- United States

- /

- Professional Services

- /

- NasdaqGS:ADP

ADP Halts Payroll Data Supply to Fed Might Change The Case For Investing In ADP (ADP)

Reviewed by Sasha Jovanovic

- Automatic Data Processing (ADP) has recently stopped providing its aggregated private-sector employment data to the Federal Reserve, ending a long-standing collaboration that had been a key input for policy decisions.

- This move, combined with limited official labor market data during the ongoing government shutdown, has heightened market attention due to potential challenges for economic forecasting and policy-making.

- We'll examine how ADP's withdrawal of payroll data from the Fed may alter the company's investment narrative and longer-term positioning.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Automatic Data Processing Investment Narrative Recap

To see value in Automatic Data Processing, I believe you need confidence in the long-term demand for outsourced HR and payroll technology, especially as compliance complexity and digital transformation push companies toward integrated solutions. The recent halt in ADP’s payroll data sharing with the Fed may draw attention, but for now, it appears unlikely to affect the leading catalyst, demand for cloud and AI-driven HR products, or change the primary risk of slowing U.S. payroll growth and competitive headwinds in core markets.

Among recent company updates, ADP’s September launch of Embedded Payroll for small businesses stands out as directly relevant; it supports the push for broader adoption in the key SMB space, which remains one of the primary long-term growth drivers and is closely tied to the same labor data customers and policymakers value.

In contrast, it is important to remember that persistent delays in bookings growth for large, complex deals, especially as economic data access tightens, represent a risk investors should watch for as...

Read the full narrative on Automatic Data Processing (it's free!)

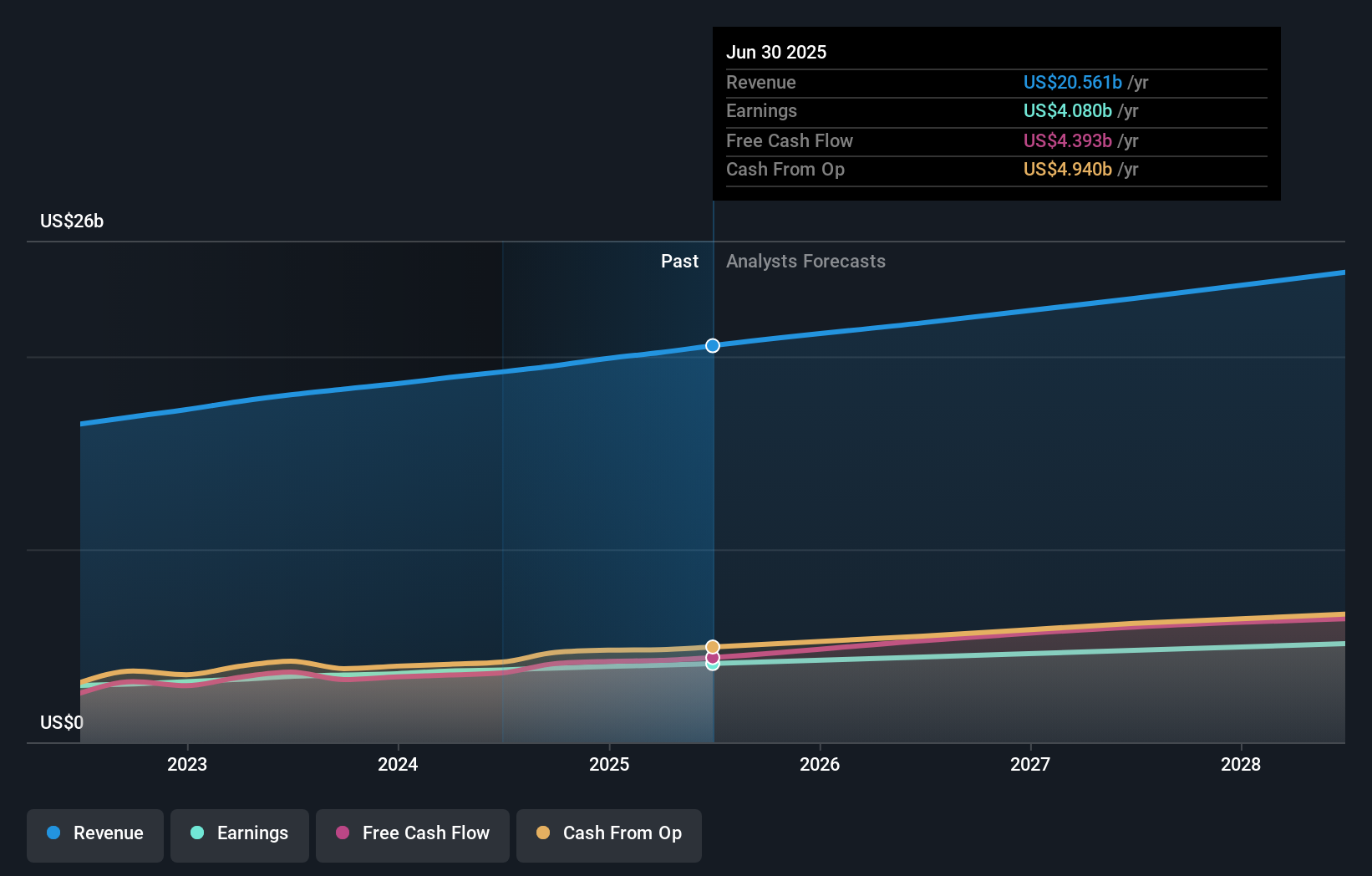

Automatic Data Processing's narrative projects $24.3 billion revenue and $5.1 billion earnings by 2028. This requires 5.7% yearly revenue growth and a $1.0 billion earnings increase from $4.1 billion today.

Uncover how Automatic Data Processing's forecasts yield a $314.17 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members set fair value estimates for ADP ranging from US$267.16 to US$389.35 across four analyses. Against this wide backdrop of opinions, slowing US payroll growth remains in focus as a central risk that could shape future performance expectations, consider reviewing several perspectives to weigh the full picture.

Explore 4 other fair value estimates on Automatic Data Processing - why the stock might be worth as much as 38% more than the current price!

Build Your Own Automatic Data Processing Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Automatic Data Processing research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Automatic Data Processing research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Automatic Data Processing's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADP

Automatic Data Processing

Provides cloud-based human capital management (HCM) solutions worldwide.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives