- United States

- /

- Professional Services

- /

- NasdaqGS:BZ

Kanzhun (NasdaqGS:BZ): Exploring Valuation After Recent Dip Despite Strong Growth

Reviewed by Simply Wall St

Kanzhun (NasdaqGS:BZ) shares have drifted slightly lower over the past month, even as the company posted double-digit annual growth in both revenue and net income. Investors seem to be weighing recent results in comparison with longer-term trends.

See our latest analysis for Kanzhun.

The latest 30-day share price return of -5.3% hints at shifting sentiment after this year’s rapid climb. However, the total shareholder return stands at 49.8% over the past twelve months, reflecting enduring optimism about Kanzhun’s expansion and profitability story.

If Kanzhun’s performance got you thinking about what else is gaining momentum, now is the perfect opportunity to discover fast growing stocks with high insider ownership

Yet with shares cooling off after a strong year, the key question for investors is whether Kanzhun’s impressive fundamentals are still underappreciated, or if the market has already factored in much of the company’s future potential.

Most Popular Narrative: 18% Undervalued

With Kanzhun’s estimated fair value sitting above the current share price, there is an argument that the market is not fully recognizing its long-term growth potential. The following perspective drives the prevailing consensus among market watchers.

Operating leverage through cost control, efficiency gains from AI integration across R&D and customer service, and a robust two-sided network effect are together driving margin expansion. This suggests continued improvement in net margins and profitability.

What is the secret behind the big price gap? Analysts are banking on a future shaped by higher margins, outsized revenue growth, and ambitious cost-cutting targets. But what is fueling those projections, and how bold are the assumptions? Only a deep dive into the full narrative will reveal how this valuation story takes shape.

Result: Fair Value of $25.03 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, declining graduate numbers and rising competition could limit Kanzhun’s growth trajectory. These factors pose real challenges to the optimistic outlook seen so far.

Find out about the key risks to this Kanzhun narrative.

Another View: Valuation Gaps Remain

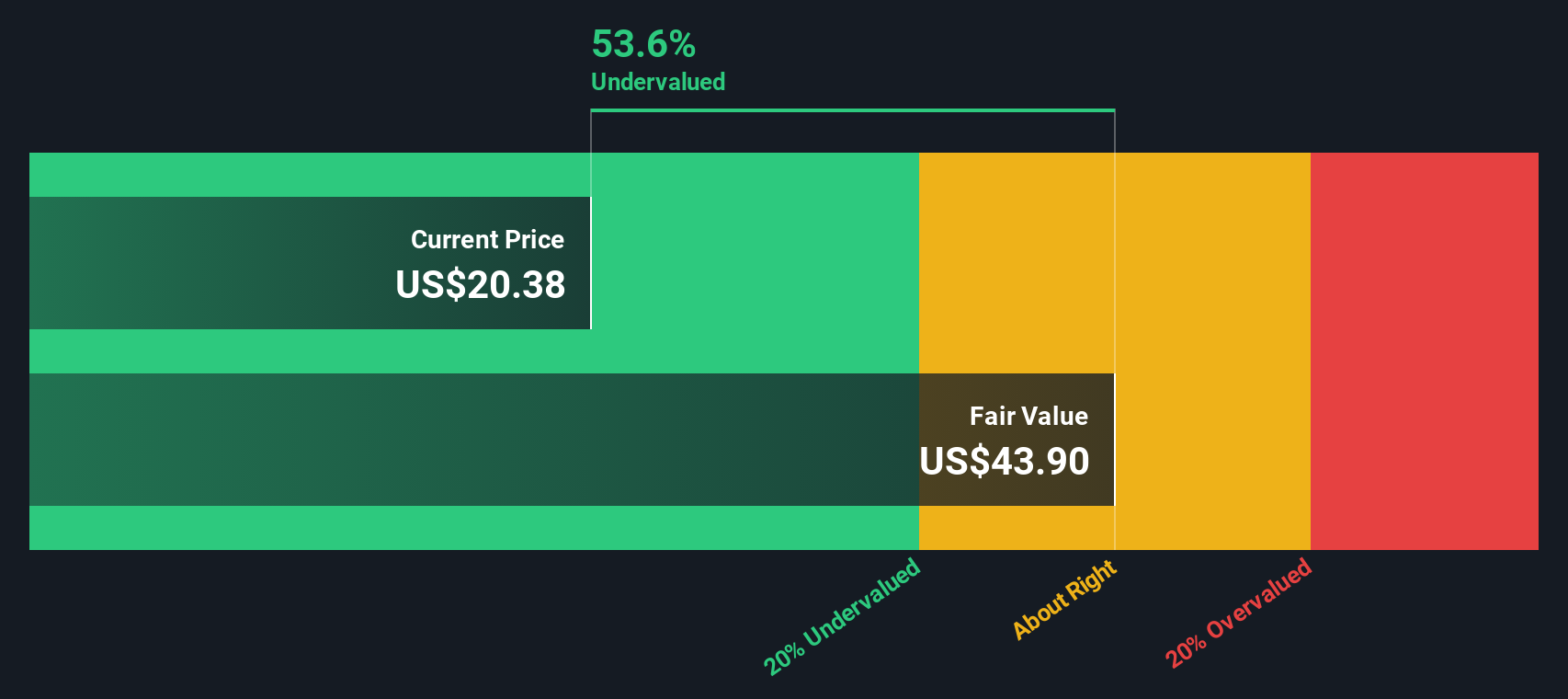

Switching perspective, the SWS DCF model suggests Kanzhun might be significantly undervalued, with the current share price well below our estimate of fair value. This method takes into account future cash flows and not just today’s multiples. Could the market be underestimating long-term potential?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Kanzhun Narrative

If you want to investigate the numbers for yourself or prefer a hands-on approach, you can piece together your own view of Kanzhun in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Kanzhun.

Looking for more investment ideas?

The smartest investors always have new opportunities on their radar. Don’t miss your chance to take action, sharpen your strategy, and find stocks with explosive potential using these handpicked idea screens:

- Boost your passive income by tapping into these 18 dividend stocks with yields > 3%, which offer generous yields above 3% and steady payout histories.

- Expand your portfolio with confidence through these 27 AI penny stocks, pushing the envelope in artificial intelligence and reshaping tomorrow’s industries.

- Position yourself ahead of the crowd by tracking these 894 undervalued stocks based on cash flows, where strong cash flows signal real value that others may have missed.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kanzhun might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BZ

Kanzhun

Provides online recruitment services in the People’s Republic of China.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives