- United States

- /

- Commercial Services

- /

- NasdaqGS:HCSG

Healthcare Services Group (HCSG): Evaluating Valuation After a 51% Year-to-Date Rally

Reviewed by Simply Wall St

Healthcare Services Group (HCSG) has caught the eye of investors following a sustained rally over the past month. The stock has gained more than 5% in that period, bringing its year-to-date return to over 51%.

See our latest analysis for Healthcare Services Group.

The latest surge in Healthcare Services Group’s share price builds on months of accelerating momentum, suggesting renewed optimism around its growth story. With a 51.4% year-to-date share price return and a 1-year total shareholder return of 50.4%, HCSG has turned a corner after years of underperformance, and the market seems to be taking notice.

If this turnaround in healthcare services has you curious, it could be the perfect time to check out other compelling names using our See the full list for free.

But with shares already up more than 50% this year, investors are left wondering if Healthcare Services Group is still undervalued or if the market has already priced in the company’s future growth prospects.

Most Popular Narrative: 21.1% Undervalued

With the narrative fair value set at $22 versus the last close at $17.35, the latest market price sits well below what the most widely followed narrative suggests. The stage is set for a deeper look at the drivers behind this valuation call.

Strong operational execution, including 90%+ client retention, increased cross-selling of dining services into environmental accounts, and a focus on bundled solutions, should drive recurring revenues and improve earnings consistency over time.

Ever wondered what power move could push this stock’s value up? The narrative hints at a surprising combination of recurring revenues, margin growth, and bold cost strategies fueling this premium. But what is the key financial leap that turns today’s price into opportunity? Click through to unravel the full playbook and see which assumptions tip the scale.

Result: Fair Value of $22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing client concentration and persistent industry-wide labor pressures could quickly change the outlook and act as meaningful headwinds to future growth.

Find out about the key risks to this Healthcare Services Group narrative.

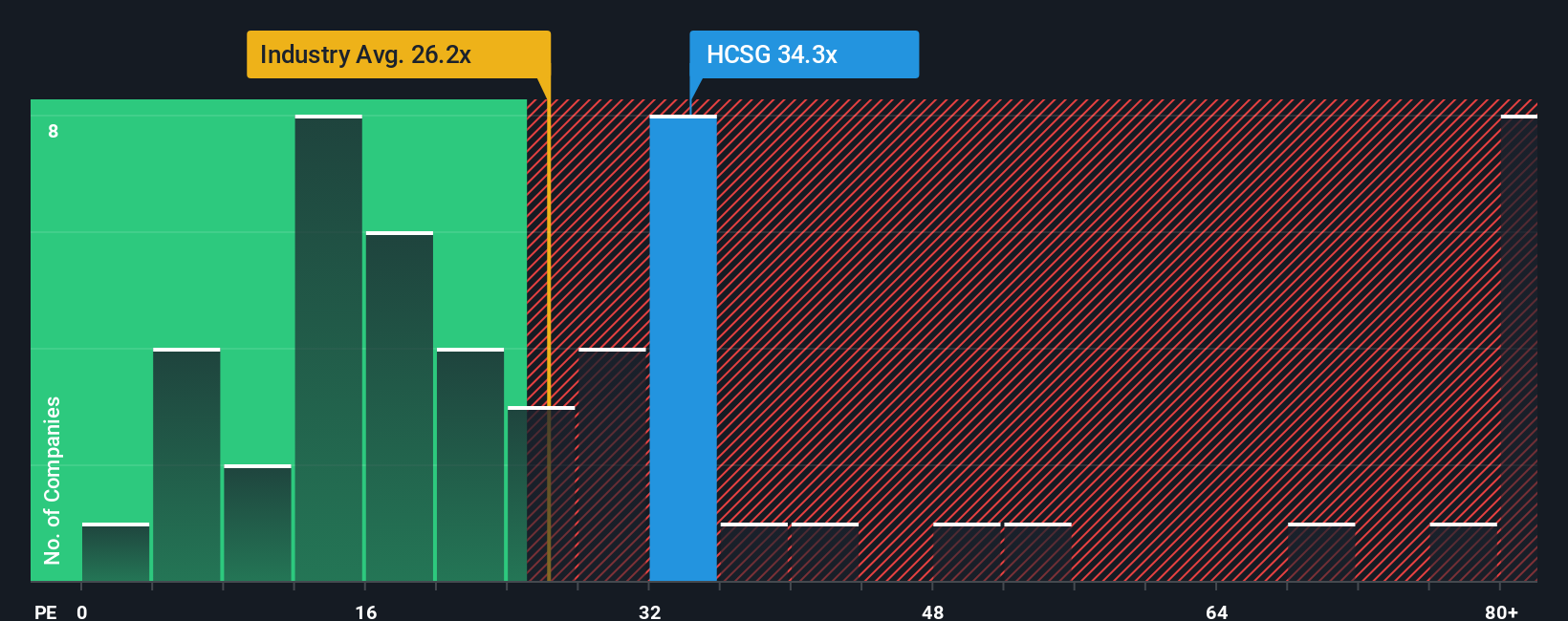

Another View: A Look Through Multiples

Looking at valuation through the lens of the company's price-to-earnings ratio reveals a different perspective. Healthcare Services Group trades at 30.8x earnings, which is higher than both the US Commercial Services industry average of 23.3x and the calculated fair ratio of 28.5x. This premium suggests the market is still factoring in higher hopes, but it could also introduce additional risk if results fail to impress.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Healthcare Services Group Narrative

If you see these numbers differently or like to draw your own conclusions, you can piece together your unique story in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Healthcare Services Group.

Ready for Even More Smart Investment Ideas?

Don’t let your next winning opportunity slip by. Hand-pick your favorites from our powerful screener tools and uncover stocks that fit your goals and strategy.

- Capitalize on strong cash flow potential by checking out these 879 undervalued stocks based on cash flows, finding companies that the market may be overlooking right now.

- Seize the potential of stable income streams and review these 16 dividend stocks with yields > 3% for businesses offering attractive yields above 3%.

- Tap into tomorrow’s innovations by browsing these 26 quantum computing stocks, featuring pioneers driving breakthroughs in cutting-edge technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Healthcare Services Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HCSG

Healthcare Services Group

Provides management, administrative, and operating services to the housekeeping, laundry, linen, facility maintenance, and dietary service departments of nursing homes, retirement complexes, rehabilitation centers, and hospitals in the United States.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives