- United States

- /

- Commercial Services

- /

- NasdaqCM:BTM

Why Bitcoin Depot (BTM) Is Up 8.5% After Revenue Forecast Hike and S&P Index Inclusion

Reviewed by Sasha Jovanovic

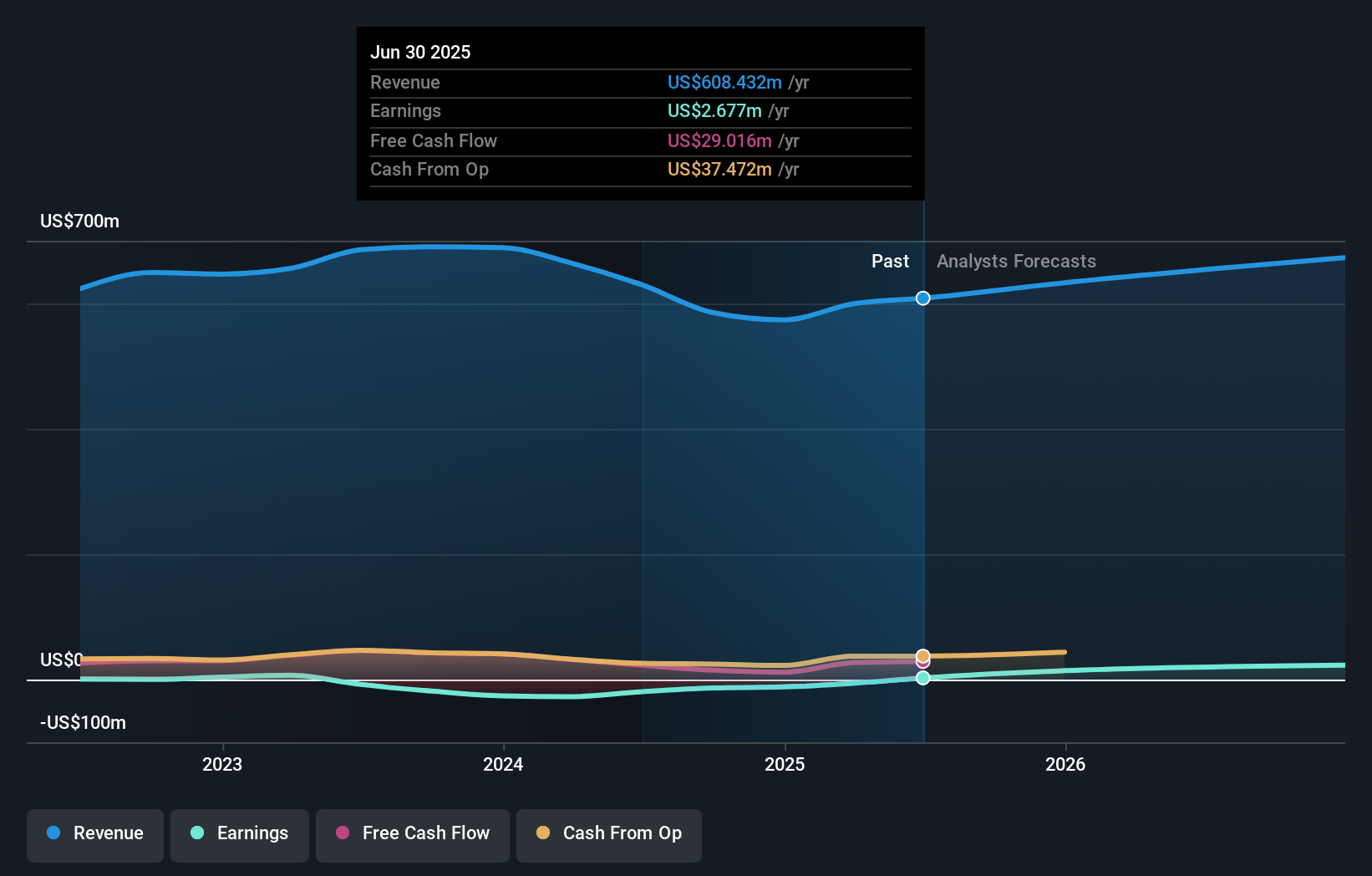

- Bitcoin Depot Inc. recently announced guidance projecting approximately US$160 million in revenue for the third quarter of 2025, reflecting an anticipated 18% increase over the prior year’s period.

- The company was also added to the S&P Global BMI Index in late September, marking a milestone that elevates its profile among institutional investors.

- We’ll explore how Bitcoin Depot’s projected revenue growth and index inclusion shape its investment narrative amid rising investor attention.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Bitcoin Depot's Investment Narrative?

For anyone considering Bitcoin Depot, the latest Q3 2025 guidance and S&P Global BMI Index inclusion arrive at a pivotal moment. The company’s projected US$160 million in quarterly revenue marks a stronger near-term outlook than previous estimates, potentially shifting one of the main catalysts: stronger top-line momentum could reinforce confidence in management’s direction and industry relevance. Meanwhile, the index addition is more than symbolic, as it draws institutional eyes and may boost trading liquidity, short-term price activity could react, but lasting effects hinge on continued operational execution. That said, key risks like the less experienced board and high debt levels are more important than ever, particularly as visibility improves. With recent share price swings and community value estimates covering a wide spread, investors face a mix of renewed opportunity and persistent uncertainty.

However, the board's limited experience remains a potential pitfall investors should keep on their radar.

Exploring Other Perspectives

Explore 3 other fair value estimates on Bitcoin Depot - why the stock might be worth as much as 96% more than the current price!

Build Your Own Bitcoin Depot Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bitcoin Depot research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Bitcoin Depot research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bitcoin Depot's overall financial health at a glance.

No Opportunity In Bitcoin Depot?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Bitcoin Depot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BTM

Bitcoin Depot

Owns and operates a network of bitcoin ATMs in North America and Hong Kong.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion