- United States

- /

- Commercial Services

- /

- NasdaqGS:CTAS

Is Cintas Still Worth the Premium After Recent 9% Drop in Share Price?

Reviewed by Bailey Pemberton

- Wondering if Cintas stock is a hidden value or priced to perfection? You are not alone; digging into its numbers just might surprise you.

- The stock’s journey has seen some turbulence recently, with shares down 3.0% in the last week and 9.1% over the past month. Still, it has managed to edge up 1.1% year-to-date and shows strong gains of 75.5% over three years and 114.4% over five years.

- This recent price weakness comes as the market reacts to broader concerns around macroeconomic trends and evolving investor sentiment, even though there have been no explosive news stories or guidance changes specific to Cintas. There have only been a few industry headlines sparking talk of shifting demand and cost pressures in the sector.

- Out of the six key valuation checks we track, Cintas currently scores 0/6 for being underpriced. This sets the scene for a closer look at different ways to assess its valuation before revealing what might be an even better way to judge if the shares are truly worth your attention.

Cintas scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Cintas Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future free cash flows and discounting them back to today's value. This provides a present-day estimate based on how much cash the business is expected to generate.

For Cintas, the most recent Free Cash Flow stands at $1.69 billion. Analyst forecasts predict this figure will grow steadily, with projections reaching $2.37 billion by 2028. Looking further ahead, Simply Wall St extrapolates annual free cash flows out ten years, ultimately reaching $3.14 billion by 2035. Only the first five years are based on actual analyst estimates.

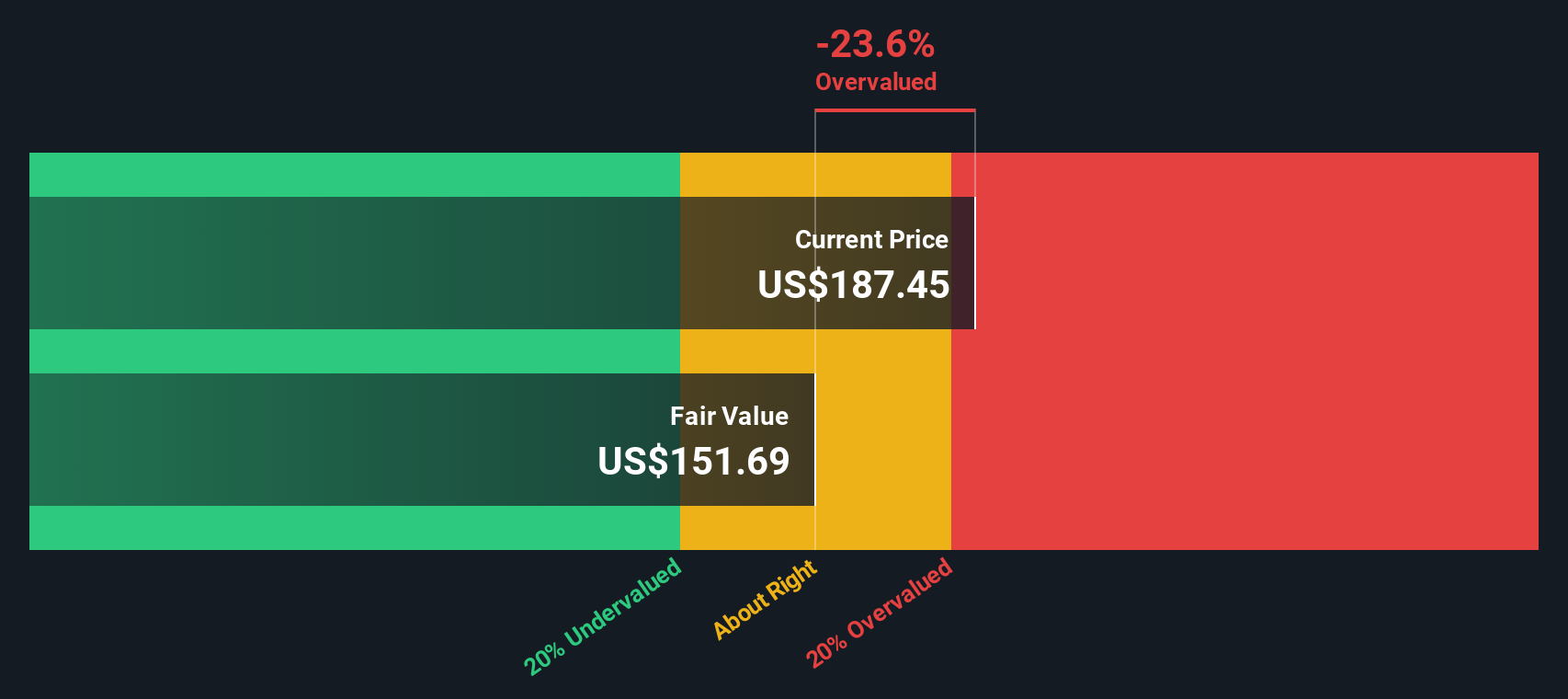

According to this DCF analysis, Cintas’s fair value is estimated at $156.13 per share. When compared with its current market price, the DCF model suggests the stock is trading at a 17.9% premium, indicating it is overvalued based on projected future cash generation.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Cintas may be overvalued by 17.9%. Discover 843 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Cintas Price vs Earnings

The Price-to-Earnings (PE) ratio is widely recognized as a go-to measure for valuing profitable companies. It allows investors to easily compare how much the market is willing to pay for each dollar of earnings, an especially useful metric for firms like Cintas that have a solid profit track record.

Growth expectations and risk both play key roles in determining what a "normal" or "fair" PE ratio should be. Companies with strong earnings growth and lower risk profiles are usually rewarded with higher PE ratios, while more cyclical or riskier names tend to trade at lower levels.

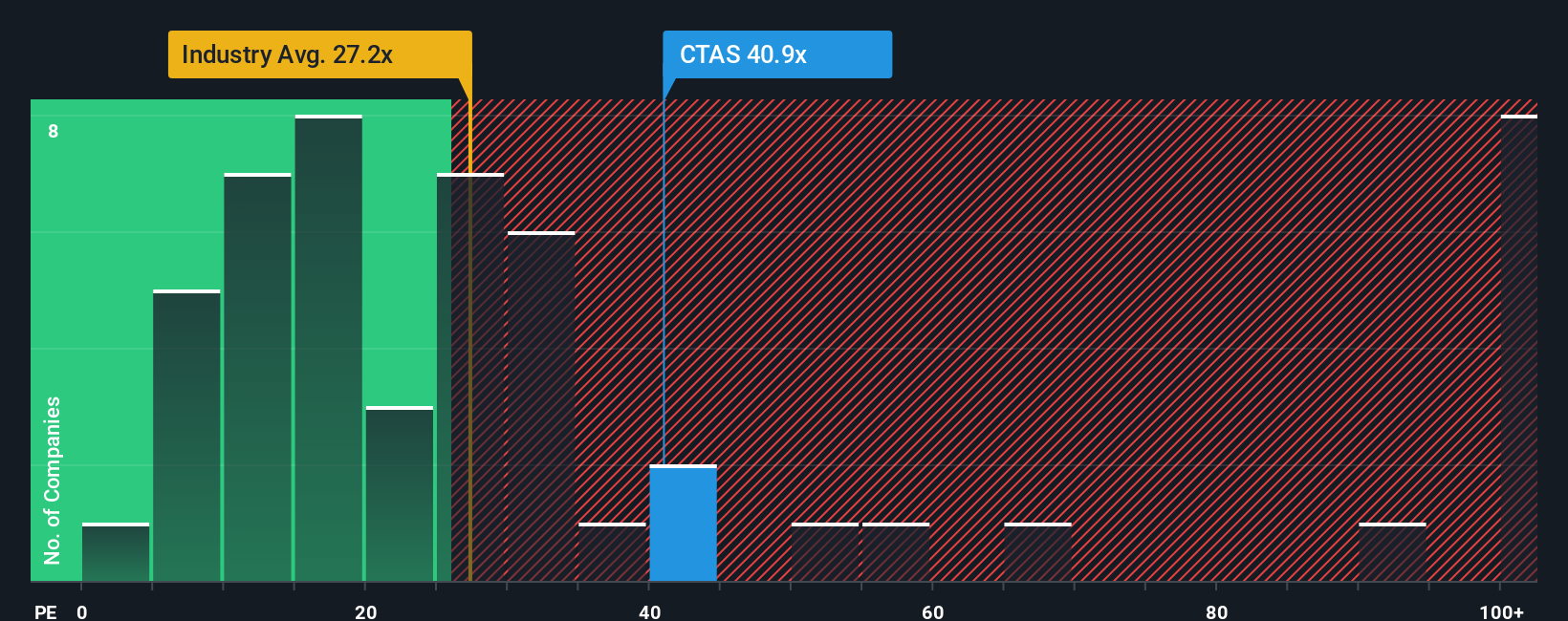

Cintas’s current PE ratio stands at 40.1x, which is noticeably above both its peer average of 32.3x and the commercial services industry average of 22.4x. This signals that investors are placing a premium on the stock, likely reflecting expectations for continued growth and operational strength.

Simply Wall St’s proprietary Fair Ratio for Cintas is 29.9x. This figure is specifically tailored for Cintas and blends together growth, profit margins, industry norms, company size, and risk. That makes it a richer benchmark than simply comparing to peers or the broad industry average, as it factors in everything that gives Cintas its unique investment profile.

With Cintas currently trading at a PE multiple that is materially above its Fair Ratio, the data suggests the shares are overvalued on an earnings basis.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1408 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Cintas Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple yet powerful way to express your viewpoint about a company’s future by linking the story you believe in, such as upcoming product launches, industry trends, or management strategy, to financial forecasts like revenue growth, profit margins, and ultimately, a fair value estimate.

Narratives are more than just numbers; they connect a company’s qualitative story with quantitative assumptions, helping you see clearly how your beliefs result in a price target. As an easy and accessible tool available right on Simply Wall St’s Community page, Narratives let millions of investors share, compare, and refine their views in real time.

They empower you to confidently decide whether to buy or sell by weighing your calculated Fair Value against the live market Price, with Narratives updating dynamically every time new information is released, whether it is a news headline or an earnings report.

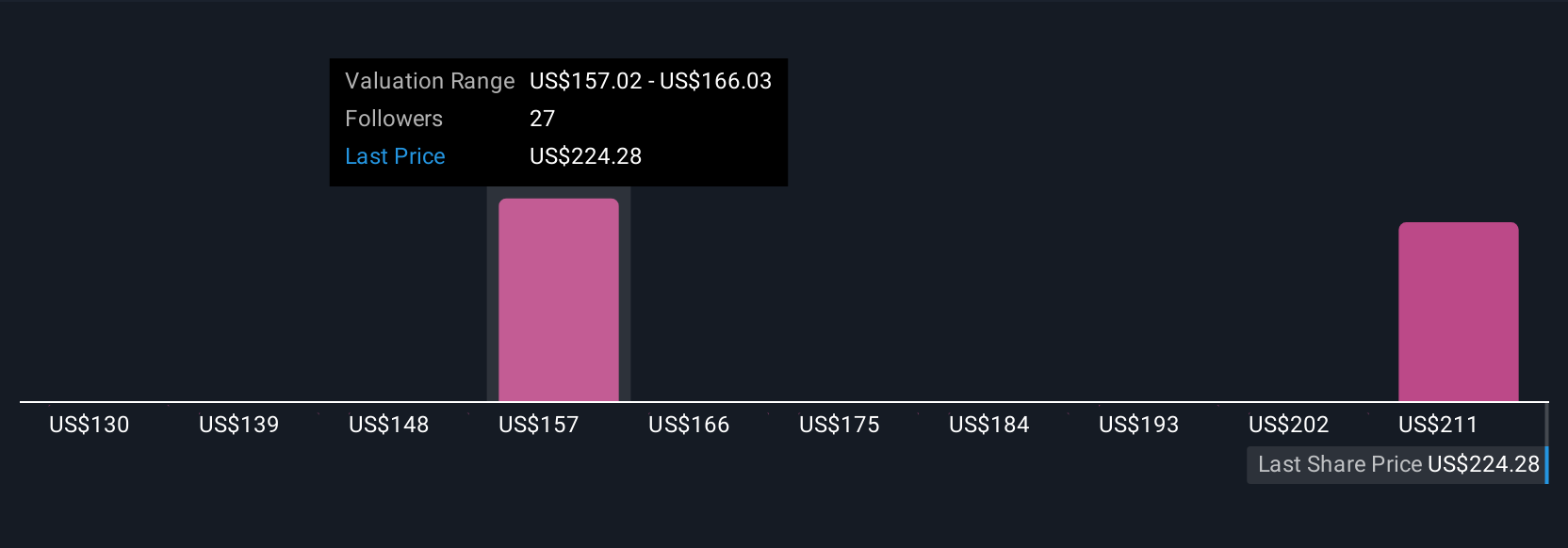

For example, among investors tracking Cintas, some see abundant market share growth and set bullish price targets as high as $257, while more cautious views, focused on remote work risks and cost pressures, land closer to $172 per share. Narratives help you find which scenario aligns with your own view, turning complex financials into actionable insights.

Do you think there's more to the story for Cintas? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CTAS

Cintas

Engages in the provision of corporate identity uniforms and related business services primarily in the United States, Canada, and Latin America.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives