- United States

- /

- Professional Services

- /

- NasdaqGS:CSGS

A Look at CSG Systems International’s (CSGS) Valuation Following Its 2024 Share Price Rally

Reviewed by Simply Wall St

See our latest analysis for CSG Systems International.

After a breakout stretch, CSG Systems International’s short-term momentum has accelerated, with a 1-month share price return of over 20%. This builds on a substantial year-to-date share price gain of nearly 55%, and the company’s 1-year total shareholder return now stands at an impressive 63%, highlighting both recent optimism and longer-term growth potential.

If you're curious about what else is driving strong returns lately, now’s a perfect time to broaden your investing landscape and discover fast growing stocks with high insider ownership

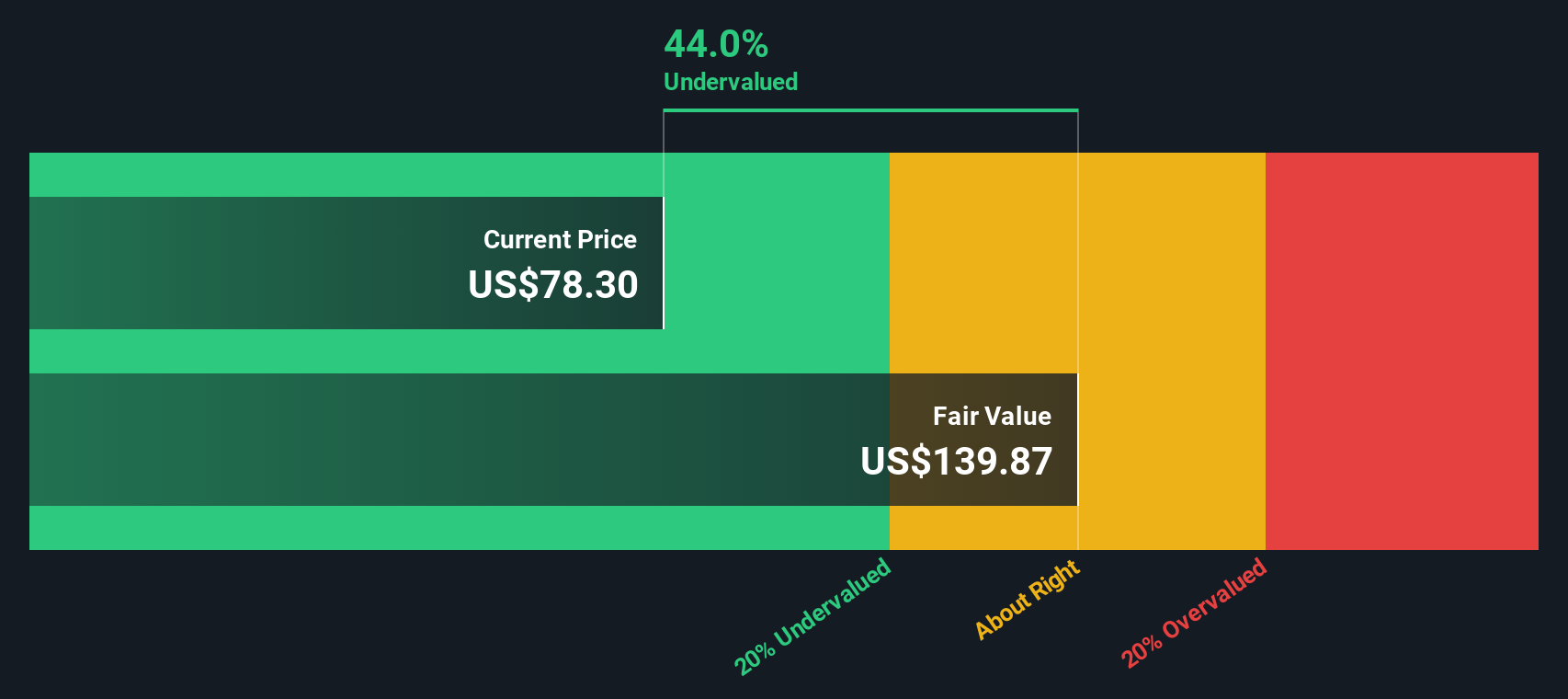

With shares soaring in 2024, the big question is whether CSG Systems International is trading below its true worth, or if the market has already factored in all its future growth prospects for investors.

Most Popular Narrative: 3.1% Undervalued

CSG Systems International's last close at $78.15 sits just below the most popular narrative's fair value of $80.68. This places the company’s shares slightly under typical analyst expectations, with the acquisition premium and revenue resiliency top of mind for many market-watchers.

Ongoing strategic migration to asset-light, SaaS and cloud-based platforms is driving improvements in operating leverage, higher gross and operating margins, and robust free cash flow. This is demonstrated by operating margin expanding 250 basis points year-over-year and guidance being raised for margins and free cash flow growth in both 2025 and 2026.

How does a company command a price above recent trading highs? The secret mix fueling this fair value includes aggressive margin expansion, ambitious future earnings projections, and a focus on recurring revenue growth. Curious what else analysts believe will keep this stock elevated through an acquisition cycle? Delve into the full story and see which forecasts are driving this call.

Result: Fair Value of $80.68 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, CSG’s future growth could be hampered if revenue from key clients slows or if one-off gains fail to repeat. This could introduce new uncertainty for investors.

Find out about the key risks to this CSG Systems International narrative.

Another View: What Does the SWS DCF Model Say?

While the current share price suggests an undervalued situation by common valuation multiples, our SWS DCF model estimates CSG Systems International's fair value at $146.70, which is a staggering 46.7% above the present market price. Could this significant gap be an opportunity, or is the market signaling caution for a reason?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own CSG Systems International Narrative

Prefer to follow your own path? You can easily dive into the data and build your own perspective on CSG Systems International in just a few minutes. Do it your way

A great starting point for your CSG Systems International research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

This rally in CSG Systems International is just one opportunity in a market full of standout investments. Don’t miss your chance to elevate your portfolio even further with ideas that fit your style and goals.

- Spot high-potential companies before the crowd by checking out these 844 undervalued stocks based on cash flows, which focuses on tangible cash flow advantages and smart pricing.

- Unlock steady income streams with these 20 dividend stocks with yields > 3%, featuring strong yields and dividend consistency for any portfolio.

- Join the race to tomorrow’s breakthroughs and harness pioneering opportunities with these 27 AI penny stocks, which showcases the cutting edge of artificial intelligence innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSGS

CSG Systems International

Provides revenue management and digital monetization, customer experience, and payment solutions primarily to the communications industry in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives