- United States

- /

- Professional Services

- /

- NasdaqGS:HSII

Heidrick & Struggles (HSII): $39.4M One-Off Loss Challenges Narrative of Consistent Profitability

Reviewed by Simply Wall St

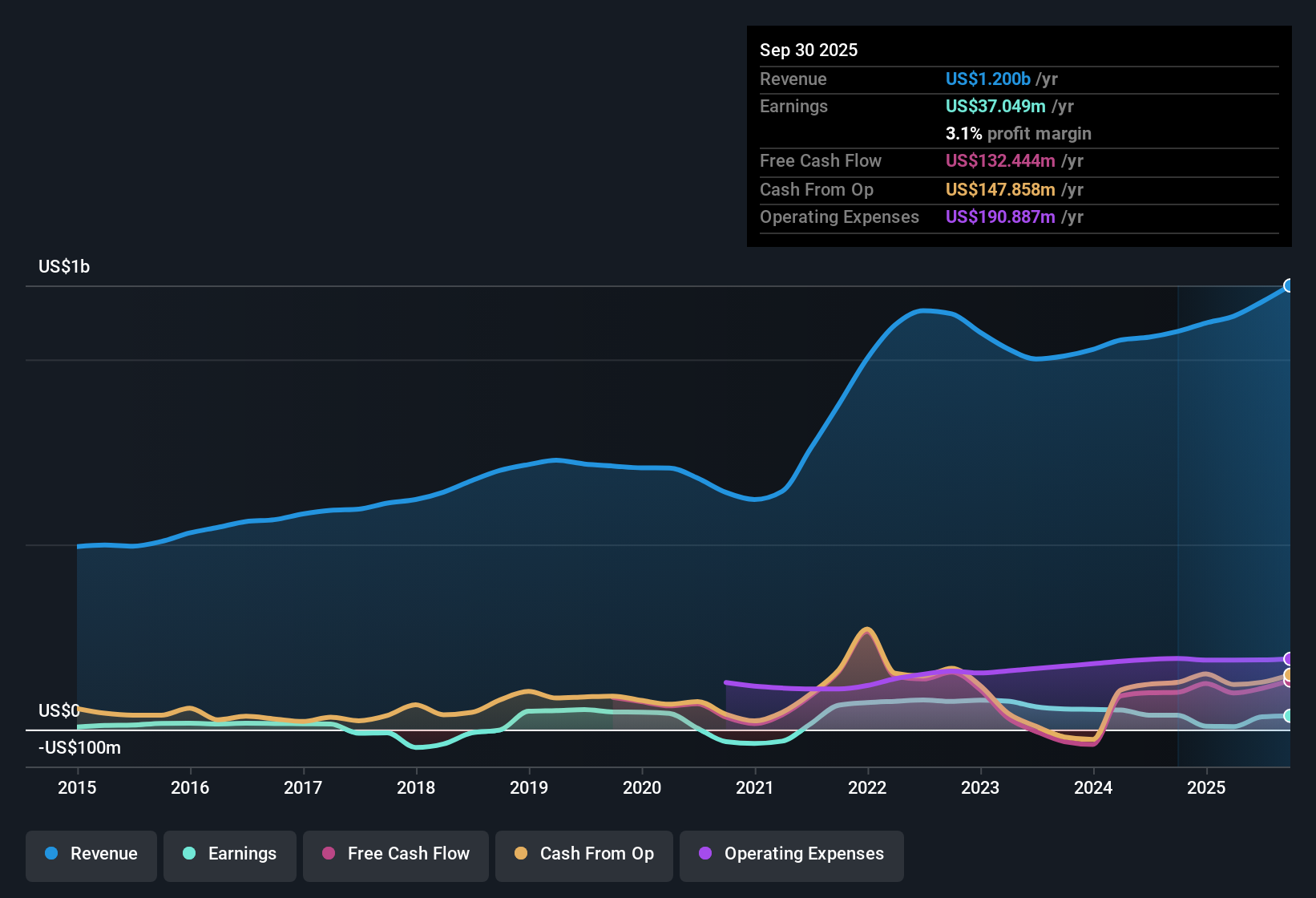

Heidrick & Struggles International (HSII) reported net profit margins of 3.1% this period, down from 3.6% previously. A significant one-off loss of $39.4 million weighed on earnings over the last twelve months. Over the past five years, the company managed to grow earnings by 11.2% per year, although the most recent year saw negative earnings growth. Looking ahead, forecasts suggest a strong rebound with expected annual earnings growth of 28.4% and this rate exceeds the US market even as revenue growth is expected to lag behind the industry average.

See our full analysis for Heidrick & Struggles International.The next section puts these headline numbers in context by looking at how they compare with the narratives and expectations commonly discussed among investors and analysts.

See what the community is saying about Heidrick & Struggles International

One-Off $39.4 Million Loss Clouds Recent Profitability

- Heidrick & Struggles booked a $39.4 million non-recurring loss in the last twelve months up to September 2025, which sharply impacted its net profit margin of 3.1%.

- According to the analysts' consensus view, while the company has managed 11.2% annual earnings growth over five years, the recent surprise loss contributes to a more volatile performance than peers.

- The consensus narrative notes that management’s investments in digital consulting are expected to deliver steadier, higher-margin revenue. However, this setback highlights the challenge of relying on stable consulting and executive search pipelines.

- There is a tension between diversified service expansion supporting recurring income and exposure to costly one-off items that can drag down short-term results.

- Despite this, analysts are betting on a recovery, forecasting a once-in-five-years scenario rather than a new normal with continued large one-time charges for Heidrick & Struggles.

- Don’t miss what analysts think is still the core story. Discover the deeper case in the consensus view. 📊 Read the full Heidrick & Struggles International Consensus Narrative.

Profit Margins Poised to More Than Double by 2028

- Analysts project profit margins to rise from 3.0% today to 7.3% within three years, nearly tripling the margin and implying stronger operating leverage ahead.

- The consensus narrative highlights that this rebound depends in large part on digital platforms and consulting services gaining traction.

- Digital investments are expected by analysts to lift recurring revenues and smooth out the volatility seen from heavy, one-off losses.

- Yet the path to wider margins assumes new consulting and leadership offerings grow faster than rising fixed expenses and compensation investments.

Shares Trade at a Discount to Peers, but Not to the Sector

- Heidrick & Struggles' Price-to-Earnings ratio sits at 33x, lower than the peer average of 38.7x but still above the broader US Professional Services industry at 25x. The current share price of $58.75 sits well below the DCF fair value estimate of $81.68.

- The analysts’ consensus narrative frames this valuation as a bet on future earnings ramping up to $95.9 million by 2028.

- The consensus target price is $59.00, nearly matching the current price. This implies the market already prices in much of the expected earnings growth.

- There is upside only if profit margins expand or digital offerings outperform what analysts anticipate over the next few years.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Heidrick & Struggles International on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the figures? Share your own perspective and shape the story yourself in just a few minutes. Do it your way

A great starting point for your Heidrick & Struggles International research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Heidrick & Struggles’ earnings have been volatile, with recent one-off losses highlighting how inconsistent cash flow and performance can impact investor confidence.

If choppy results concern you, use stable growth stocks screener (2077 results) to focus on companies demonstrating reliably steady growth through varied market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Heidrick & Struggles International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HSII

Heidrick & Struggles International

Provides executive search, consulting, and on-demand talent services to businesses and business leaders worldwide.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives