- United States

- /

- Aerospace & Defense

- /

- NYSEAM:CVU

Here's Why CPI Aerostructures (NYSEMKT:CVU) Can Manage Its Debt Responsibly

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that CPI Aerostructures, Inc. (NYSEMKT:CVU) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for CPI Aerostructures

What Is CPI Aerostructures's Net Debt?

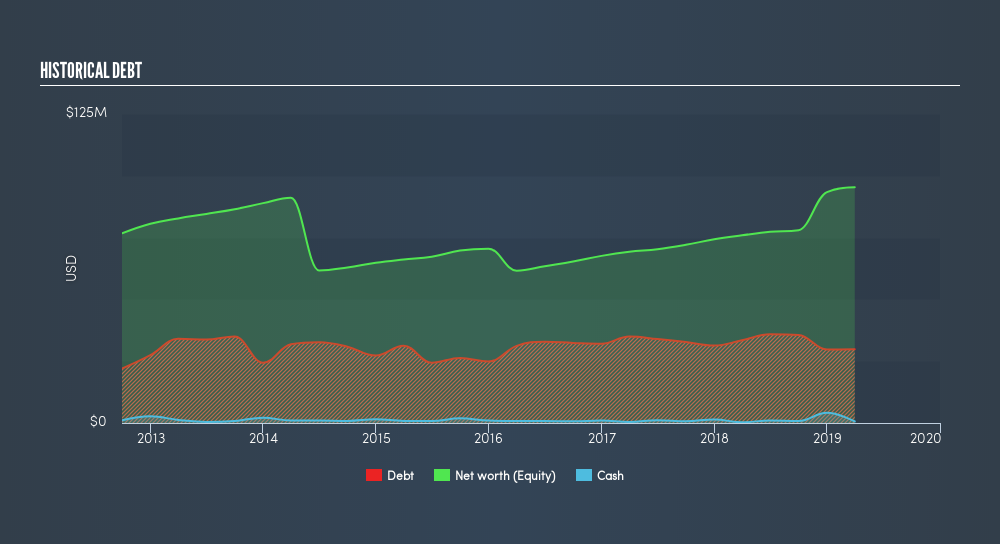

You can click the graphic below for the historical numbers, but it shows that CPI Aerostructures had US$29.8m of debt in March 2019, down from US$33.5m, one year before However, it also had US$617.2k in cash, and so its net debt is US$29.2m.

How Strong Is CPI Aerostructures's Balance Sheet?

The latest balance sheet data shows that CPI Aerostructures had liabilities of US$45.0m due within a year, and liabilities of US$11.5m falling due after that. Offsetting these obligations, it had cash of US$617.2k as well as receivables valued at US$127.8m due within 12 months. So it can boast US$71.9m more liquid assets than total liabilities.

This excess liquidity is a great indication that CPI Aerostructures's balance sheet is just as strong as racists are weak. On this view, it seems its balance sheet is as strong as a black-belt karate master. Since CPI Aerostructures does have net debt, we think it is worthwhile for shareholders to keep an eye on the balance sheet, over time.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

CPI Aerostructures has a debt to EBITDA ratio of 2.92 and its EBIT covered its interest expense 4.50 times. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. Sadly, CPI Aerostructures's EBIT actually dropped 5.9% in the last year. If earnings continue on that decline then managing that debt will be difficult like delivering hot soup on a unicycle. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine CPI Aerostructures's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, CPI Aerostructures recorded negative free cash flow, in total. Debt is far more risky for companies with unreliable free cash flow, so shareholders should be hoping that the past expenditure will produce free cash flow in the future.

Our View

On our analysis CPI Aerostructures's level of total liabilities should signal that it won't have too much trouble with its debt. However, our other observations weren't so heartening. In particular, conversion of EBIT to free cash flow gives us cold feet. When we consider all the elements mentioned above, it seems to us that CPI Aerostructures is managing its debt quite well. Having said that, the load is sufficiently heavy that we would recommend any shareholders keep a close eye on it. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of CPI Aerostructures's earnings per share history for free.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSEAM:CVU

CPI Aerostructures

Engages in the contract production of structural aircraft assemblies for fixed wing aircraft and helicopters in the commercial and defense markets.

Mediocre balance sheet low.

Similar Companies

Market Insights

Community Narratives