- United States

- /

- Building

- /

- NYSE:WMS

Advanced Drainage Systems (WMS): Examining the Current Valuation After Recent Share Price Trends

Reviewed by Kshitija Bhandaru

Advanced Drainage Systems (WMS) has seen its stock price move in recent sessions, as investors reassess the company's valuation. With shares trending mostly flat over the past month, some are examining long-term performance and current fundamentals more closely.

See our latest analysis for Advanced Drainage Systems.

While Advanced Drainage Systems’ share price has climbed 23.16% year-to-date and added over 15% in the past three months, its total shareholder return for the past year stands slightly negative. This combination of momentum and recent cooling may have some investors reconsidering the balance between growth expectations and current valuation.

If you’re weighing opportunities in today’s dynamic market, consider broadening your perspective and discover fast growing stocks with high insider ownership

With analysts seeing some upside from current levels but past yearly returns still lagging, the question is whether Advanced Drainage Systems is trading below its true worth or if the promise of future growth is already included in the current price.

Most Popular Narrative: 12.7% Undervalued

With a narrative fair value of $161.33 set against a recent close of $140.81, analysts are forecasting a sizable upside for Advanced Drainage Systems. The market seems to be questioning whether the current price is missing out on significant potential.

"Ongoing climate change and increasing frequency/severity of extreme weather events are driving up the necessity for advanced stormwater management and resilient drainage infrastructure, underpinning structural, long-term volume growth, supporting sustained revenue acceleration. Rising regulatory emphasis on water quality and sustainable construction, with more stringent stormwater and pollution controls, is increasing adoption of high-margin, innovative solutions such as the recently launched Arcadia hydrodynamic separator and EcoStream Biofiltration products. This is likely to expand net margins and boost revenue mix over time."

Want to know what truly underpins that valuation call? The narrative leans on a future growth surge rooted in regulatory tailwinds and higher-margin product expansion. Wondering which assumptions are turning this sector story into a bullish price target? The numbers behind the scenes are likely to surprise you. Dig into the full narrative to see how the pros are connecting the dots.

Result: Fair Value of $161.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain if end-market demand weakens or if input costs rise sharply. These factors could quickly compress margins and challenge the bullish thesis.

Find out about the key risks to this Advanced Drainage Systems narrative.

Another Perspective: Is the Discounted Cash Flow Model Missing Something?

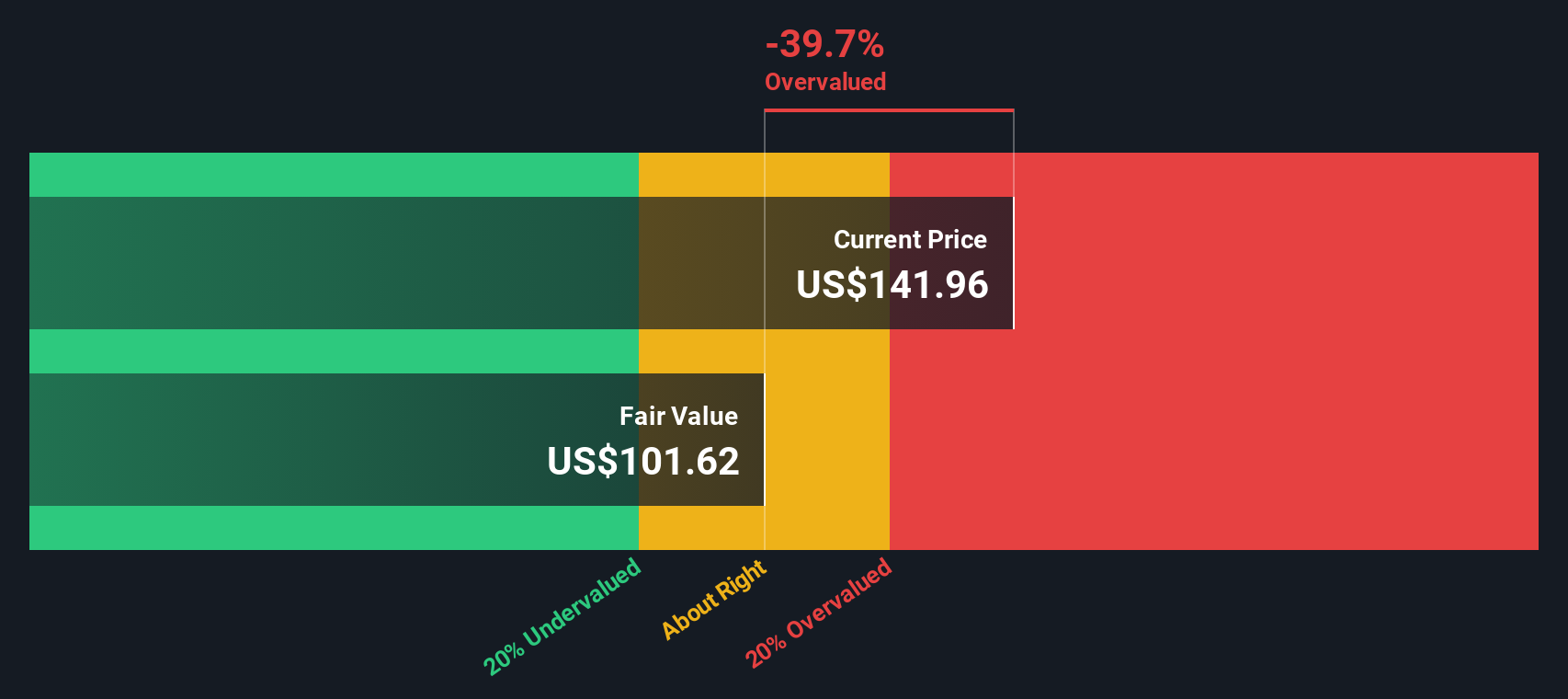

The SWS DCF model points to a lower fair value of $100.59 for Advanced Drainage Systems, meaning the current price sits well above this estimate and may be overvalued on a strict cash flow basis. This presents a complicated picture: are the growth expectations too optimistic, or is the market betting on something the model cannot capture?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Advanced Drainage Systems for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Advanced Drainage Systems Narrative

If you’re keen to dive deeper or think there’s more to the story, try building your own narrative in just a few minutes: Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Advanced Drainage Systems.

Looking for more investment ideas?

Smart investors know opportunities span beyond a single stock. Uncover unique market plays and take advantage of insights others might overlook. Get ahead with these powerful ideas on Simply Wall Street:

- Capture compelling income potential and steady yields by checking out these 19 dividend stocks with yields > 3% that consistently outperform with reliable dividends above 3%.

- Tap into the next big breakthrough by following these 25 AI penny stocks paving the way in artificial intelligence innovation and disruptive tech trends.

- Position yourself for maximum value by targeting these 891 undervalued stocks based on cash flows that meet strict cash flow criteria and may be flying under the radar of most investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WMS

Advanced Drainage Systems

Designs, manufactures, and markets thermoplastic corrugated pipes and related water management products in the United States, Canada, and internationally.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion