- United States

- /

- Building

- /

- NYSE:ZWS

Zurn Elkay Water Solutions (ZWS): Assessing Valuation Following Launch of Liv EZ Filtered Water Dispenser for Homes

Reviewed by Simply Wall St

Zurn Elkay Water Solutions has just introduced Liv EZ, a built-in filtered water dispenser designed for residential spaces. Drawing on years of commercial experience, they are now offering advanced filtration and sleek design for home use.

See our latest analysis for Zurn Elkay Water Solutions.

The stock has seen impressive momentum lately, with a 20.7% share price return over the past 90 days and year-to-date gains of 25.6%. Looking further back, total shareholder return exceeds 30% in the past year and reaches 213% over five years, suggesting both strong execution and increasing confidence in Zurn Elkay’s ability to capture long-term growth opportunities.

If you want to see what else is gaining traction in the industrial space, now is a smart moment to explore fast growing stocks with high insider ownership.

With shares riding high on strong returns and an innovative product launch, the key question now is whether Zurn Elkay Water Solutions is trading at fair value or if there is still room for investors to capture future upside.

Most Popular Narrative: Fairly Valued

With the last close price at $46.36 and the most popular narrative's fair value at $47.43, market expectations and analyst projections are nearly aligned. Investors are watching closely as every incremental shift in guidance or outlook has the potential to influence future upside and sentiment.

Government funding and rising legislative requirements for water quality in schools (such as filter first mandates) are expected to drive broader adoption of advanced filtration and water safety products. This could expand Zurn Elkay's addressable market and boost long-term revenue growth.

Wondering what forecasts could justify today’s price? Big revenue and earnings jumps, combined with a profit multiple that’s anything but average, are at the heart of this narrative. Curious which bold projections underpin this premium? Find out what’s fueling these high-stakes expectations in the full narrative.

Result: Fair Value of $47.43 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including the chance that recent sales were boosted by customers ordering ahead of price hikes, and that funding momentum in key sectors could slow.

Find out about the key risks to this Zurn Elkay Water Solutions narrative.

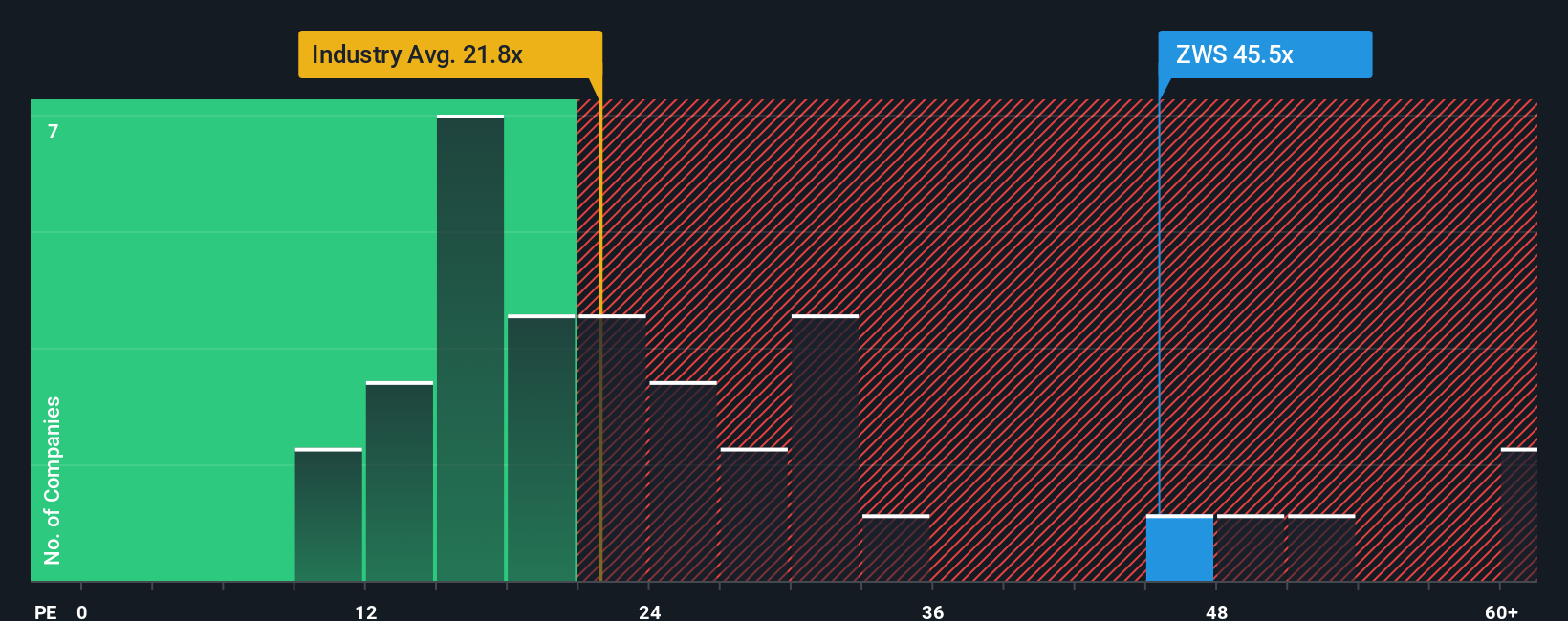

Another View: Multiples Send a Warning

Looking at valuation through earnings ratios, Zurn Elkay trades at around 45.5 times earnings. This is far above both the US Building industry average of 19.8 and its peer group at 34.6. Even compared to the fair ratio of 23.5, the market price looks stretched. Does this multiples premium mean higher long-term risks for investors, or could growth still catch up?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Zurn Elkay Water Solutions Narrative

If you have a different perspective or want to dive deeper, you can easily create your own personalized take in just a few minutes. Do it your way.

A great starting point for your Zurn Elkay Water Solutions research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Remarkable opportunities are just a click away. Don’t let great stocks with unique potential slip through your fingers. Use these tailored investment screens today:

- Start building reliable income streams by checking out these 17 dividend stocks with yields > 3% with yields that outshine the average and reward patient investors.

- Catch the next big innovation wave in healthcare by reviewing these 33 healthcare AI stocks, spotlighting pioneers at the intersection of artificial intelligence and medical breakthroughs.

- Seize undervalued gems before the crowd by sifting through these 876 undervalued stocks based on cash flows, where potential growth often hides in plain sight.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zurn Elkay Water Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZWS

Zurn Elkay Water Solutions

Engages in design, procurement, manufacture, and marketing of water management solutions in the United States, Canada, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives