- United States

- /

- Professional Services

- /

- NasdaqGS:CRAI

Will CRA International's (CRAI) Dividend Hike Reveal Broader Shifts in Management’s Growth Priorities?

Reviewed by Sasha Jovanovic

- On October 30, 2025, CRA International, Inc. announced a 16% increase in its quarterly dividend to US$0.57 per share, raised full-year 2025 revenue guidance to a range of US$740.0 million to US$748.0 million, and reported third-quarter sales of US$185.89 million with net income of US$11.47 million.

- This combination of higher earnings, a boosted revenue outlook, and a substantial dividend hike highlights management's confidence in CRA International's ongoing business momentum and cash generation.

- We'll examine how the dividend increase signals management's positive outlook and its potential effect on CRA International's investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

CRA International Investment Narrative Recap

To be a shareholder in CRA International, you need to believe that demand for regulatory, economic, and litigation consulting will remain resilient amid changing market and policy cycles, with growth supported by M&A activity and regulatory complexity. The recent revenue guidance increase and dividend hike may offer reassurance on near-term momentum, but the company’s key risk, exposure to potential downturns in global dealmaking, remains unchanged and is not directly addressed by these announcements.

Among the recent updates, the enhanced revenue guidance stands out as most relevant. Raising expected 2025 revenue from US$730.0–745.0 million to US$740.0–748.0 million points to ongoing business strength and compliments CRA’s investment case centered on regulatory and M&A trends, aligning with the current short-term catalyst for the business.

By contrast, investors should pay close attention to the possibility that a sudden slowdown in global M&A activity could impact CRA's top line more than expected, as...

Read the full narrative on CRA International (it's free!)

CRA International's narrative projects $822.0 million revenue and $60.0 million earnings by 2028. This requires 4.9% yearly revenue growth and a $3.6 million earnings increase from $56.4 million today.

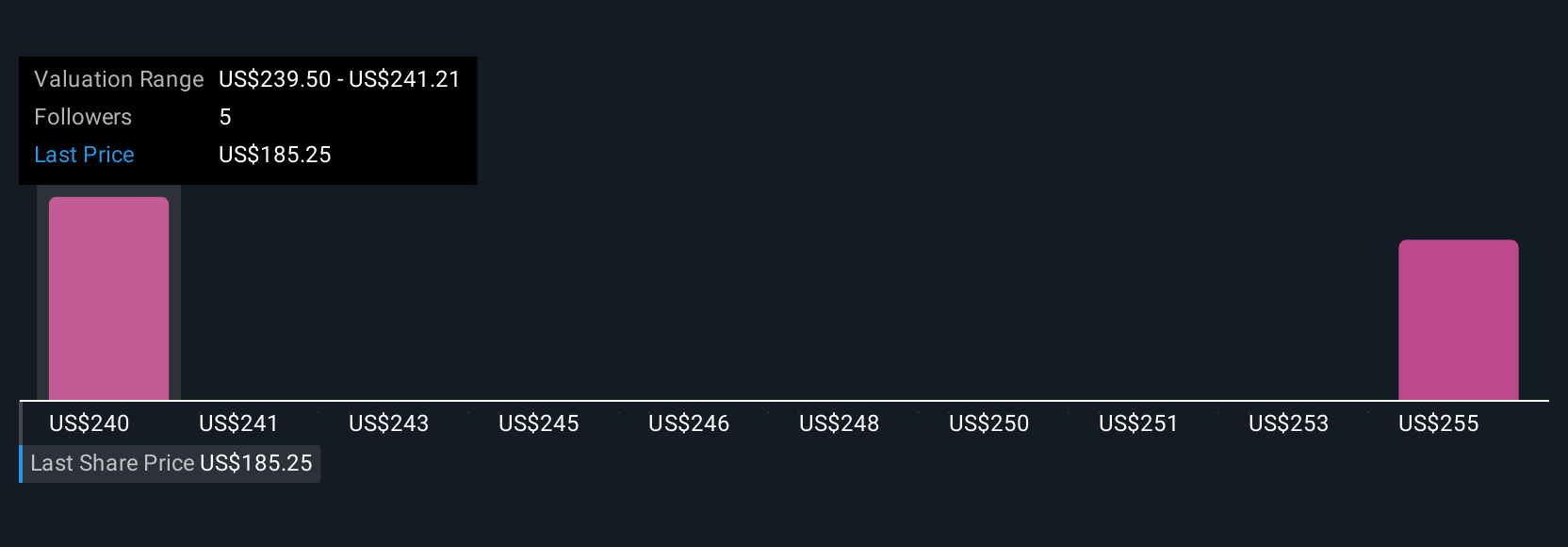

Uncover how CRA International's forecasts yield a $249.50 fair value, a 38% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community users estimate CRA International’s fair value between US$249.50 and US$305.15, based on two perspectives. In light of continued reliance on robust global M&A activity, your own outlook for dealmaking may shape how you interpret these valuations.

Explore 2 other fair value estimates on CRA International - why the stock might be worth just $249.50!

Build Your Own CRA International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CRA International research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free CRA International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CRA International's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRAI

CRA International

Provides economic, financial, and management consulting services worldwide.

Outstanding track record and good value.

Similar Companies

Market Insights

Community Narratives