalized take in just a few minutes. Do it your way

A great starting point for your Heidrick & Struggles International research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More High-Potential Investments?

Smart investors act now, not later. Fuel your portfolio’s growth engine and stay ahead of the market by tapping into these unique opportunities right away.

- Capitalize on undervalued potential by checking out these 928 undervalued stocks based on cash flows which demonstrate solid financial fundamentals and attractive entry points.

- Secure greater cash flow with these 16 dividend stocks with yields > 3%, featuring stocks offering robust dividends with yields above 3% and durable payout histories.

- Ride the innovation boom and harness the rise of automation and smart tech through these 26 AI penny stocks that are shaping tomorrow's most dynamic industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Heidrick & Struggles International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HSII

Heidrick & Struggles International

Provides executive search, consulting, and on-demand talent services to businesses and business leaders worldwide.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives