- United States

- /

- Machinery

- /

- OTCPK:CRAW.A

Crawford United (CRAW.A): Margin Gains Challenge Cautious Outlook as Growth Forecasts Weaken

Reviewed by Simply Wall St

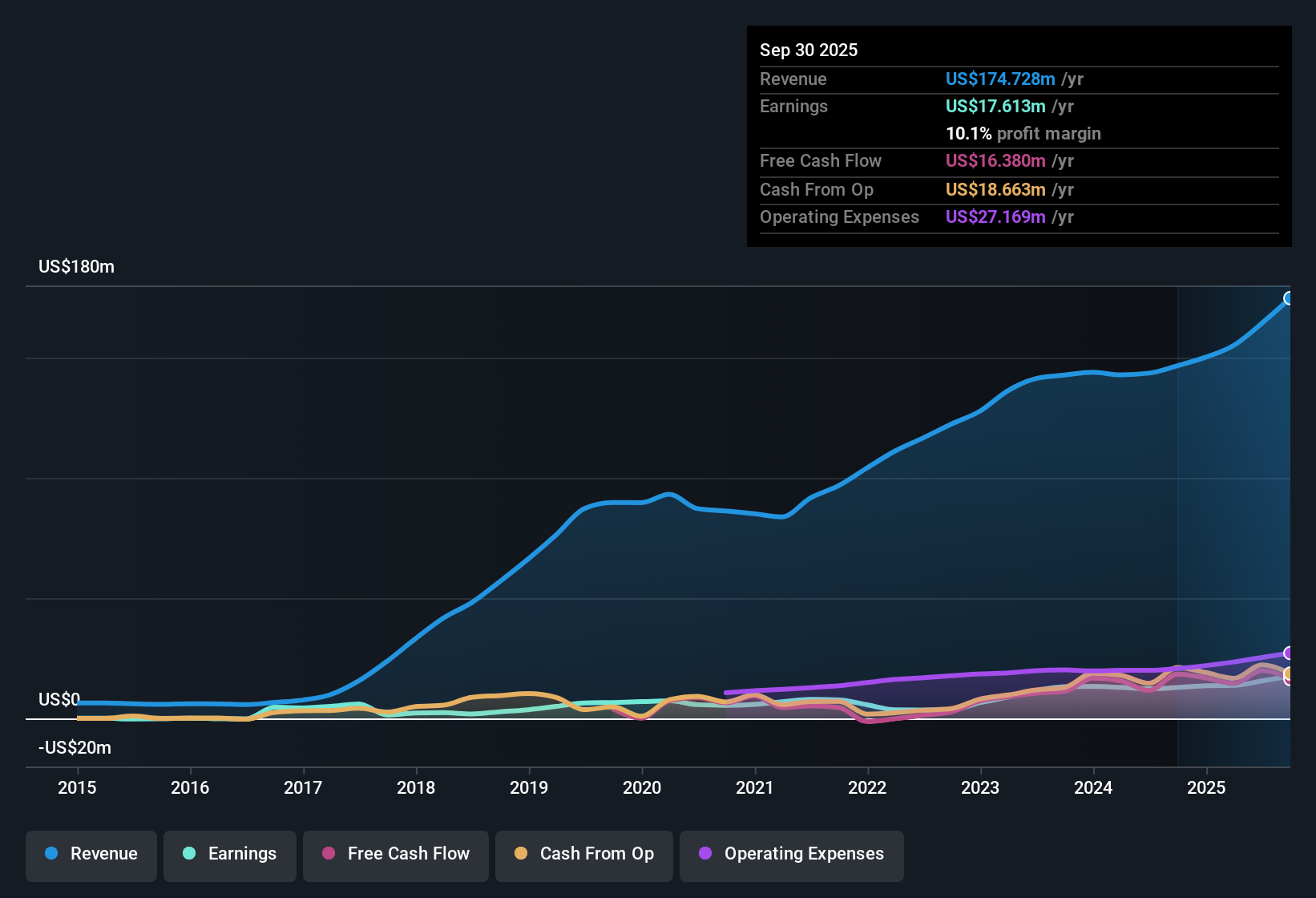

Crawford United (CRAW.A) reported revenue growth averaging 1.1% per year, which is significantly behind the broader US market’s 10.5% per year. EPS has increased by 24.8% annually over five years, with a recent year rising 36.7%, but the forecast now calls for annual earnings declines of 19.8% for at least the next three years. Net profit margins improved to 10.1% from 8.8% the prior year, and while the company’s valuation remains below peers, the current share price of $82 still trades well above a fair value estimate of $61.98.

See our full analysis for Crawford United.Now, let’s see how the latest numbers do or don’t line up with the broader market narratives. Sometimes the figures reinforce the story, and other times they turn it on its head.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Steady Despite Slowing Growth

- The company’s net profit margin rose from 8.8% to 10.1%, standing out even as revenue growth lags at just 1.1% per year versus the US market’s 10.5%.

- While profits have historically climbed, up 24.8% annually over five years, analysts see the margin uptick as a potential sign of operational discipline. They also caution that forecasted earnings declines of 19.8% per year could erode these gains.

- Profitability improvements challenge concerns about weak top-line momentum, showing the business still finds ways to improve the bottom line even as sales growth stalls.

- However, without stronger revenue acceleration, analysts worry the improved margin could prove temporary if falling earnings forecasts materialize as expected.

Discount Valuation Stands Out

- Crawford United trades at a Price-To-Earnings ratio of 16.5x, noticeably below both industry and peer averages of 23.9x. Its $82 share price sits well above the DCF fair value of $61.98.

- Market perspectives point to a company viewed as good value on paper, but some caution about the current price premium and muted growth outlook.

- The valuation discount versus peers may attract “value” investors, particularly as the P/E gap could widen if profit growth continues to lag sector trends.

- Still, the share price trading well above DCF fair value reinforces skepticism about upside, making future profit delivery even more crucial to justify current levels.

Growth Forecasts Flip the Story

- Despite a recent 36.7% uptick in annual earnings, guidance now calls for a sharp reversal with forecast annual declines of 19.8% over the next three years.

- Current outlooks emphasize the gap between historical momentum and what lies ahead, underscoring the need for investors to focus on the direction rather than the rearview mirror.

- The sharp pivot from sustained five-year EPS gains to projected multi-year contraction poses a direct challenge to those citing past growth as justification for higher valuation multiples.

- This narrative clash is critical, as it pushes investors to distinguish between backward-looking results and the significance of forward-facing risks to future performance.

To see how the long-term trajectory stacks up against other investor perspectives, check the full snapshot from all sides. 📊 Read the full Crawford United Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Crawford United's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Crawford United’s slowing sales growth, uncertain earnings outlook, and premium share price could make its future performance less predictable than investors prefer.

If you want more confidence in your investment’s value and upside, use these 844 undervalued stocks based on cash flows to find stocks that offer bigger discounts and stronger growth potential right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:CRAW.A

Crawford United

Provides specialty industrial products in the United States, Canada, the United Kingdom, Puerto Rico, and internationally.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives