- United States

- /

- Commercial Services

- /

- NasdaqCM:GFAI

Here's Why We're Not Too Worried About Guardforce AI's (NASDAQ:GFAI) Cash Burn Situation

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

So, the natural question for Guardforce AI (NASDAQ:GFAI) shareholders is whether they should be concerned by its rate of cash burn. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

Does Guardforce AI Have A Long Cash Runway?

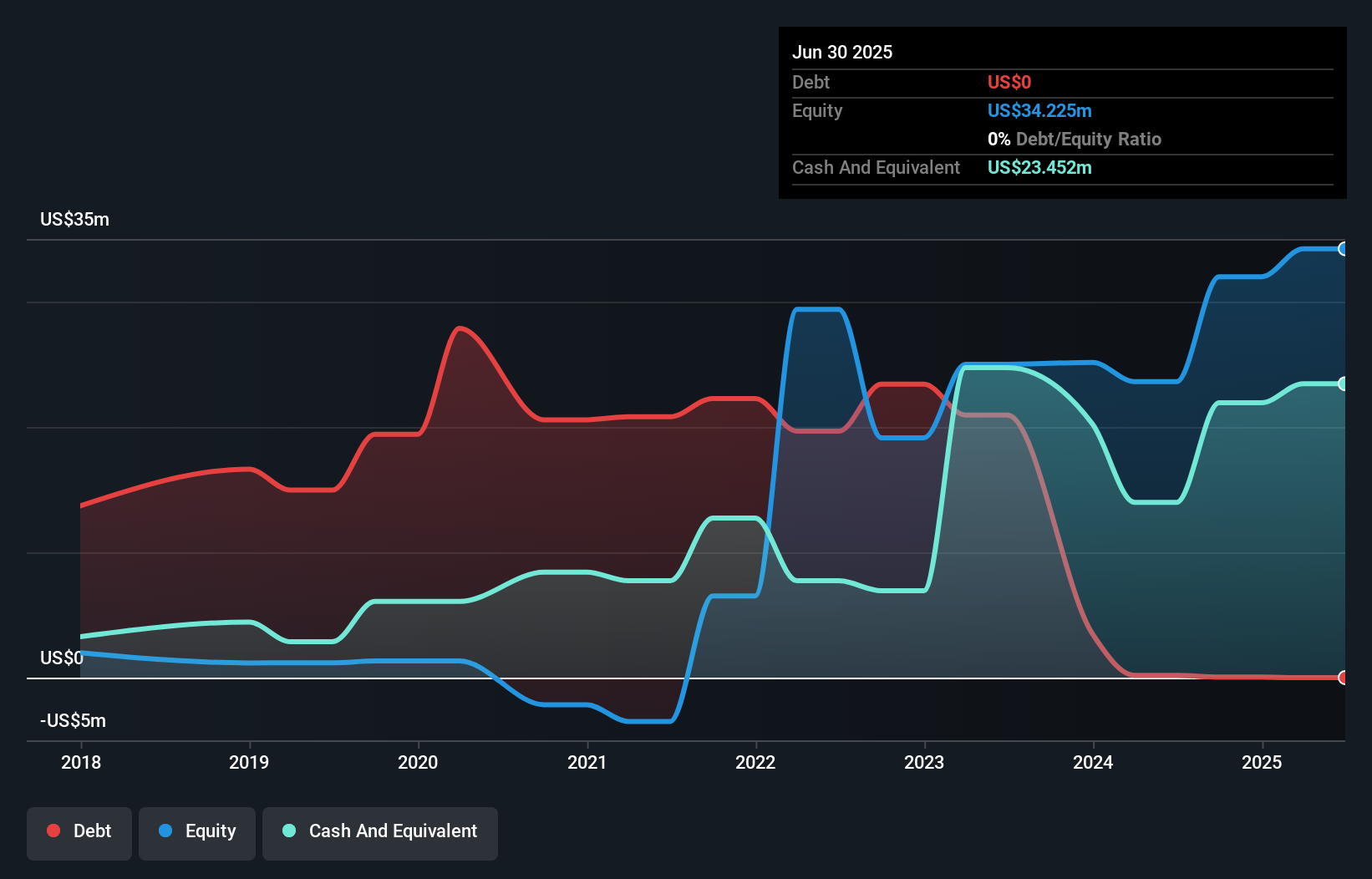

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. When Guardforce AI last reported its June 2025 balance sheet in September 2025, it had zero debt and cash worth US$23m. Looking at the last year, the company burnt through US$3.1m. So it had a cash runway of about 7.6 years from June 2025. Even though this is but one measure of the company's cash burn, the thought of such a long cash runway warms our bellies in a comforting way. Depicted below, you can see how its cash holdings have changed over time.

Check out our latest analysis for Guardforce AI

How Well Is Guardforce AI Growing?

On balance, we think it's mildly positive that Guardforce AI trimmed its cash burn by 3.2% over the last twelve months. And operating revenue was up by 3.2% too. Considering both these factors, we're not particularly excited by its growth profile. In reality, this article only makes a short study of the company's growth data. This graph of historic earnings and revenue shows how Guardforce AI is building its business over time.

How Hard Would It Be For Guardforce AI To Raise More Cash For Growth?

We are certainly impressed with the progress Guardforce AI has made over the last year, but it is also worth considering how costly it would be if it wanted to raise more cash to fund faster growth. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Many companies end up issuing new shares to fund future growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Since it has a market capitalisation of US$25m, Guardforce AI's US$3.1m in cash burn equates to about 12% of its market value. As a result, we'd venture that the company could raise more cash for growth without much trouble, albeit at the cost of some dilution.

Is Guardforce AI's Cash Burn A Worry?

Guardforce AI appears to be in pretty good health when it comes to its cash burn situation. Not only was its cash burn relative to its market cap quite good, but its cash runway was a real positive. Based on the factors mentioned in this article, we think its cash burn situation warrants some attention from shareholders, but we don't think they should be worried. On another note, Guardforce AI has 3 warning signs (and 2 which can't be ignored) we think you should know about.

Of course Guardforce AI may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:GFAI

Guardforce AI

Engages in the provision of secured logistics services in the Asia Pacific.

Flawless balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success