- United States

- /

- Building

- /

- NYSE:ZWS

Zurn Elkay Water Solutions (ZWS): Margin Improvement Challenges Market-Lagging Growth Narrative

Reviewed by Simply Wall St

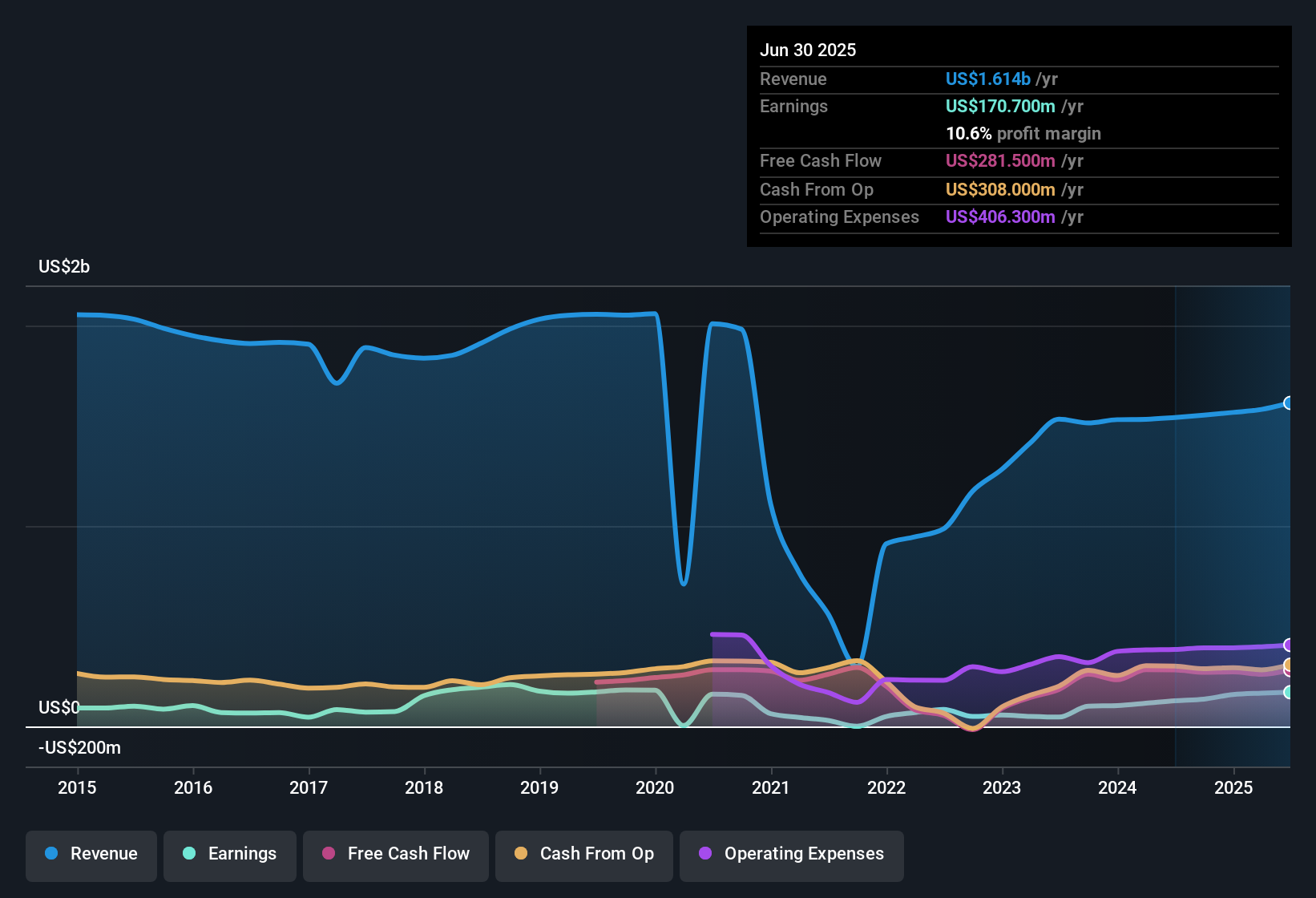

Zurn Elkay Water Solutions (ZWS) posted robust earnings growth, recording a 37.1% increase over the past year and an average growth rate of 26% per year over the last five years. Net profit margins rose to 11.3%, up from 8.8% the previous year, indicating stronger profitability. Looking ahead, the company is forecast to grow earnings at 12.42% per year. This pace falls short of the broader US market's expected 15.6% annual growth. Revenue is projected to climb by 4.6% annually, which is also below the national average of 10.2%. Investors may be encouraged by the high-quality profit expansion and recent margin gains. However, the elevated trading price and premium P/E ratio could temper some enthusiasm, as growth expectations remain below the market pace.

See our full analysis for Zurn Elkay Water Solutions.The next section takes these numbers and compares them directly with the most-followed narratives about Zurn Elkay, highlighting where expectations are met and where the story diverges.

See what the community is saying about Zurn Elkay Water Solutions

Margin Expansion Points to Cost Advantages

- Net profit margins have risen to 11.3%, up from 8.8% the prior year, showcasing substantial operational leverage and improved cost structure.

- Consensus narrative highlights that ongoing supply chain localization and successful pricing strategies are key drivers of this margin durability.

- Reduced exposure to tariff volatility and raw material cost management underpin current profitability.

- These improvements directly support higher earnings and margin expansion even as revenue growth trails the broader market.

Consensus narrative notes Zurn Elkay’s strategic moves in cost management are reflected in margins holding up better than might be expected given modest top-line growth.

📊 Read the full Zurn Elkay Water Solutions Consensus Narrative.

Filtration Technology Drives Revenue Quality

- Analysts expect profit margins to rise from 10.6% to 14.2% over three years, largely propelled by the company’s advances in filtration systems and drop-in replacement platforms.

- According to the consensus narrative, the filtration business is a structural growth lever, not just a cyclical bump.

- High-margin filtration revenue, supported by product innovation and longer filter lifespans, is expected to sustain double-digit growth within this segment even if broader demand slows.

- Government funding and legislative mandates in schools are boosting adoption, expanding the total addressable market for filtration products.

Premium Valuation with Modest Upside

- The current share price of $47.98 stands just 1.2% above the consensus analyst target of $47.43, while also sitting well above the DCF fair value of $45.28.

- Consensus narrative underscores that, for investors to agree with the current price, they must believe in sustained revenue growth to $1.9 billion and a drop in the company’s price-to-earnings ratio from 45.1x today to 34.8x by 2028, which still implies a premium compared to the US Building industry average of 23.0x.

- This tight difference between current price and target suggests analysts see limited room for near-term upside unless growth surprises to the upside.

- The stock’s premium valuation may not leave much margin for error in execution or market demand trends over the next several years.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Zurn Elkay Water Solutions on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got your own read on these results? Share your perspective and craft a unique narrative in just a few minutes: Do it your way

A great starting point for your Zurn Elkay Water Solutions research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Zurn Elkay’s premium valuation, limited earnings upside, and slower revenue growth compared to market averages leave little room for error if expectations fall short.

To target greater value and less risk of overpaying, consider searching for these 853 undervalued stocks based on cash flows that may offer better upside and stronger fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zurn Elkay Water Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZWS

Zurn Elkay Water Solutions

Engages in design, procurement, manufacture, and marketing of water management solutions in the United States, Canada, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives