- United States

- /

- Machinery

- /

- NYSE:XYL

Xylem (XYL): Assessing Valuation After Analyst Upgrades and Strong Earnings Outlook

Reviewed by Simply Wall St

Xylem (NYSE:XYL) has been in the spotlight lately as several analysts have increased their earnings estimates, reflecting a brighter outlook for the water technology specialist. This boost, combined with Xylem’s recent affirmation of its dividend for the third quarter, has served as a signal to investors that the company’s foundation looks stable and growth prospects are improving. It is this positive shift in sentiment, rather than the routine dividend news, that seems to be driving the current market buzz.

Looking at the bigger picture, Xylem’s stock has recorded meaningful gains both in the near term and over longer periods. Shares climbed 24% year-to-date, and have delivered a 62% total return over three years, suggesting buyers have been steadily building momentum behind the stock. Recent upbeat earnings revisions and a pattern of outpacing earnings expectations have contributed to the latest rally, increasing investor optimism and highlighting the market’s focus on Xylem’s growth story.

After such a run, the big question is whether Xylem’s shares still offer value for new investors, or if the market has already priced in the company’s strong growth potential.

Most Popular Narrative: 8.8% Undervalued

According to the community narrative, Xylem is viewed as undervalued based on projections of recurring growth, robust earnings expansion, and strategic moves in smart water infrastructure. The narrative combines analyst expectations for multi-year revenue and profit improvements, building a case for upside in the stock price.

Continued market and regulatory push for advanced water treatment, nutrient removal, and zero-liquid-discharge solutions is expanding Xylem's addressable market. This is evidenced by recent acquisitions (Vacom, Envirex) that add higher-value, differentiated offerings and support long-term revenue and margin expansion.

Curious about what “hidden math” lies beneath this bullish valuation? There is a future forecast here, fueled by bold analyst estimates. What is driving the optimism? Find out the surprising projections and profit assumptions that contribute to this pathway to a higher fair value.

Result: Fair Value of $157.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent weakness in developing markets or delays in infrastructure funding could challenge these bullish assumptions and disrupt Xylem’s projected growth path.

Find out about the key risks to this Xylem narrative.Another View: Is the Discount Real?

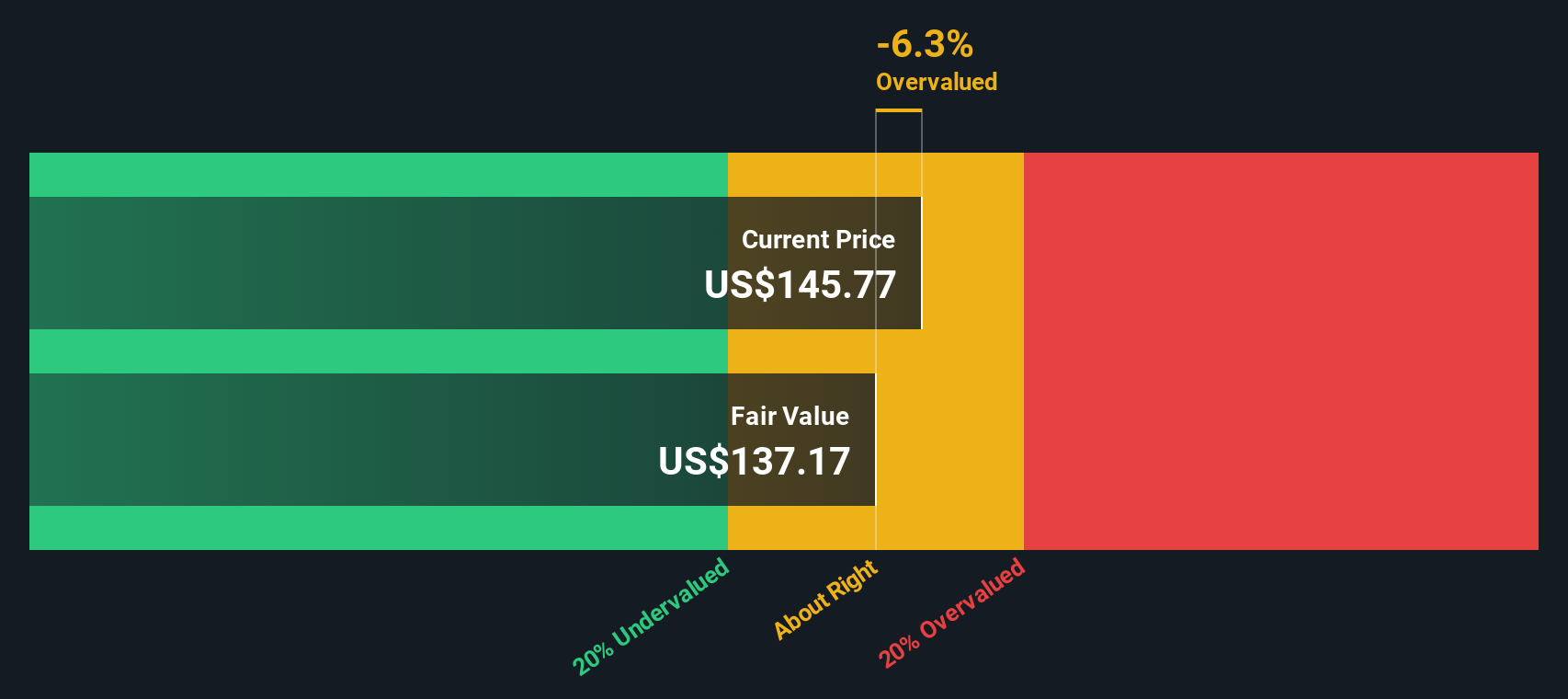

While analysts see Xylem as undervalued based on future growth and smart infrastructure investments, our DCF model tells a more cautious story. This approach currently points to a less optimistic fair value. Which method deserves more trust?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Xylem for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Xylem Narrative

If you see things differently or would rather dig into the numbers on your own, you can shape a fresh view in just a few minutes. Simply do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Xylem.

Looking for More Standout Investment Ideas?

Smart investors never stop at just one opportunity. Keep your edge by seeking fresh stocks with unique stories and potential that go beyond the obvious. Maximize your portfolio’s potential by acting on powerful trends that others might be overlooking. Don’t let your next big idea slip away.

- Uncover the strongest dividend payers in the market by checking out companies offering dividend stocks with yields > 3% and see how your passive income can increase.

- Stay ahead of the curve and benefit from the AI boom by targeting tomorrow’s leaders in AI penny stocks, where innovation is shaping the next generation of industries.

- Search for stocks priced below their true value and find opportunities with undervalued stocks based on cash flows before the rest of the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XYL

Xylem

Engages in the design, manufacture, and servicing of engineered products and solutions for utility, industrial, and residential and commercial building services settings worldwide.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives