- United States

- /

- Machinery

- /

- NYSE:XYL

Is Xylem’s (XYL) Latest Dividend Hike Reflecting Strong Execution or Prioritizing Shareholder Returns?

Reviewed by Sasha Jovanovic

- Earlier this month, Xylem’s Board of Directors declared a fourth quarter dividend of US$0.40 per share, payable on December 23, 2025, to shareholders on record as of November 25, 2025, following the company’s third quarter results.

- Despite reporting revenues and earnings above analyst estimates and highlighting strong operational execution, the company’s robust financial performance was not immediately reflected in investor sentiment.

- We’ll now explore how Xylem’s strong third quarter results paired with its latest dividend announcement may shape its investment outlook.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Xylem Investment Narrative Recap

To be a shareholder in Xylem, you need to believe that robust digital infrastructure growth, innovation in water management, and disciplined execution will offset risks tied to public funding cycles and shifting global demand. The latest quarterly dividend affirmation, paired with strong third quarter results, reinforces the company’s commitment to consistent capital returns, but it is not likely to materially change the most pressing short-term catalyst: securing visibility on end-market demand as government funding cycles remain uncertain.

Among recent developments, the enhanced full-year earnings guidance stands out, reflecting management’s confidence in Xylem’s multi-year backlog and ongoing investments in water infrastructure upgrades. This guidance, paired with the company’s strengthened operating results, addresses the key catalyst investors are watching, order momentum supported by regulatory and funding trends in core North American and European markets.

However, in contrast to earnings beats and a stable dividend, investors should be aware of the persistent risks tied to delays in infrastructure funding cycles, especially as...

Read the full narrative on Xylem (it's free!)

Xylem's narrative projects $10.2 billion revenue and $1.4 billion earnings by 2028. This requires 5.2% yearly revenue growth and a $462 million earnings increase from $938 million.

Uncover how Xylem's forecasts yield a $163.24 fair value, a 16% upside to its current price.

Exploring Other Perspectives

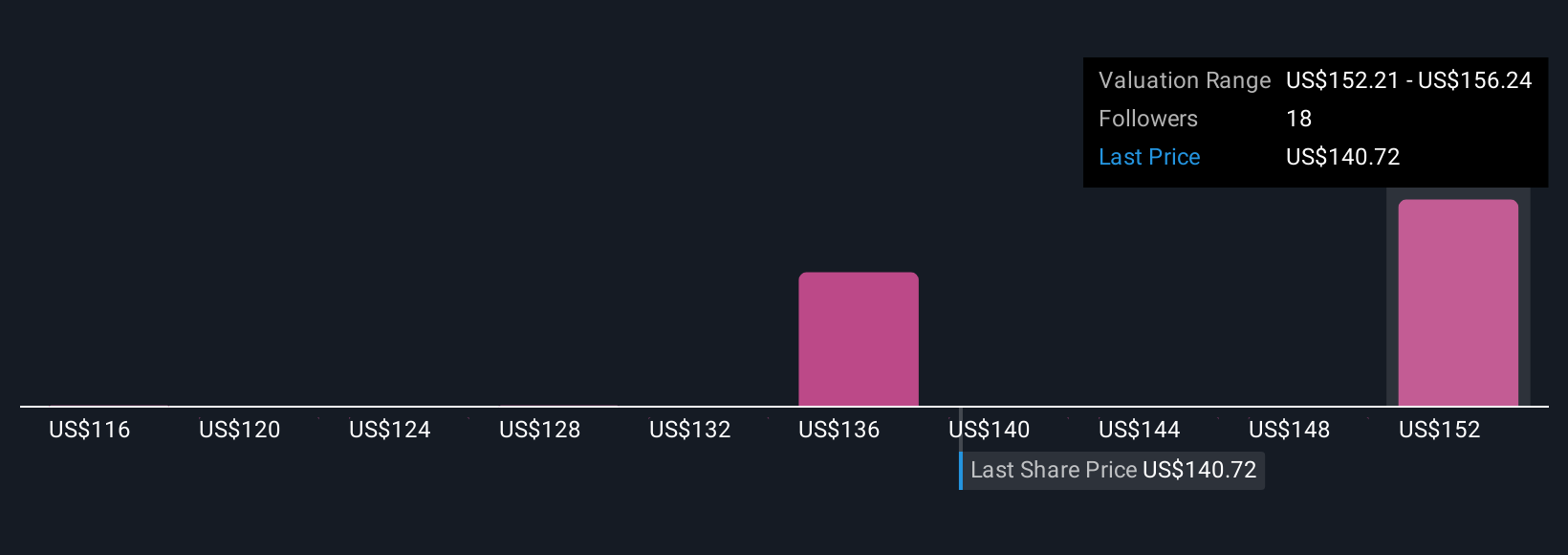

The Simply Wall St Community’s fair value estimates for Xylem span from US$116 to US$163.24 across four perspectives, showing wide variation in growth sentiment. While order momentum and digital solutions adoption are central drivers, ongoing uncertainties around government infrastructure funding remind you to weigh many viewpoints before deciding on next steps.

Explore 4 other fair value estimates on Xylem - why the stock might be worth as much as 16% more than the current price!

Build Your Own Xylem Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Xylem research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Xylem research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Xylem's overall financial health at a glance.

No Opportunity In Xylem?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XYL

Xylem

Engages in the design, manufacture, and servicing of engineered products and solutions for utility, industrial, and residential and commercial building services settings worldwide.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives