- United States

- /

- Aerospace & Defense

- /

- NYSE:VVX

Will Rising Analyst Optimism and Earnings Estimates Shift V2X's (VVX) Investment Narrative?

Reviewed by Simply Wall St

- V2X recently attracted increased analyst interest after a period of raised earnings estimates ahead of its upcoming quarterly results announcement expected on August 4, 2025.

- Although analysts are optimistic about potential earnings growth despite lower revenues, uncertainty remains due to the company's Zacks Rank of #4.

- We’ll explore how climbing analyst optimism ahead of earnings could influence V2X’s existing investment narrative and future prospects.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

V2X Investment Narrative Recap

To be a shareholder in V2X, you need confidence in the company’s ability to convert its strong contract backlog into sustainable earnings amid a shifting defense landscape. The recent upswing in analyst earnings estimates, despite expectations for lower revenues, brings added attention to the August 4 quarterly report, but it does not fundamentally alter the near-term catalyst: delivering profitability even as contract transitions and margin pressures remain the key risk to watch.

Among recent announcements, the $118 million cost-plus-fixed-fee contract to support Iraq’s F-16 program is especially relevant, it bolsters V2X’s backlog but highlights the company’s continued reliance on lower-margin contract types, making margin expansion the central issue tied to both its risk profile and future earnings trajectory.

However, investors should also consider how setbacks in margin improvement initiatives could...

Read the full narrative on V2X (it's free!)

V2X's narrative projects $4.9 billion revenue and $150.4 million earnings by 2028. This requires 4.4% yearly revenue growth and a $108.8 million earnings increase from $41.6 million today.

Uncover how V2X's forecasts yield a $62.50 fair value, a 28% upside to its current price.

Exploring Other Perspectives

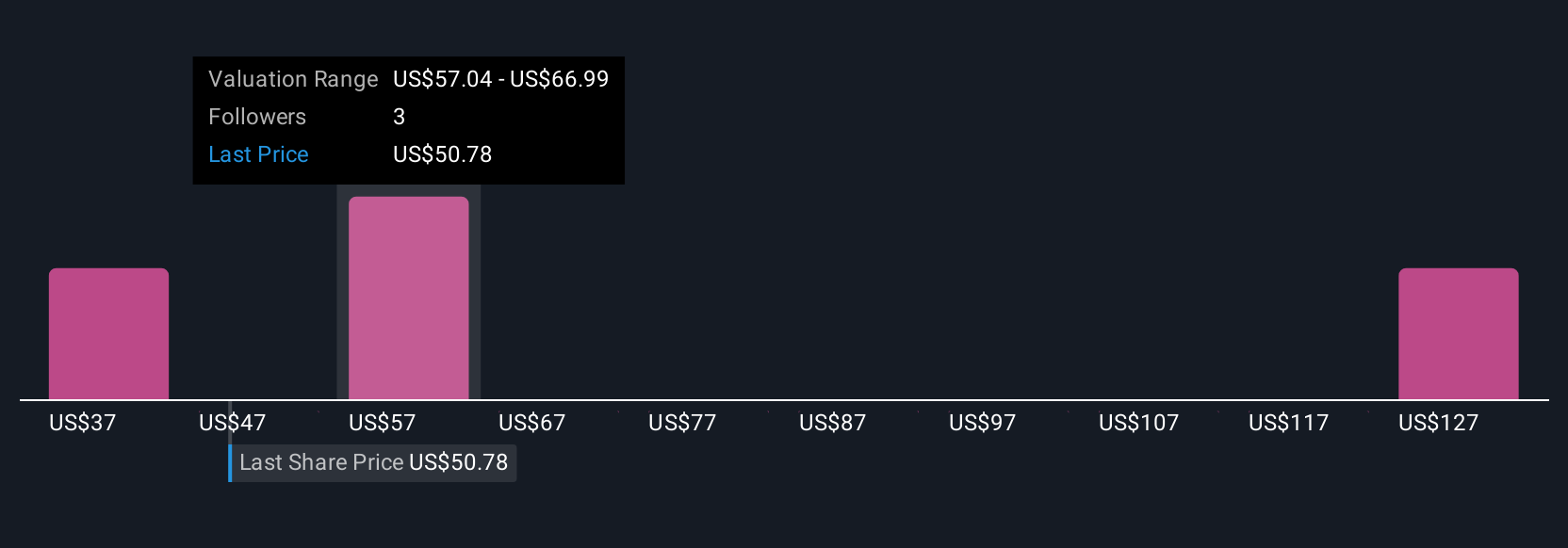

Four community members at Simply Wall St provided fair value estimates for V2X ranging from US$37.14 to US$143.30. With contract mix and margin pressures in focus, these kinds of differences show just how many ways market participants are weighing V2X’s outlook, be sure to consider several perspectives before making up your mind.

Explore 4 other fair value estimates on V2X - why the stock might be worth 24% less than the current price!

Build Your Own V2X Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your V2X research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free V2X research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate V2X's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VVX

V2X

Provides critical mission solutions and support services to defense customers worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives