- United States

- /

- Machinery

- /

- NYSE:WAB

How Should Investors Value Wabtec After 10% YTD Rally and Contract Wins?

Reviewed by Bailey Pemberton

- Wondering if Westinghouse Air Brake Technologies is a hidden bargain or overpriced? You are not alone. Investors are buzzing about the company's current value.

- The stock has shown steady gains recently, up 0.9% over the past week and 7.4% in the last month. This has pushed its year-to-date return to a solid 10%.

- Market observers have connected these movements to ongoing developments in the rail and transportation sector, including government initiatives supporting infrastructure and a string of high-profile contract wins for key players like Westinghouse. This news keeps optimism high while adding context to the company’s positive momentum this year.

- However, right now, Westinghouse Air Brake Technologies scores a 0 out of 6 on our quick undervaluation checklist. This means it does not look undervalued by standard measures, at least at first glance. We will dive into what goes into these scores, look at some classic and creative ways to value the business, and introduce a more holistic approach you will not want to miss by the end of this article.

Westinghouse Air Brake Technologies scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Westinghouse Air Brake Technologies Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s value. This method helps investors gauge whether a stock price reflects the true long-term earning power of the business, using realistic growth assumptions and a required rate of return.

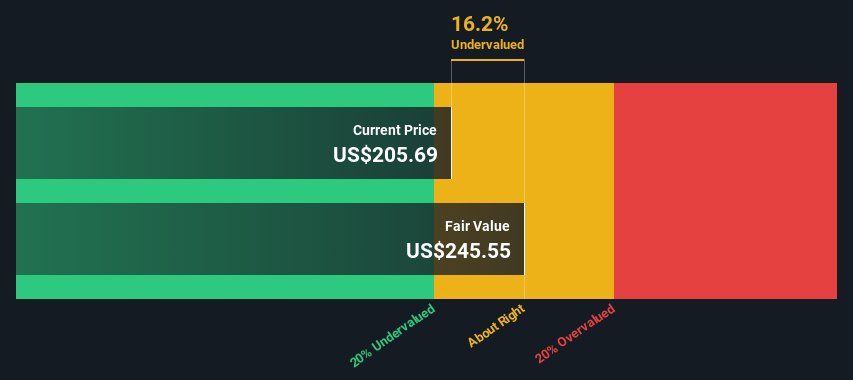

For Westinghouse Air Brake Technologies, the latest reported Free Cash Flow stands at $1.28 billion. Analysts provide forecasts up to 2028, expecting Free Cash Flow to reach $1.82 billion that year. Beyond this, projections are based on gradual growth trends, with estimates rising to roughly $2.15 billion by 2035. These long-term numbers are calculated by extrapolating past performance and expected industry growth rates.

After discounting all projected cash flows back to the present, the DCF model puts the company’s intrinsic value at $175.39 per share. When compared to the current market price, this suggests the stock trades at a premium and indicates it is 18.6% overvalued by this method.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Westinghouse Air Brake Technologies may be overvalued by 18.6%. Discover 856 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Westinghouse Air Brake Technologies Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a popular valuation metric for profitable companies because it links a company’s share price to its actual earnings, giving investors a quick sense of how much they are paying for each dollar of profit. This ratio is especially meaningful when a company generates steady profits, as it allows for apples-to-apples comparison with similar businesses.

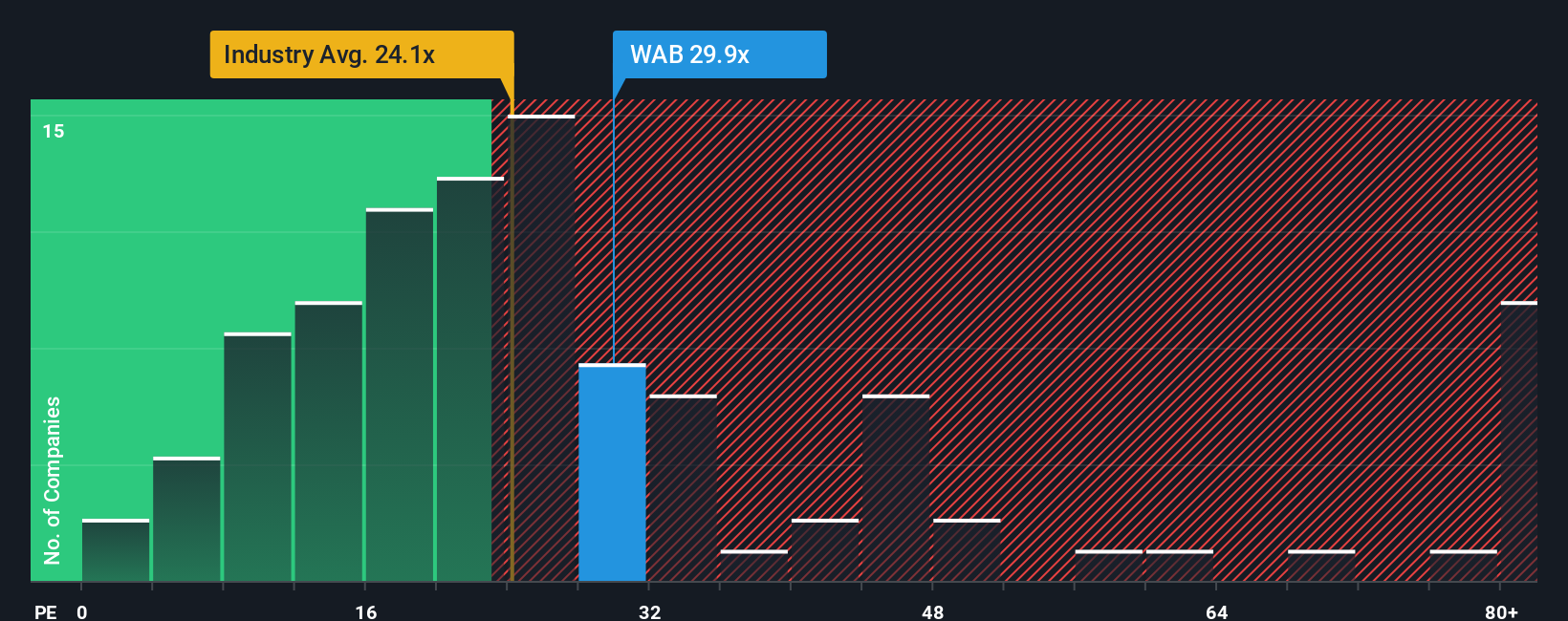

Growth expectations and risk play a big role in determining what a “normal” or “fair” PE ratio should be. Fast-growing, lower-risk companies often command higher PE multiples, while companies with slower growth or more uncertainty usually see lower ratios. For Westinghouse Air Brake Technologies, the current PE ratio stands at 30.2x, which is noticeably higher than the machinery industry average of 24.1x and its peer group average of 21.0x.

To address the shortcomings of simply comparing company multiples to those of peers or industry, Simply Wall St introduces the “Fair Ratio.” This is a proprietary metric that goes beyond basic benchmarks by considering the company’s growth outlook, profit margins, risk profile, size, and its place within the broader industry. The Fair Ratio for Westinghouse Air Brake Technologies is 28.4x, which reflects its strong, but not extraordinary, growth trajectory and financial profile.

Comparing the Fair Ratio of 28.4x to the current PE of 30.2x, the stock appears slightly overvalued using this approach. The gap, however, is not extreme, suggesting the stock is priced only moderately above what would be considered fair value when all factors are weighed together.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1372 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Westinghouse Air Brake Technologies Narrative

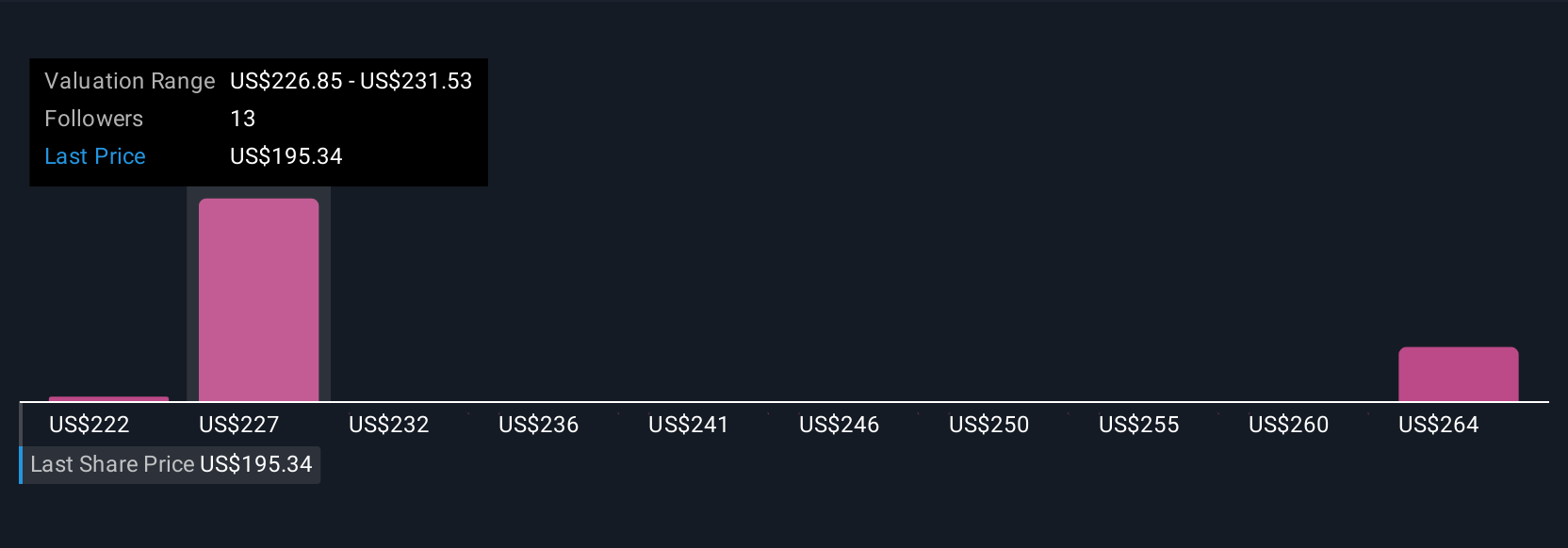

Earlier we mentioned a better way to understand valuation. Let's introduce you to Narratives. A Narrative is simply your story or perspective about a company’s future, brought to life with your own assumptions about fair value, revenue, profits, and margins. Narratives connect the dots between what’s happening in a business, how you think it will perform financially, and what a share should really be worth.

On Simply Wall St’s Community page, Narratives are an accessible tool used by millions of investors. They help you clarify your investment thesis and update your view when new information, like earnings or major deals, comes in. By comparing your calculated Fair Value to the current market price, Narratives show if the stock looks attractive to buy, hold, or sell, all at a glance and always with your unique outlook in mind.

For Westinghouse Air Brake Technologies, Narratives show how opinions vary. The most optimistic holders expect transformative revenue growth from international rail deals and new tech, assigning a fair value of $250 per share. More cautious analysts cite North American softness and execution risks, seeing value closer to $200. Whether you believe in sustained global growth or expect headwinds to limit upside, Narratives turn your personal expectations into actionable, dynamic insights.

Do you think there's more to the story for Westinghouse Air Brake Technologies? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Westinghouse Air Brake Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WAB

Westinghouse Air Brake Technologies

Provides technology-based locomotives, equipment, systems, and services for the freight rail and passenger transit industries worldwide.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives