- United States

- /

- Professional Services

- /

- NasdaqGS:ADP

Assessing ADP (ADP) Valuation as Shares Slip 11% This Month

Reviewed by Simply Wall St

Automatic Data Processing (ADP) shares have slipped about 11% over the past month, giving investors pause to reevaluate the company’s current valuation. Several factors may be influencing recent sentiment shifts in this leading payroll and HR services provider.

See our latest analysis for Automatic Data Processing.

ADP’s recent slip follows a longer stretch of fading momentum, as the 1-year total shareholder return stands at -14.02% despite the company’s impressive track record of 61.59% total return over five years. After a strong run, the current pullback may reflect shifting views around growth prospects and near-term risk. This could be setting a new tone for the stock’s valuation outlook.

If you’re weighing your next moves, now’s a great chance to broaden your watchlist and discover fast growing stocks with high insider ownership

With ADP’s shares now trading at a discount to analyst targets, investors may be wondering if this downturn presents a compelling entry point or if the current price already accounts for the company’s future growth prospects.

Most Popular Narrative: 35.3% Undervalued

According to yiannisz, the most widely followed outlook places Automatic Data Processing's fair value well above its recent close. This signals that many see opportunity in the current disconnect between narrative value and market price, with key drivers behind the estimate looking beyond short-term setbacks.

Automatic Data Processing, Inc. (NASDAQ: ADP) remains one of the most reliable pillars in human capital management, blending predictable cash flows with an expanding suite of digital HR solutions. However, as the market increasingly values companies for innovation rather than legacy reliability, ADP finds itself at a crossroads between stability and transformation.

Curious which future trends and bold financial bets might be powering this narrative? Hints of significant transformation and a fresh approach to margins are embedded in these projections. What’s the secret path that justifies such a bullish view? Tap deeper to see what’s fueling this valuation.

Result: Fair Value of $387.77 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps or rising technology costs could undermine anticipated margin gains and challenge the case for sustained undervaluation in the near term.

Find out about the key risks to this Automatic Data Processing narrative.

Another View: What Do the Market Multiples Say?

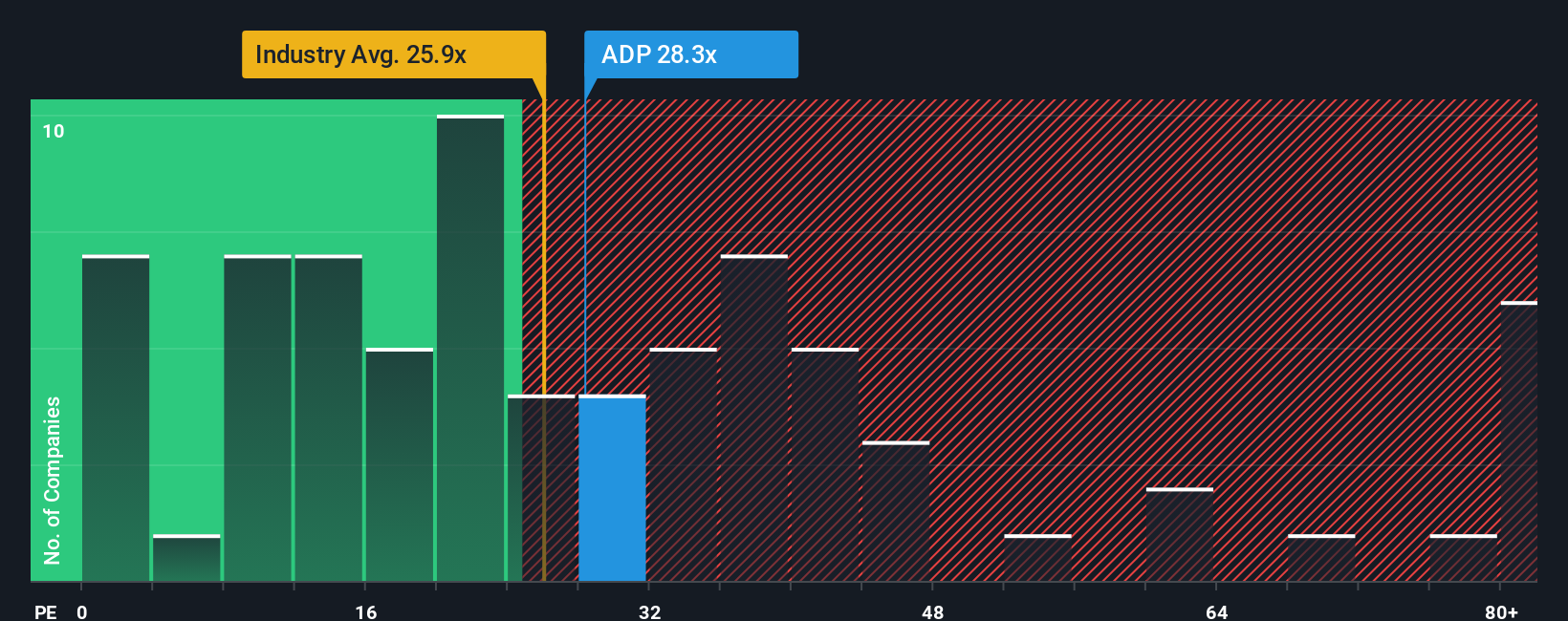

Our quick check using the price-to-earnings ratio takes a different route than the DCF approach. ADP trades at 24.5 times earnings, a touch higher than the US Professional Services industry average of 23.2, but below its peers at 27.8 and well under the 29.8 fair ratio our model suggests the market could eventually target. This suggests either muted upside or that investors are pricing in more risk. Is this market caution a sign to dig deeper?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Automatic Data Processing Narrative

Not convinced by these takes, or eager to dig into the numbers yourself? It only takes a few minutes to uncover your own view and shape the story with Do it your way

A great starting point for your Automatic Data Processing research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for Fresh Investment Opportunities?

Let the momentum work for you. Don’t risk overlooking your next winner. Spark your portfolio growth by searching stocks with distinct qualities geared for today’s market.

- Capitalize on high yields and long-term value by checking out these 18 dividend stocks with yields > 3% offering steady income and growth potential.

- Spot emerging trends in medicine and unlock potential by reviewing these 31 healthcare AI stocks powering breakthroughs in healthcare innovation.

- Catch the next wave of game-changing tech when you scan these 27 AI penny stocks fueling advancements in artificial intelligence-driven industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADP

Automatic Data Processing

Provides cloud-based human capital management (HCM) solutions worldwide.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives