- United States

- /

- Commercial Services

- /

- NasdaqGS:CECO

A Look at CECO Environmental’s (CECO) Valuation Following Its Ambitious 2026 Revenue Outlook and Recent Sales Growth

Reviewed by Simply Wall St

CECO Environmental (CECO) grabbed attention by rolling out its 2026 revenue outlook, targeting growth beyond its already strong 2025 guidance. The announcement follows impressive year-to-date sales gains, which have reinforced positive sentiment among investors.

See our latest analysis for CECO Environmental.

CECO Environmental’s upbeat 2026 revenue guidance and substantial sales momentum appear to have captured the market’s attention, fueling a remarkable 70.8% share price gain year-to-date. In addition, the company’s shelf registration filing and sustained multi-year outperformance—with a 1-year total shareholder return of 135.6% and an eye-catching 597.4% over five years—suggest that momentum remains strong, even as recent quarterly earnings came in lighter.

If this kind of growth story has you curious about other opportunities, now is a great moment to broaden your investing lens and discover fast growing stocks with high insider ownership.

With CECO Environmental’s shares surging and ambitious new revenue targets on the table, the big question is whether the impressive run has left the stock undervalued or if the market is fully pricing in future growth potential.

Most Popular Narrative: 8.8% Undervalued

CECO Environmental’s consensus narrative assigns a fair value above the recent closing price, reflecting optimism around announced growth targets and sustained momentum. With analysts setting an updated price target at $58.83 against the last close at $53.63, the outlook captures both the company’s progress and the market’s higher expectations.

Record-high backlog and robust pipeline growth, especially in power generation, industrial water, and natural gas infrastructure, suggest that increasing global enforcement of environmental regulations is translating into sustained demand and forward visibility for CECO's solutions. This supports topline revenue growth over the next 18 to 24 months. CECO's ongoing expansion into high-growth international markets such as the Middle East, Southeast Asia, and India, supported by new offices and recent acquisitions, positions the company to benefit from rapid industrialization in these regions. This further diversifies revenue streams and reduces reliance on North America.

Curious what keeps this stock in the spotlight? The narrative’s valuation hinges on high conviction about CECO Environmental’s global demand drivers and ambitious expansion plans. Want to see which accelerating financial metrics are convincing analysts there’s still more headroom? Dive in for the full story behind these projections.

Result: Fair Value of $58.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising expenses from aggressive expansion and any slowdown in revenue growth could present challenges for CECO Environmental in maintaining profit momentum.

Find out about the key risks to this CECO Environmental narrative.

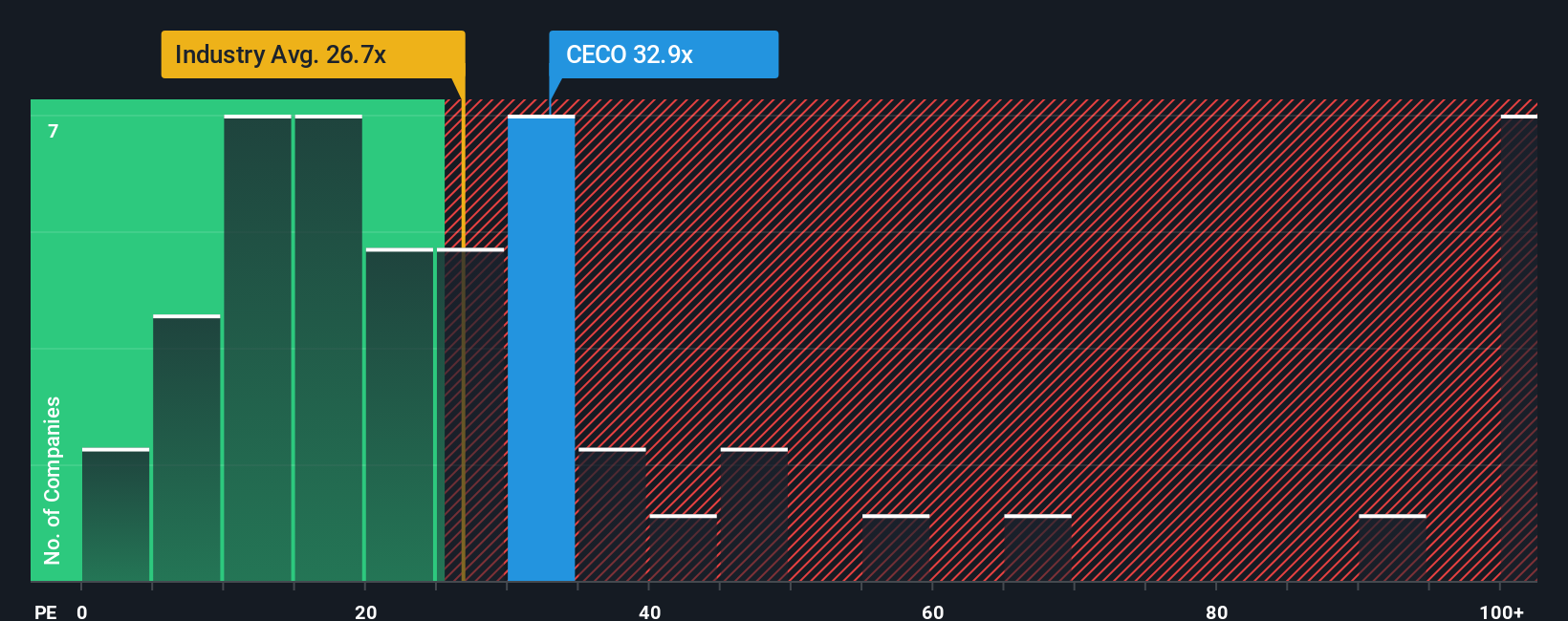

Another View: Valuation by Multiples

From a multiples perspective, CECO Environmental’s price-to-earnings ratio of 36.8x is notably higher than both the peer average (47.8x) and the Commercial Services industry at 22.3x. However, it is double what is considered its fair ratio (18.5x). This suggests investors may be pricing in considerable future growth, but also signals a risk if expectations are not met. Could market confidence be overshooting reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CECO Environmental Narrative

If you think there’s another angle to this story or want to see how your own analysis stacks up, you can dive into the data yourself and shape a narrative in just a few minutes. Do it your way.

A great starting point for your CECO Environmental research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't miss out on powerful new opportunities outside the headlines. Use the Simply Wall St screener to unlock under-the-radar stocks with strong potential for your next smart move.

- Boost your portfolio with consistent income by targeting market leaders using these 20 dividend stocks with yields > 3% which offer attractive yields above 3%.

- Capitalize on the artificial intelligence surge by exploring these 26 AI penny stocks that are shaping tomorrow’s biggest innovations and trends.

- Get ahead of the curve with breakthrough companies revolutionizing crypto and blockchain by acting on these 82 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CECO

CECO Environmental

Provides critical solutions in industrial air quality, industrial water treatment, and energy transition solutions in the United States, the United Kingdom, the Netherlands, China, and internationally.

Proven track record and fair value.

Market Insights

Community Narratives