- United States

- /

- Professional Services

- /

- NasdaqGS:ADP

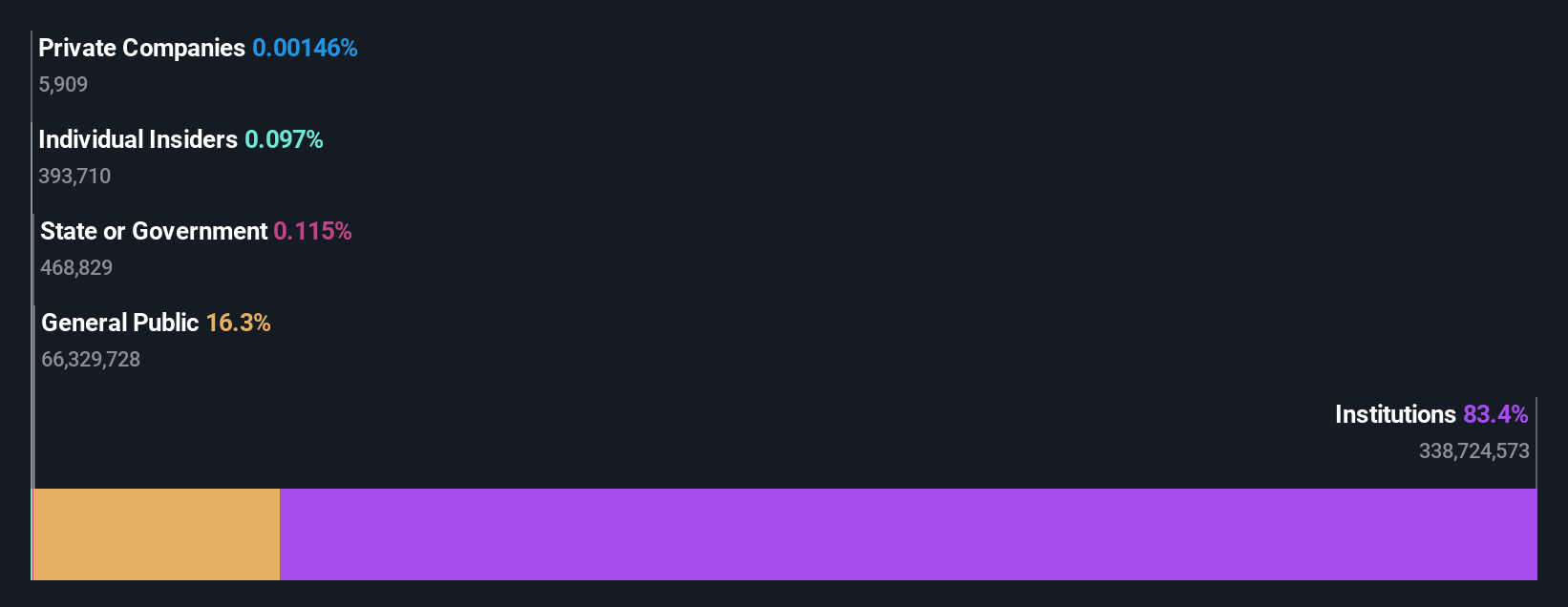

Automatic Data Processing, Inc. (NASDAQ:ADP) is favoured by institutional owners who hold 83% of the company

Key Insights

- Institutions' substantial holdings in Automatic Data Processing implies that they have significant influence over the company's share price

- A total of 25 investors have a majority stake in the company with 48% ownership

- Using data from analyst forecasts alongside ownership research, one can better assess the future performance of a company

If you want to know who really controls Automatic Data Processing, Inc. (NASDAQ:ADP), then you'll have to look at the makeup of its share registry. We can see that institutions own the lion's share in the company with 83% ownership. That is, the group stands to benefit the most if the stock rises (or lose the most if there is a downturn).

Because institutional owners have a huge pool of resources and liquidity, their investing decisions tend to carry a great deal of weight, especially with individual investors. As a result, a sizeable amount of institutional money invested in a firm is generally viewed as a positive attribute.

In the chart below, we zoom in on the different ownership groups of Automatic Data Processing.

See our latest analysis for Automatic Data Processing

What Does The Institutional Ownership Tell Us About Automatic Data Processing?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

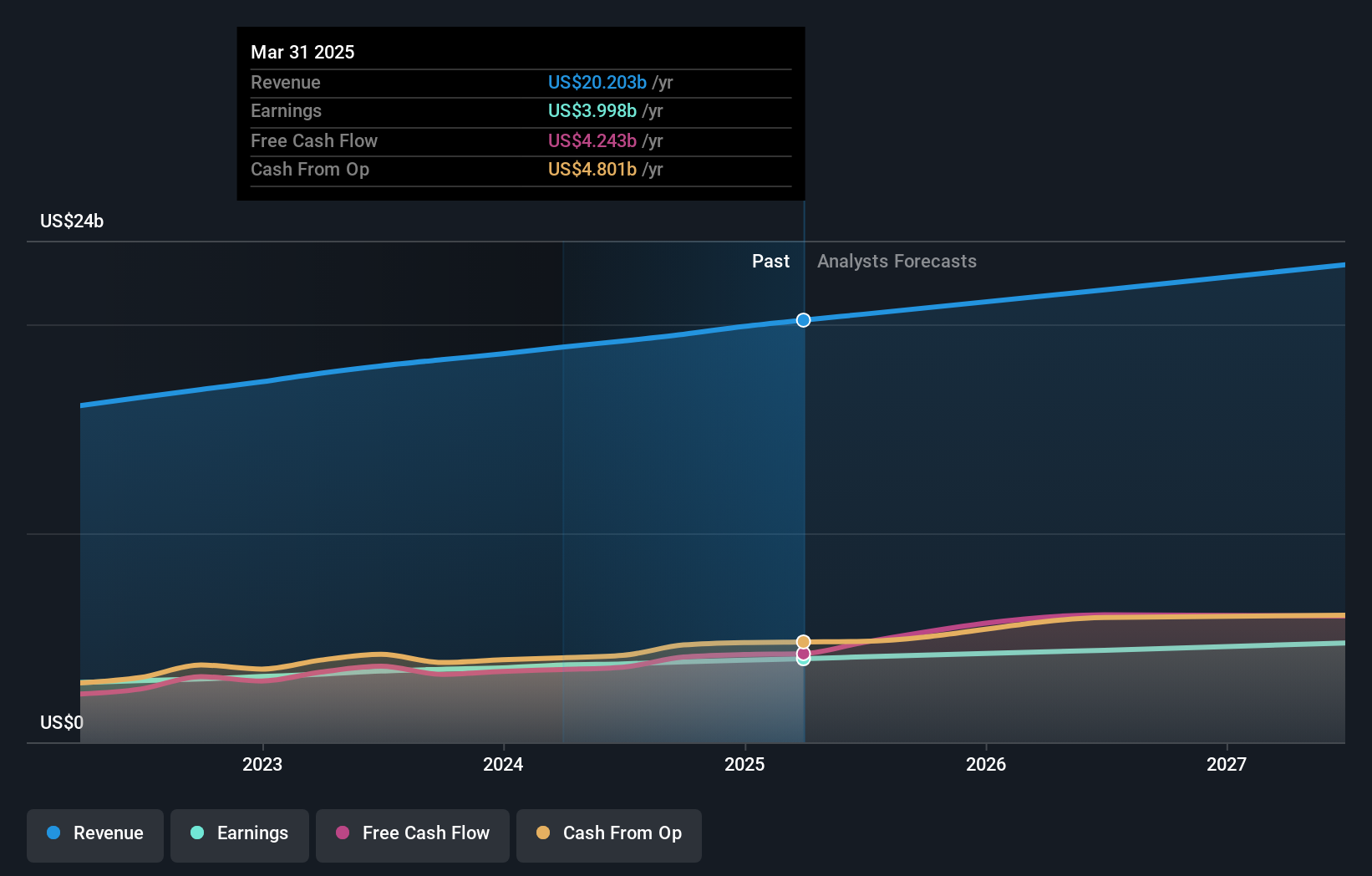

We can see that Automatic Data Processing does have institutional investors; and they hold a good portion of the company's stock. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of Automatic Data Processing, (below). Of course, keep in mind that there are other factors to consider, too.

Investors should note that institutions actually own more than half the company, so they can collectively wield significant power. Hedge funds don't have many shares in Automatic Data Processing. Our data shows that The Vanguard Group, Inc. is the largest shareholder with 10% of shares outstanding. For context, the second largest shareholder holds about 8.9% of the shares outstanding, followed by an ownership of 4.6% by the third-largest shareholder.

On studying our ownership data, we found that 25 of the top shareholders collectively own less than 50% of the share register, implying that no single individual has a majority interest.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. Quite a few analysts cover the stock, so you could look into forecast growth quite easily.

Insider Ownership Of Automatic Data Processing

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Our data suggests that insiders own under 1% of Automatic Data Processing, Inc. in their own names. As it is a large company, we'd only expect insiders to own a small percentage of it. But it's worth noting that they own US$121m worth of shares. It is good to see board members owning shares, but it might be worth checking if those insiders have been buying.

General Public Ownership

The general public, who are usually individual investors, hold a 16% stake in Automatic Data Processing. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too.

I like to dive deeper into how a company has performed in the past. You can find historic revenue and earnings in this detailed graph.

But ultimately it is the future, not the past, that will determine how well the owners of this business will do. Therefore we think it advisable to take a look at this free report showing whether analysts are predicting a brighter future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ADP

Automatic Data Processing

Provides cloud-based human capital management (HCM) solutions worldwide.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

This strategic transformation of TTE? Significant re-rating potential

Q3 Outlook modestly optimistic

Okamoto Machine Tool Works focus on profitability

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.