- United States

- /

- Commercial Services

- /

- NasdaqGS:CWST

Casella Waste Systems (CWST): Profit Margin Hit and $32M Loss Raise Valuation Concerns

Reviewed by Simply Wall St

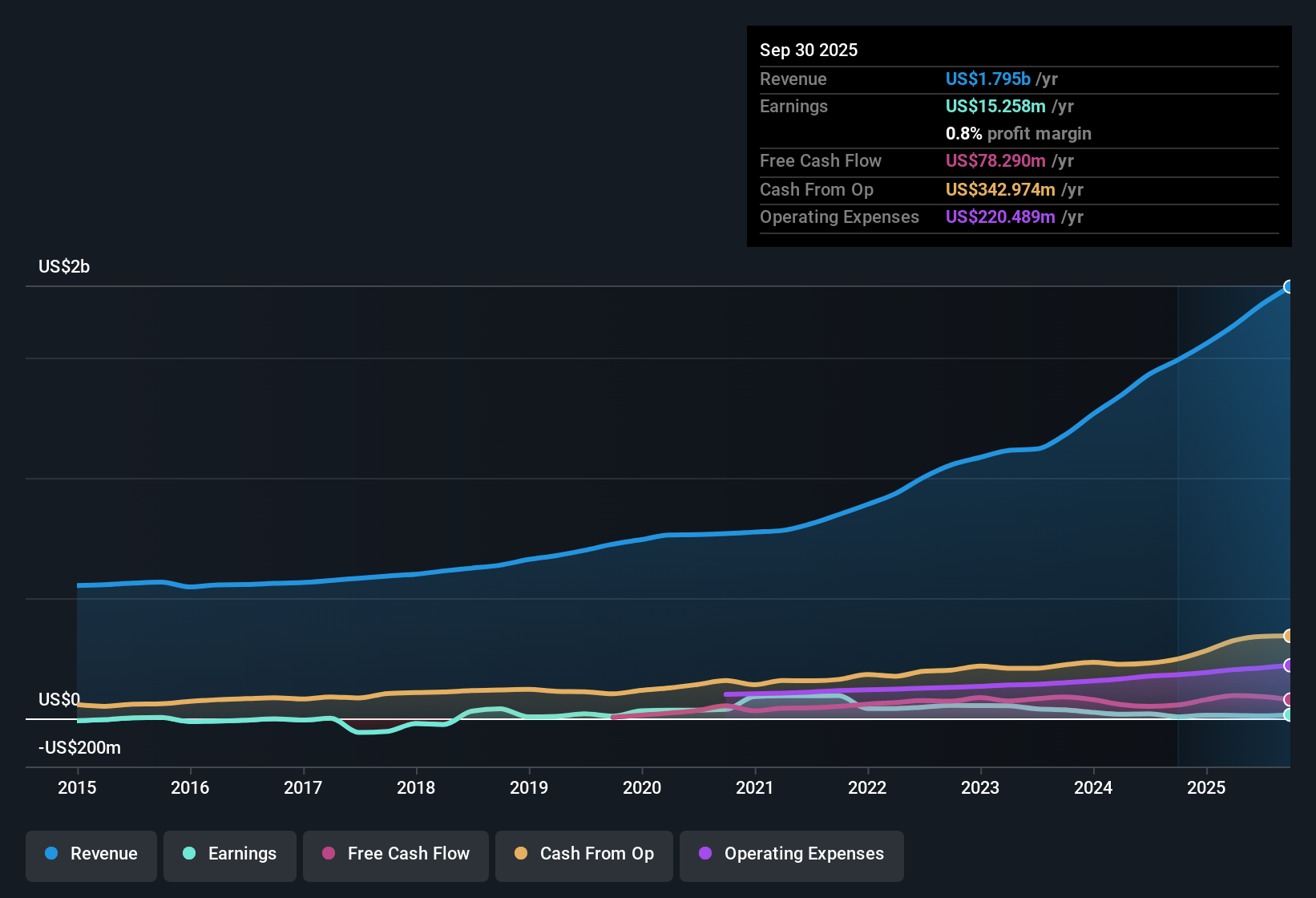

Casella Waste Systems (CWST) reported a net profit margin of 0.6% for the latest period, down from 1.3% a year ago. Over the past five years, annual earnings have fallen by 37%, and the results for the twelve months ending September 30, 2025, included a one-off loss of $32.1 million. The company’s Price-to-Sales ratio sits at 3.3x, ahead of both its peers and the broader industry, signaling a premium valuation. Investors are eyeing projected annual earnings growth of 65.8% going forward, but skepticism lingers given the recent earnings declines and premium pricing.

See our full analysis for Casella Waste Systems.The next step is to see how these results compare with the key narratives investors follow, and whether the story told by the latest numbers matches up with wider market expectations or challenges them heading into the next quarter.

See what the community is saying about Casella Waste Systems

Margin Expansion Hopes Face Integration Risks

- Analysts expect profit margins to rise from 0.6% now to 4.1% over the next three years, even as Casella grapples with ongoing operational hurdles tied to its acquisitions.

- According to the consensus narrative, while recent investments in landfill automation and upgraded recycling facilities are projected to support long-term margin gains,

- the aggressive acquisition approach in the Mid-Atlantic region increases the risk of persistent operational inefficiencies. This may make margin expansion a more challenging target than headline forecasts might suggest.

- Ongoing integration challenges, particularly the need to unlock delayed cost synergies from newly acquired assets, could cause margin improvement to arrive more slowly than the consensus expects.

Premium Valuation Puts Pressure on Execution

- Casella’s Price-to-Sales ratio stands at 3.3x, well above peer and industry averages. This level highlights investor expectations for future execution and strong growth delivery.

- The consensus narrative notes this premium pricing challenges the investment case:

- The company would need to grow earnings to $94.9 million by 2028 and achieve a PE ratio of 102.0x to justify current analyst estimates. These levels are much higher than the US Commercial Services industry average PE of 25.7x.

- With the share price at $88.57, there is a 24.5% gap to the analyst target of $115.00. This gap raises the stakes for management to deliver on ambitious growth and margin expansion plans.

Growth Outlook Balances Opportunity and Geographic Limits

- Revenue is forecast to grow 8.7% per year, below the broader US market’s 10.3% annual rate. Casella’s focus on the Northeast and Mid-Atlantic creates both growth opportunity and natural limits.

- The consensus narrative flags this geographic concentration as a double-edged sword:

- Urban expansion and landfill integration in these core markets are anticipated to sustain steady volume growth and pricing power.

- However, limited reach reduces Casella’s ability to benefit from faster-growing regions elsewhere in the US. This could potentially cap longer-term revenue and earnings potential relative to more diversified peers.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Casella Waste Systems on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the numbers? Shape your perspective and build your own narrative in just a few minutes. Do it your way.

A great starting point for your Casella Waste Systems research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Casella Waste Systems faces skepticism over its premium valuation and inconsistent earnings. Operational headwinds are putting pressure on management to deliver sustained performance.

If you prefer stocks trading at more attractive prices, use these 832 undervalued stocks based on cash flows to focus on companies with stronger value credentials built in from the start.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CWST

Casella Waste Systems

Operates as a vertically integrated solid waste services company in the United States.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives