- United States

- /

- Machinery

- /

- OTCPK:MUEL

Paul Mueller (MUEL) Swings to Profitability, Challenging Quality Concerns with Margin Turnaround

Reviewed by Simply Wall St

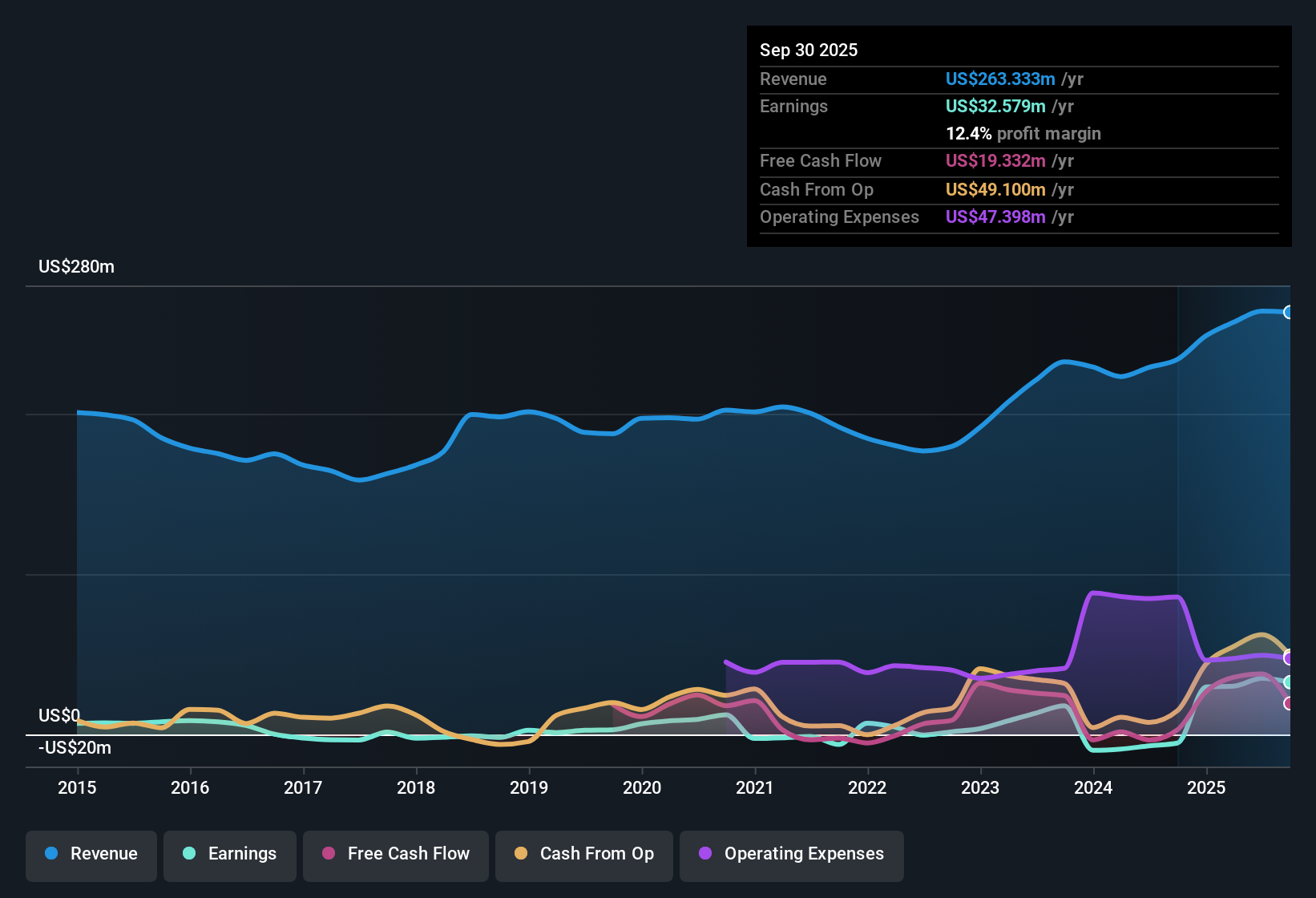

Paul Mueller (MUEL) posted a noteworthy turnaround in its recent earnings, swinging to profitability over the past year after a stretch of losses. Earnings have accelerated at an average annual rate of 41.3% over the last five years, and the company’s net profit margin has expanded as profitability returned. The latest data points to attractive value with shares trading below estimated fair value, but investors should keep an eye on the high proportion of non-cash earnings when weighing the quality of reported profits.

See our full analysis for Paul Mueller.Next, we will compare these headline numbers to the most widely followed narratives for Paul Mueller to uncover where expectations meet reality and where surprises might emerge.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Expansion Signals Turnaround

- Net profit margin improved notably as the company shifted to profitability, illustrating a clear break from its prior years of losses and highlighting a more efficient core business.

- Recent gains heavily support bullish claims that Paul Mueller is benefiting from sector tailwinds and a renewed focus on operational efficiency.

- The move into the black aligns with optimistic views that contract wins and sustainability initiatives make the company more resilient. Profitability is a key marker of execution when sector peers face volatility.

- Investors prioritizing niche manufacturing strength may find these margin improvements especially persuasive, given the context of wider industrial headwinds.

P/E Ratio Nearly Half Sector Average

- Paul Mueller trades at a price-to-earnings ratio of 14.5x, a meaningful discount to both the peer average (28x) and US machinery sector (24.6x). This suggests the market values its profit stream more conservatively than competitors.

- The prevailing narrative highlights how this sizable valuation gap adds to Paul Mueller's investment appeal for value-focused buyers.

- Trading so far below peer multiples brings the potential for positive re-rating if the profit trajectory continues. This reinforces the case for value investors eyeing industrials with improving financials.

- However, the stock price at $509.00 also reflects caution that non-cash earnings quality concerns should not be ignored. This encourages diligence for those seeking sustainable upside.

Share Price Lags DCF Fair Value

- With shares at $509.00, Paul Mueller trades well below its estimated DCF fair value of $1,580.47. This amplifies the company's value story relative to sector dynamics.

- The analysis shows market participants often anchor on near-term risks, such as high levels of non-cash earnings, even when headline profit growth is strong.

- This persistent fair value gap may signal that the market discounts recent gains due to questions about the endurance of current earnings quality.

- While profit and value metrics are positive at face value, deeper scrutiny is warranted given the composition of earnings and typical volatility for micro-cap industrials.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Paul Mueller's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite the turnaround and attractive valuation, Paul Mueller’s high proportion of non-cash earnings raises questions about how durable its profit growth truly is.

If you want to prioritize companies with more transparent cash-based profits and less volatility in reported results, check out stable growth stocks screener (2102 results) that consistently deliver genuine and steady financial performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:MUEL

Paul Mueller

Provides manufactured equipment and components in the United States, North America, the Netherlands, Europe, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives