- United States

- /

- Electrical

- /

- NYSE:VRT

Why Vertiv Holdings (VRT) Is Up 6.9% After Raising 2025 Outlook on Surging AI Data Center Demand

Reviewed by Sasha Jovanovic

- Vertiv Holdings Co recently reported third quarter 2025 results that exceeded expectations, raising full-year guidance for sales, operating profit, and earnings per share, driven by heightened demand for AI data centers.

- CEO Giordano Albertazzi highlighted increased investments in system integration and a vibrant M&A pipeline, underscoring the company's commitment to maintaining technology leadership and meeting the complexities of next-generation data center infrastructure.

- We'll explore how the raised guidance and accelerated AI-driven demand could reshape Vertiv's investment narrative going forward.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Vertiv Holdings Co Investment Narrative Recap

To be a shareholder in Vertiv Holdings Co today, you need conviction in the accelerating global demand for AI-powered data centers and the company's ability to lead with integrated technology solutions. The company's strong third-quarter report and raised guidance reinforce the short-term catalyst of robust AI-driven orders, while ongoing supply chain and operational challenges, especially from tariffs and EMEA execution, remain the most prominent risks. At this stage, the recent news is material to the catalysts but does not diminish the underlying risks.

Among recent announcements, Vertiv's expanded collaboration with NVIDIA to deliver 800 VDC power architectures stands out as a clear example of how the company is positioning itself at the leading edge of AI-centric data center demand. This advancement links directly to both the catalyst of market expansion and the ongoing need for substantial R&D investment, themes that are top of mind following the company’s upbeat earnings and sales outlook.

Yet, despite strong growth signals, a key risk for investors to keep in mind is the continued headwinds in EMEA and supply chain disruptions, which could persist longer than anticipated...

Read the full narrative on Vertiv Holdings Co (it's free!)

Vertiv Holdings Co is projected to reach $13.9 billion in revenue and $2.3 billion in earnings by 2028. This projection is based on an expected annual revenue growth rate of 15.2% and an earnings increase of $1.49 billion from current earnings of $812.3 million.

Uncover how Vertiv Holdings Co's forecasts yield a $173.11 fair value, a 7% downside to its current price.

Exploring Other Perspectives

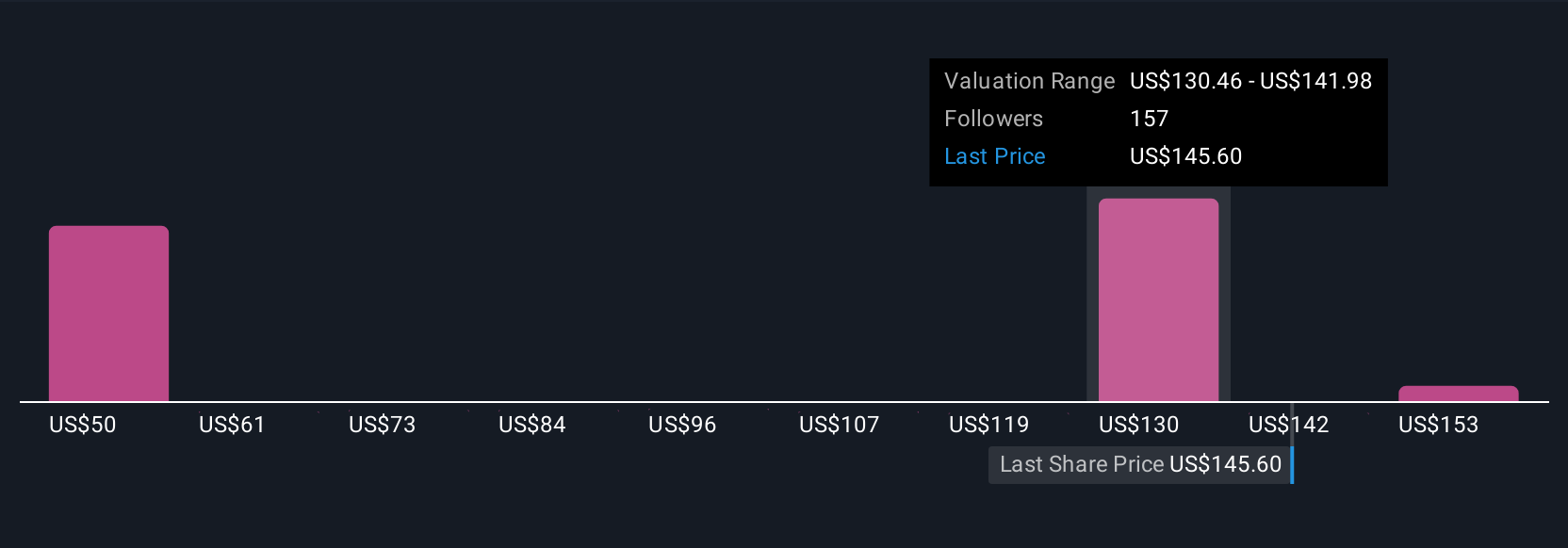

Fifteen private investors in the Simply Wall St Community see Vertiv’s fair value between US$116.63 and US$180.84 per share. Many are weighing strong backlog and AI-driven catalysts against persistent margin risks as they assess the company’s earnings trajectory.

Explore 15 other fair value estimates on Vertiv Holdings Co - why the stock might be worth 37% less than the current price!

Build Your Own Vertiv Holdings Co Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vertiv Holdings Co research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Vertiv Holdings Co research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vertiv Holdings Co's overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VRT

Vertiv Holdings Co

Designs, manufactures, and services critical digital infrastructure technologies and life cycle services for data centers, communication networks, and commercial and industrial environments in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives