- United States

- /

- Professional Services

- /

- NasdaqCM:AERT

Positive Sentiment Still Eludes Aeries Technology, Inc (NASDAQ:AERT) Following 37% Share Price Slump

To the annoyance of some shareholders, Aeries Technology, Inc (NASDAQ:AERT) shares are down a considerable 37% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 86% loss during that time.

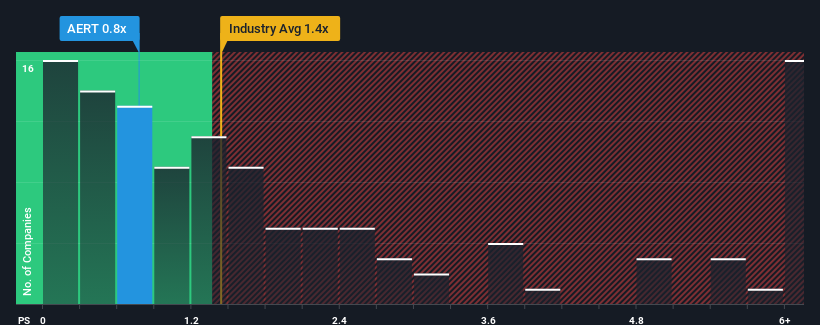

Since its price has dipped substantially, given about half the companies operating in the United States' Professional Services industry have price-to-sales ratios (or "P/S") above 1.4x, you may consider Aeries Technology as an attractive investment with its 0.8x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Aeries Technology

How Aeries Technology Has Been Performing

Aeries Technology certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. Perhaps the market is expecting future revenue performance to dwindle, which has kept the P/S suppressed. Those who are bullish on Aeries Technology will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Aeries Technology will help you shine a light on its historical performance.How Is Aeries Technology's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Aeries Technology's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered an exceptional 37% gain to the company's top line. The latest three year period has also seen an excellent 76% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 5.7% shows it's noticeably more attractive.

With this in mind, we find it intriguing that Aeries Technology's P/S isn't as high compared to that of its industry peers. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Final Word

Aeries Technology's P/S has taken a dip along with its share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Aeries Technology revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

Before you take the next step, you should know about the 3 warning signs for Aeries Technology (1 is a bit concerning!) that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:AERT

Aeries Technology

Provides professional and technology consulting services in North America, the Asia Pacific, and internationally.

Slight risk and slightly overvalued.

Market Insights

Community Narratives