- United States

- /

- Building

- /

- NYSE:ZWS

Should New School Filtration Mandates Boosting Recurring Filter Revenue Require Action From Zurn Elkay (ZWS) Investors?

Reviewed by Sasha Jovanovic

- Recently, Zurn Elkay Water Solutions has benefited from Michigan’s implemented “Filter First” law and similar state-level initiatives that are driving demand for filtered water stations and associated replacement filters.

- This legislative push is reinforcing a higher-margin, recurring filter replacement stream that could meaningfully influence expectations for Zurn Elkay’s long-term earnings power.

- We’ll now examine how Michigan’s “Filter First” law and growing school filtration mandates could reshape Zurn Elkay’s existing investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Zurn Elkay Water Solutions Investment Narrative Recap

To own Zurn Elkay, you need to believe in a long run shift toward higher standards for water quality in schools and public buildings, and in the company’s ability to turn that into recurring, higher margin filtration revenue. Michigan’s “Filter First” law directly reinforces that thesis in the near term, while the main risk remains that legislative momentum or funding in education and healthcare slows, which would temper what is currently the most important demand catalyst.

Against this backdrop, Zurn Elkay’s steady pattern of dividend increases, most recently the 22% lift to an annual US$0.44 per share in October 2025, underlines management’s confidence in cash generation from this filtration upgrade cycle, even as investors weigh how dependent that outlook is on continued adoption of school filtration mandates in other states.

Yet investors should also be aware that if future school funding or regulatory timelines shift, the filtration story could look very different...

Read the full narrative on Zurn Elkay Water Solutions (it's free!)

Zurn Elkay Water Solutions' narrative projects $1.9 billion revenue and $266.9 million earnings by 2028. This requires 5.1% yearly revenue growth and about a $96 million earnings increase from $170.7 million today.

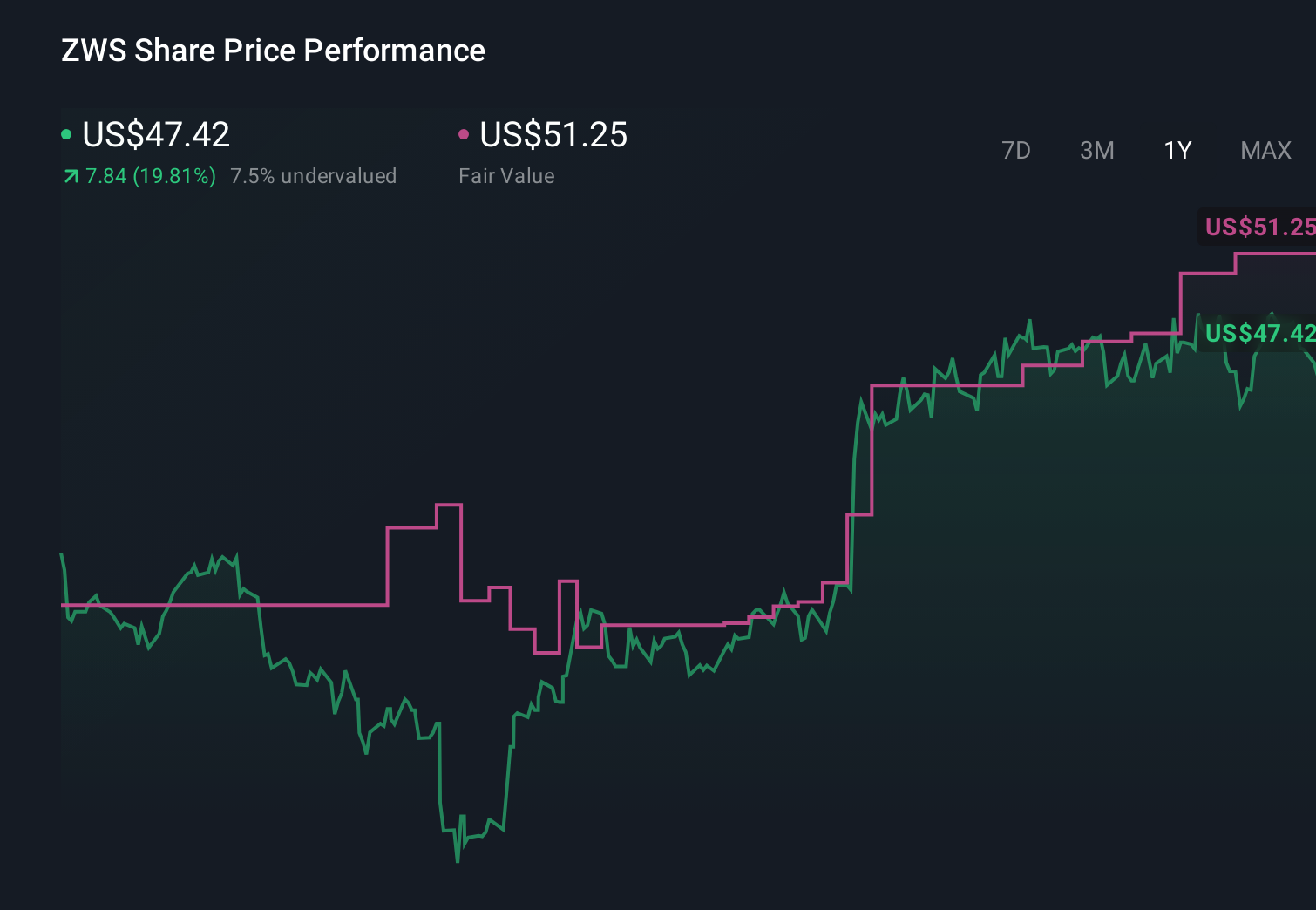

Uncover how Zurn Elkay Water Solutions' forecasts yield a $51.25 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community currently span roughly US$47.84 to US$51.25 per share, showing how differently individual investors are sizing Zurn Elkay’s opportunity. You can weigh these views against the reliance on school filtration legislation to understand how changing regulatory momentum might affect the company’s longer term performance.

Explore 2 other fair value estimates on Zurn Elkay Water Solutions - why the stock might be worth as much as 6% more than the current price!

Build Your Own Zurn Elkay Water Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zurn Elkay Water Solutions research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Zurn Elkay Water Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zurn Elkay Water Solutions' overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zurn Elkay Water Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZWS

Zurn Elkay Water Solutions

Engages in design, procurement, manufacture, and marketing of water management solutions in the United States, Canada, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion