- United States

- /

- Commercial Services

- /

- NasdaqGS:CTAS

Cintas (CTAS): Assessing Valuation Following Recent 10% Share Price Decline

Reviewed by Simply Wall St

Cintas (CTAS) shares have been under some pressure recently, pulling back roughly 10% over the past month. Investors are now weighing the company’s recent performance metrics along with broader market trends to gauge next steps.

See our latest analysis for Cintas.

Although Cintas has experienced a sharp 10% decline in its share price over the past month, this comes after an exceptional multi-year run that has seen its total shareholder return grow more than 120% over five years. The recent pullback signals some fading momentum as markets reassess risk and growth expectations. In the bigger picture, the company’s long-term story is still notable.

If this shift in sentiment has you curious about other opportunities, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With shares recently pulling back but long-term gains still impressive, the question now is whether Cintas offers true value at these levels or if Wall Street has already accounted for the company’s future growth prospects.

Most Popular Narrative: 15.7% Undervalued

Cintas trades at $183.27 while the narrative’s consensus fair value lands 15.7% higher, revealing a sizable gap between market pricing and analyst convictions. This divergence hints at upbeat projections from those following the company’s fundamentals and future earnings growth.

Ongoing customer shift toward outsourcing non-core functions, coupled with high customer retention and successful cross-selling (converting self-managed uniform users to rental programs, bundling services), expands Cintas' total addressable market and supports durable, recurring revenue streams.

Earnings growth, margin optimism, and bold assumptions about future business model shifts are fueling this potential upside. The real drivers behind this valuation might just surprise you. Uncover which financial forecasts and structural trends analysts are betting on.

Result: Fair Value of $217.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued growth of remote work and persistent inflation could dampen demand for uniforms and squeeze margins. This could challenge the bullish outlook for Cintas.

Find out about the key risks to this Cintas narrative.

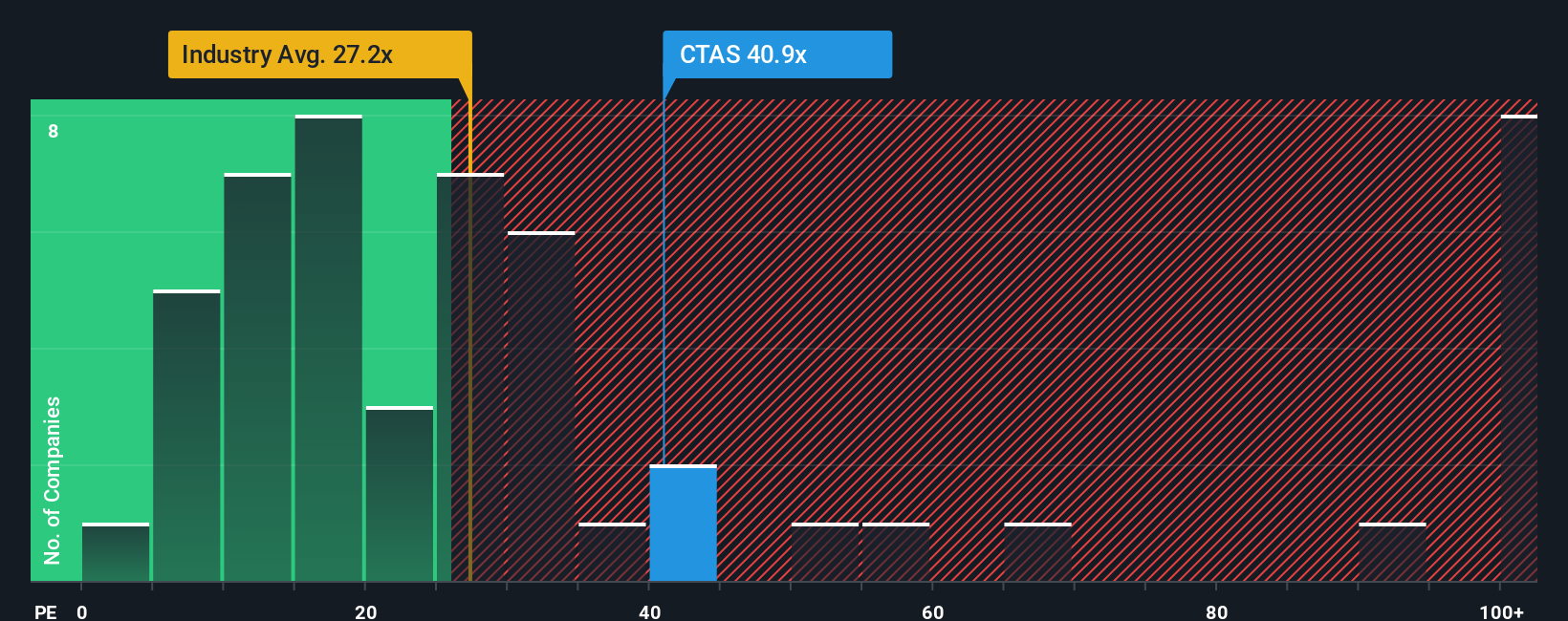

Another View: What the Market’s Multiples Say

Looking through the lens of price-to-earnings, Cintas stands out as costly. Its P/E ratio of 39.9 times is markedly higher than both the industry average of 22.3 and its peer average of 32.4, as well as its fair ratio of 32.4. This suggests investors have priced in a lot of future growth, which leaves little room for disappointment. When will the market decide if that premium is truly justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cintas Narrative

If you’ve got your own take or want to check the numbers for yourself, it’s quick and easy to craft your own viewpoint in just a few minutes. Do it your way

A great starting point for your Cintas research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Set yourself apart from the crowd by searching for standout stocks in fast-changing sectors. With the right tools, you might spot your next winner before everyone else.

- Spot value by checking out these 832 undervalued stocks based on cash flows for companies trading below their fair price based on future cash flows.

- Tap into major breakthroughs in artificial intelligence by screening these 26 AI penny stocks as these companies are positioned to shape the next era of innovation.

- Lock in persistent income streams by selecting from these 22 dividend stocks with yields > 3% featuring yields higher than 3% and a history of solid payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CTAS

Cintas

Engages in the provision of corporate identity uniforms and related business services primarily in the United States, Canada, and Latin America.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives