- United States

- /

- Professional Services

- /

- NasdaqGS:ADP

Is ADP's Latest Acquisition Enough to Strengthen Its Competitive Positioning?

- Automatic Data Processing, Inc. recently reported first quarter results for fiscal 2026, showing higher revenue of US$5.18 billion and net income of US$1.01 billion, supported by sustained growth in new business bookings and an expanded product portfolio following the acquisition of WorkForce Software.

- The company maintained its full-year consolidated revenue outlook and continues to invest in research and development while expanding internationally, although operating expenses and competition remain as ongoing challenges.

- We'll explore how the acquisition of WorkForce Software and stronger quarterly results could influence ADP's long-term investment outlook.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Automatic Data Processing Investment Narrative Recap

To be a shareholder in Automatic Data Processing, you need confidence in its ability to sustain growth through expanding its product ecosystem and winning new clients, even as HR tech competition intensifies and expenses rise. The latest quarterly results, showing both revenue and net income increases, reinforce the near-term catalyst of new business bookings; however, these positive numbers do not materially reduce the ongoing risk from rivals pressuring ADP’s pricing and market share.

Among recent announcements, ADP’s confirmation of its full-year revenue guidance is especially relevant. With management projecting consolidated growth of 5% to 6% for fiscal 2026, this offers investors continued clarity amid rapidly evolving market conditions and complements the momentum seen from integrating WorkForce Software and expanding internationally.

But while these advances are encouraging, investors should be aware that looming competitive pressures could still impact ADP’s ability to defend margins if...

Read the full narrative on Automatic Data Processing (it's free!)

Automatic Data Processing's narrative projects $24.3 billion revenue and $5.1 billion earnings by 2028. This requires 5.7% yearly revenue growth and a $1.0 billion earnings increase from $4.1 billion today.

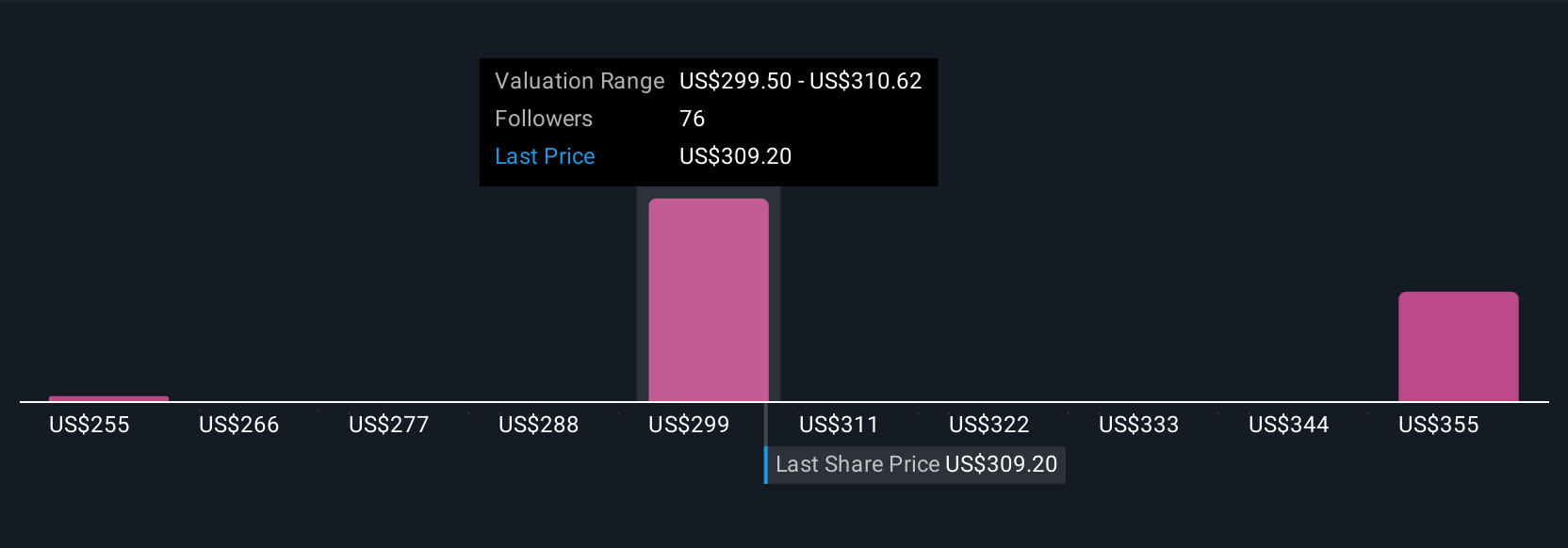

Uncover how Automatic Data Processing's forecasts yield a $311.62 fair value, a 20% upside to its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community put ADP’s intrinsic worth between US$267.16 and US$319.91. Yet as many weigh in, rising competition from SaaS-native peers remains a pressing concern that could shape outcomes for future profitability.

Explore 4 other fair value estimates on Automatic Data Processing - why the stock might be worth as much as 23% more than the current price!

Build Your Own Automatic Data Processing Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Automatic Data Processing research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Automatic Data Processing research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Automatic Data Processing's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADP

Automatic Data Processing

Provides cloud-based human capital management (HCM) solutions worldwide.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

My view on CSL Limited is positive. It’s a high-quality growth stock with strong barriers to entry through its global plasma network.

Nu holdings will continue to disrupt the South American banking market

The Transition From Automaker To AI Behemoth Is Underway, But Priced In

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

The "Physical AI" Monopoly – A New Industrial Revolution

Trending Discussion