- United States

- /

- Biotech

- /

- NasdaqGM:ACIU

AC Immune Leads Our Trio Of Promising Penny Stocks

Reviewed by Simply Wall St

The U.S. stock market has been on a positive streak, with major indices like the Dow and S&P 500 setting new records despite concerns over a government shutdown. In such an environment, investors often look for opportunities that balance potential growth with financial stability. Penny stocks, while historically seen as high-risk investments due to their association with smaller or newer companies, can still offer significant value when backed by strong financials and clear growth paths. This article will explore three penny stocks that stand out for their robust balance sheets and promising prospects in the current market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.06 | $443.61M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.89 | $683.54M | ✅ 4 ⚠️ 0 View Analysis > |

| Sensus Healthcare (SRTS) | $3.16 | $51.62M | ✅ 4 ⚠️ 2 View Analysis > |

| Performance Shipping (PSHG) | $1.95 | $23.5M | ✅ 4 ⚠️ 2 View Analysis > |

| CI&T (CINT) | $4.98 | $676.36M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| Table Trac (TBTC) | $4.70 | $21.71M | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.9501 | $7.12M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.79 | $87.68M | ✅ 3 ⚠️ 2 View Analysis > |

| Universal Safety Products (UUU) | $4.78 | $9.23M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 363 stocks from our US Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

AC Immune (ACIU)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: AC Immune SA is a clinical stage biopharmaceutical company focused on discovering, designing, and developing medicines and diagnostic products for neurodegenerative diseases linked to protein misfolding, with a market cap of $285.95 million.

Operations: AC Immune generates revenue of CHF 28.92 million from its segment focused on discovering and developing therapeutic and diagnostic products.

Market Cap: $285.95M

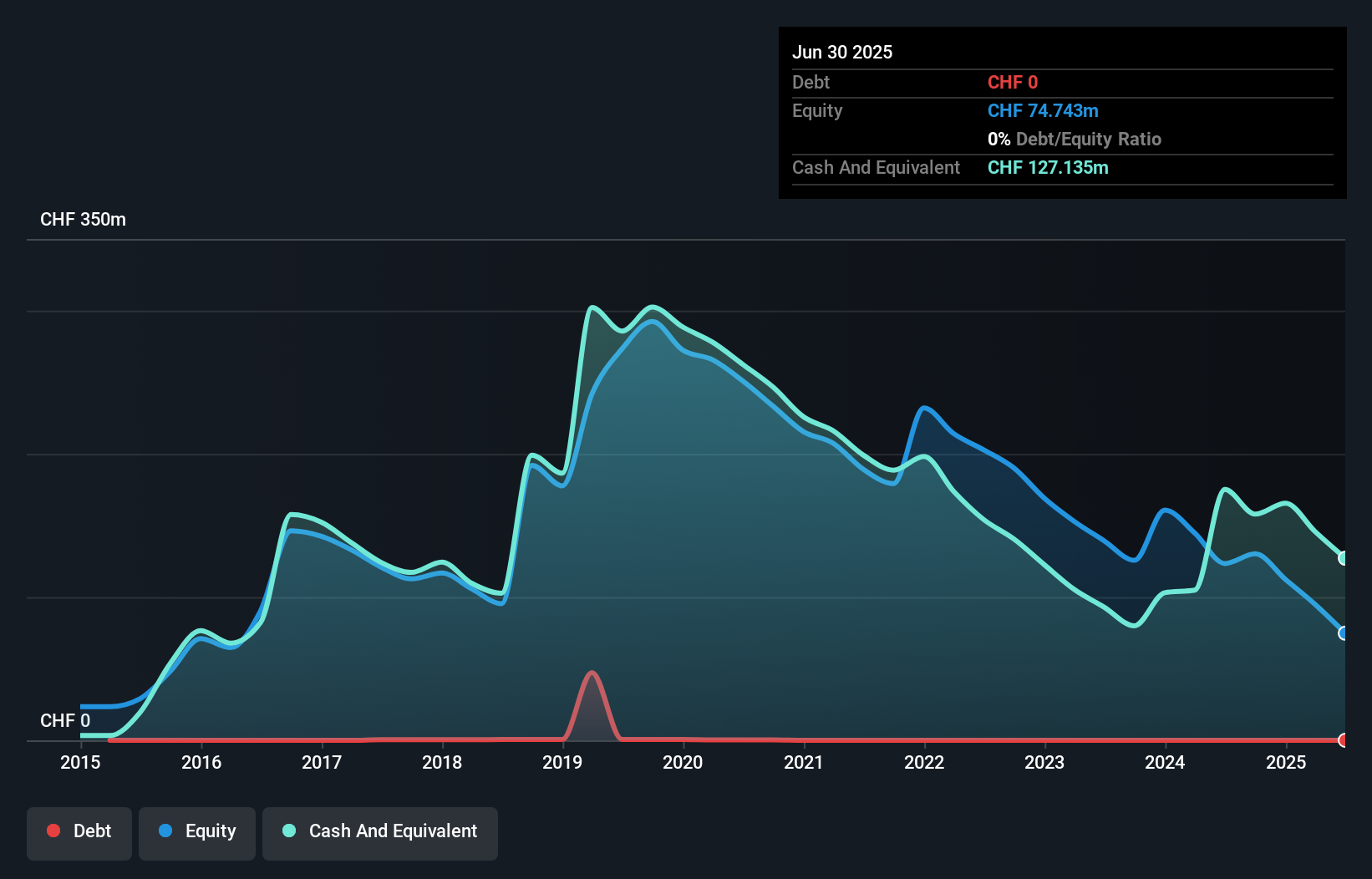

AC Immune, a clinical-stage biopharmaceutical company, recently published promising results from its Phase 1b/2a trial of ACI-35.030, showing rapid and sustained immunogenic responses against pathological Tau in Alzheimer's patients. Despite being unprofitable with a net loss of CHF 21.19 million for Q2 2025, the company has reduced its workforce by 30% to extend operations cash until Q3 2027. AC Immune remains debt-free and benefits from strong short-term asset coverage over liabilities (CHF131.8M vs CHF99M). Trading significantly below estimated fair value, it continues to focus on key assets in ongoing collaborations while maintaining sufficient cash runway for over a year.

- Click here and access our complete financial health analysis report to understand the dynamics of AC Immune.

- Gain insights into AC Immune's outlook and expected performance with our report on the company's earnings estimates.

Cytek Biosciences (CTKB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cytek Biosciences, Inc. is a company specializing in cell analysis solutions that support biomedical research and clinical applications, with a market cap of approximately $441.47 million.

Operations: Cytek Biosciences generates revenue primarily from its Scientific & Technical Instruments segment, totaling $196.04 million.

Market Cap: $441.47M

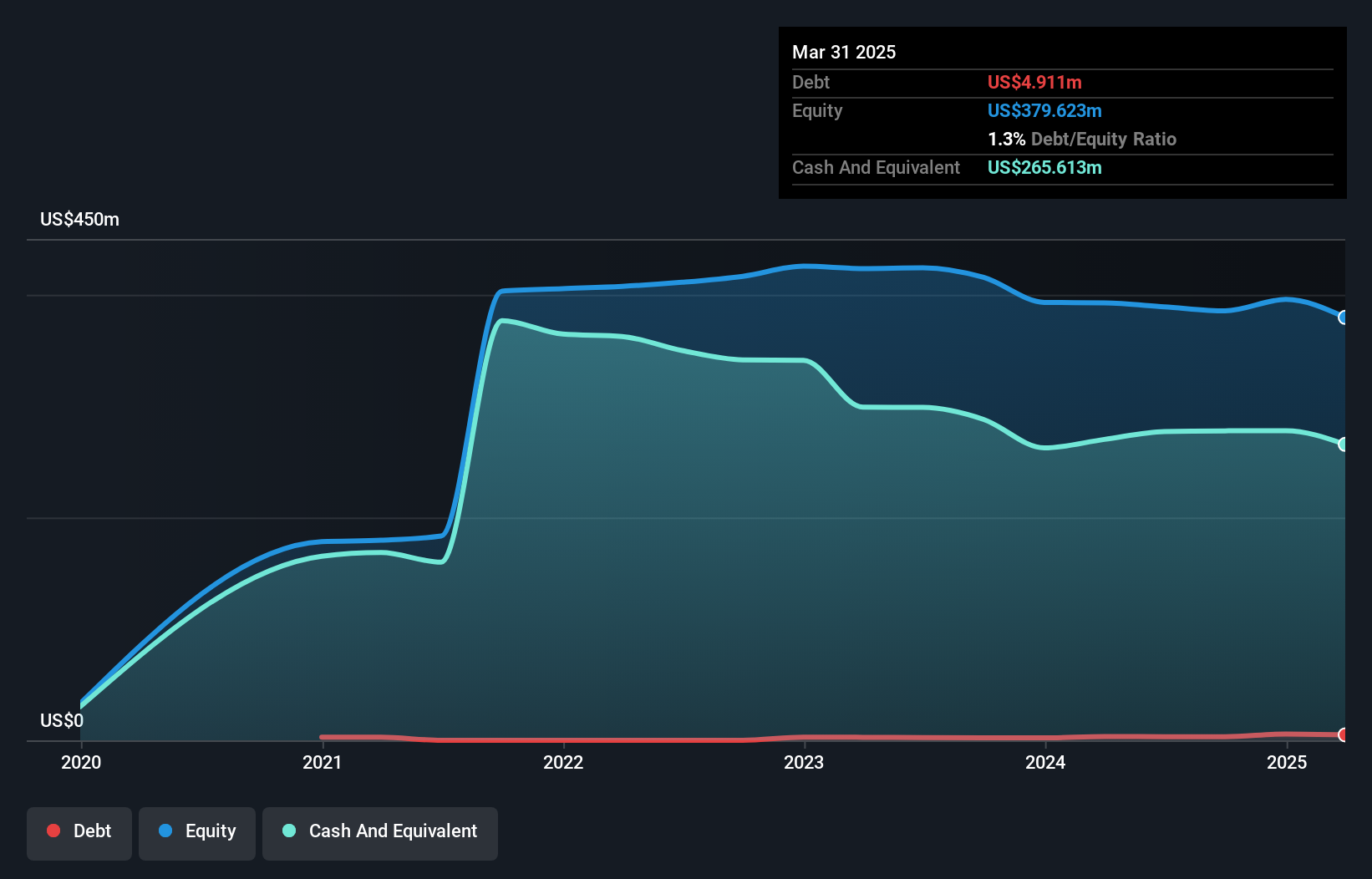

Cytek Biosciences, with a market cap of approximately US$441.47 million, specializes in cell analysis solutions and is currently unprofitable. The company reported revenue of US$87.06 million for the first half of 2025 and has narrowed its full-year revenue guidance to between US$196 million and US$205 million. Despite losses, Cytek maintains a strong cash position exceeding its debt levels, providing a cash runway for over three years due to positive free cash flow growth. Recent collaborations have enhanced their technological offerings in automated quality control testing platforms like Cell Q™, positioning them strategically within the industry.

- Dive into the specifics of Cytek Biosciences here with our thorough balance sheet health report.

- Assess Cytek Biosciences' future earnings estimates with our detailed growth reports.

Butler National (BUKS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Butler National Corporation is involved in the design, engineering, manufacturing, sales, integration, installation, repair, modification, overhaul, servicing, and distribution of aerostructures and aircraft components with a market cap of $128.02 million.

Operations: The company's revenue is primarily derived from its Gaming segment at $37.84 million, followed by Aircraft Modifications at $28.12 million, Special Mission Electronics at $13.95 million, and Aircraft Avionics contributing $4.35 million.

Market Cap: $128.02M

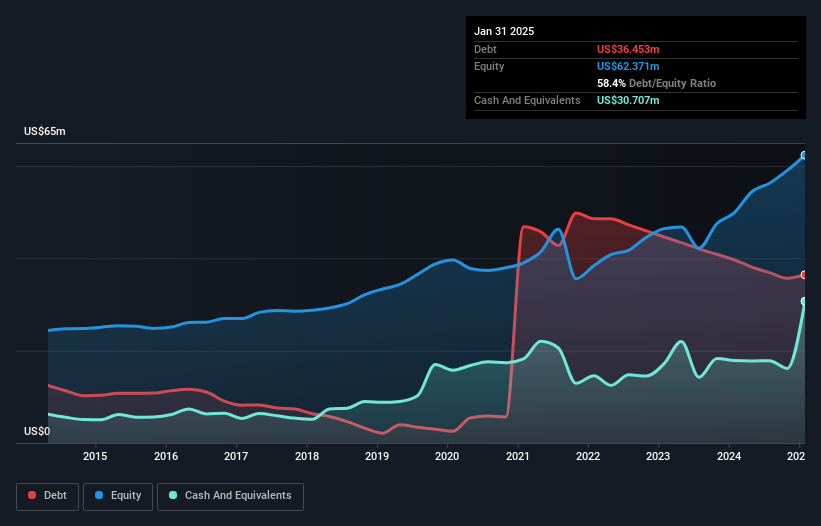

Butler National Corporation, with a market cap of US$128.02 million, has shown modest revenue growth in its latest earnings report, increasing to US$20.13 million for the first quarter ended July 31, 2025. Despite negative earnings growth over the past year and a relatively inexperienced management team with an average tenure of 0.8 years, the company maintains strong financial health as short-term assets exceed both short- and long-term liabilities. The company's debt is well covered by operating cash flow at 89.1%, and it boasts a high return on equity of 21.4%, indicating efficient use of equity capital despite recent challenges in profit margins and debt levels rising over five years from 15.6% to 51.9%.

- Navigate through the intricacies of Butler National with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into Butler National's track record.

Where To Now?

- Unlock more gems! Our US Penny Stocks screener has unearthed 360 more companies for you to explore.Click here to unveil our expertly curated list of 363 US Penny Stocks.

- Contemplating Other Strategies? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 23 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ACIU

AC Immune

A clinical stage biopharmaceutical company, discovers, designs, and develops medicines, and therapeutic and diagnostic products for the prevention and treatment of neurodegenerative diseases associated with protein misfolding.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives