- United States

- /

- Professional Services

- /

- NasdaqGS:ADP

What ADP's Dividend Hike and New Workforce Platform Reveal About Its Investment Case

Reviewed by Sasha Jovanovic

- Earlier this month, Automatic Data Processing (ADP) announced a 10% increase in its quarterly dividend to an annual rate of US$6.80 per share, marking 51 consecutive years of dividend growth, alongside the launch of its unified global workforce management suite integrated with its recent WorkForce Software acquisition.

- These moves not only highlight ADP’s ongoing commitment to shareholder returns but also showcase its innovation in global human capital management solutions.

- We’ll explore how ADP’s dividend increase reinforces confidence in its earnings resilience and shapes the company’s investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Automatic Data Processing Investment Narrative Recap

To be a shareholder in Automatic Data Processing, you need to believe in the durability of its recurring revenue model and its ability to maintain leadership in global HR technology, despite rising competition and some recent softness in bookings. The recent 10% dividend increase and product innovations reinforce the company’s earnings resilience but do not materially shift the short-term focus, which remains centered on whether ADP can accelerate new business wins and offset pipeline delays, a key catalyst for near-term growth and the main area of risk right now.

The launch of the unified ADP WorkForce Suite, integrated with acquisitions like WorkForce Software, is especially relevant, as it enhances ADP’s global platform and could strengthen adoption of its next-generation HCM solutions. This move aligns directly with the catalysts outlined for ADP: deeper product integration is expected to drive higher revenue per user and help offset competitive pressures, but execution on these offerings remains crucial to meet growth expectations.

However, investors should be aware that while the dividend news offers reassurance, growing competitive pressure and prolonged sales cycles still carry meaningful implications for ...

Read the full narrative on Automatic Data Processing (it's free!)

Automatic Data Processing's narrative projects $24.3 billion revenue and $5.1 billion earnings by 2028. This requires 5.7% yearly revenue growth and a $1.0 billion earnings increase from $4.1 billion.

Uncover how Automatic Data Processing's forecasts yield a $293.23 fair value, a 16% upside to its current price.

Exploring Other Perspectives

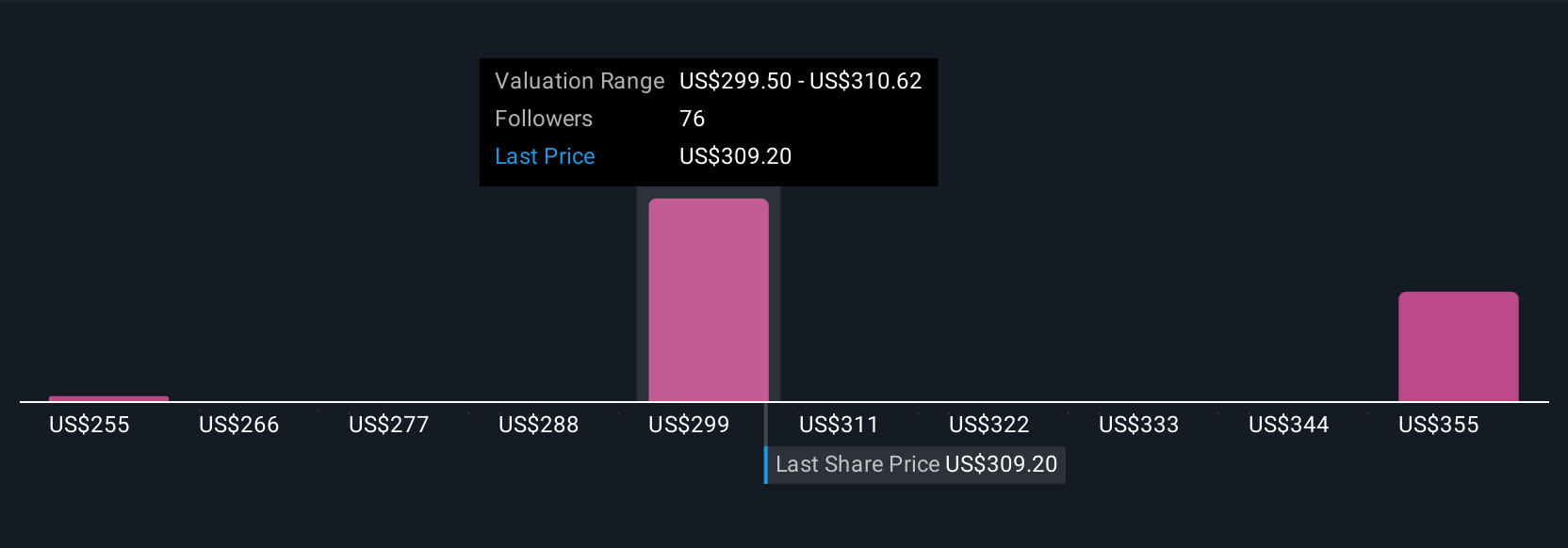

Four fair value estimates from the Simply Wall St Community range from US$276 to US$387.77 per share. As you weigh these diverse opinions, keep in mind the key catalyst is whether ADP’s new product integrations can drive enough growth to outpace competitive threats, individual perspectives suggest there’s plenty of room for debate.

Explore 4 other fair value estimates on Automatic Data Processing - why the stock might be worth just $276.00!

Build Your Own Automatic Data Processing Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Automatic Data Processing research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Automatic Data Processing research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Automatic Data Processing's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADP

Automatic Data Processing

Provides cloud-based human capital management (HCM) solutions worldwide.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives