- United States

- /

- Electrical

- /

- NYSE:VRT

Vertiv (VRT) Valuation in Focus After Bold 67% Dividend Hike and Upbeat Management Outlook

Reviewed by Simply Wall St

Vertiv Holdings (VRT) just announced a 67% jump in its annual cash dividend, raising it from $0.15 to $0.25 per share. This bold move follows strong financial results and signals management’s upbeat outlook on future earnings.

See our latest analysis for Vertiv Holdings Co.

Vertiv’s decisive dividend hike follows impressive momentum in the stock, with a 32% share price return over the last 90 days and an eye-popping three-year total shareholder return above 1,100%. While the share price has dipped 9% over the past week after its run-up, long-term holders have seen substantial gains. This has further fueled optimism around the company’s growth potential and the positive outlook that underpins management’s recent actions.

If you're curious about what other fast-growing, high-conviction stocks are catching attention right now, this is the perfect moment to explore fast growing stocks with high insider ownership.

After such a dramatic run-up and a bold dividend boost, the key question is whether Vertiv’s shares are trading at a bargain, or if the market has already built in all that future growth. Could this be a buying opportunity, or is optimism fully reflected in the price?

Most Popular Narrative: 11.3% Undervalued

Market watchers see Vertiv as priced below its fair value, with recent gains yet to fully reflect forward-looking expectations. A narrative gaining traction focuses on catalyst themes that are reshaping the company's value proposition and revenue mix.

Accelerating global demand for high-density, AI-driven data centers is driving robust growth in Vertiv's sales pipeline and backlog, as evidenced by recurring record order levels, backlog growth, and management's raised organic sales growth guidance, supporting potentially higher future revenue.

Want to know what makes analysts so bullish? It centers on a powerful set of trends in Vertiv’s end markets, and assumptions included in the future profit formula. Could this be the start of a valuation reset? The full narrative outlines the ambitious leap in margins and top-line expansion that are driving these models. Find out what numbers are turning heads.

Result: Fair Value of $192.66 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing supply chain disruptions and the threat of large customers insourcing solutions remain risks that could challenge Vertiv’s bullish growth narrative.

Find out about the key risks to this Vertiv Holdings Co narrative.

Another View: Multiples Suggest a Premium

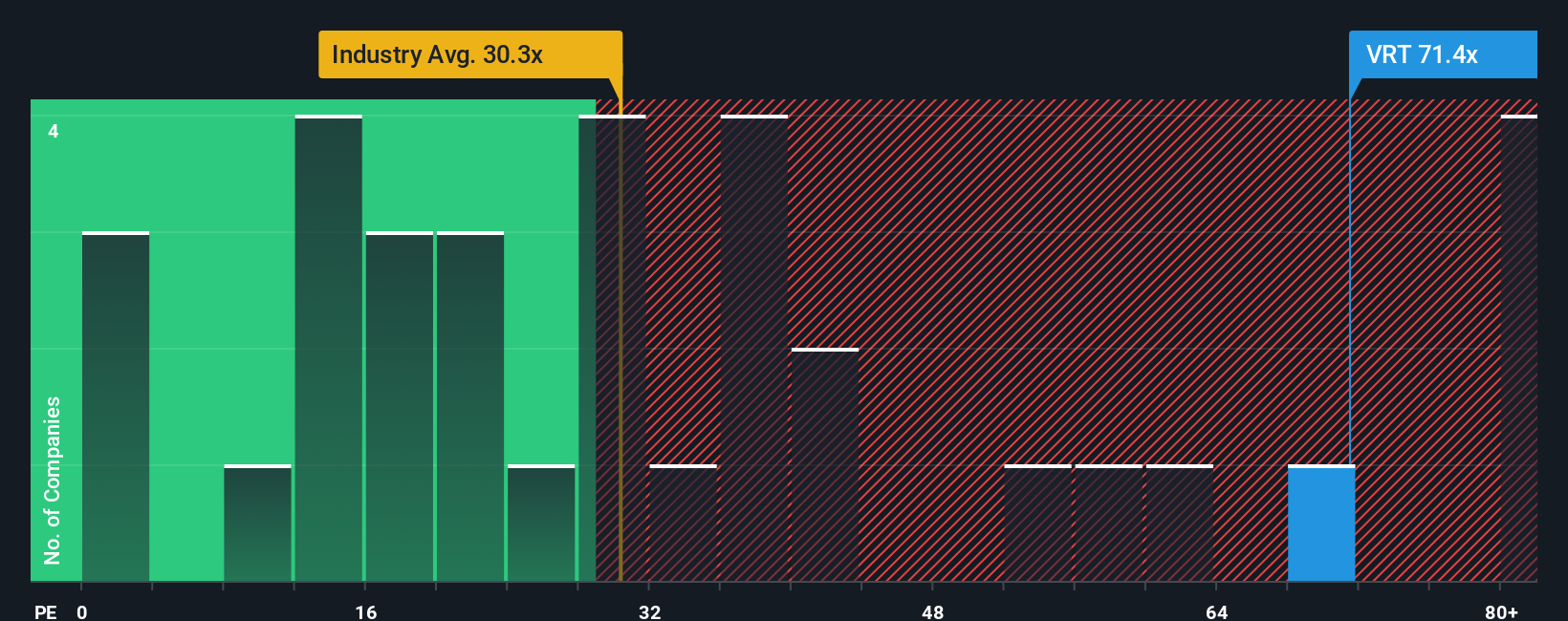

While models point to Vertiv trading below its fair value, the market is pricing the shares at a much steeper multiple than both industry peers and even its own fair ratio. At 63.2 times earnings, Vertiv stands well above the US Electrical sector average (28.4x) and peer average (36.3x). However, it aligns closely to its fair ratio (63.6x). This premium could signal investors are paying up for expected growth, yet it also introduces valuation risk if the future falls short.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vertiv Holdings Co Narrative

Not convinced by these conclusions, or ready to dig deeper for your own insights? It takes less than three minutes to build and shape your own story, so why not Do it your way.

A great starting point for your Vertiv Holdings Co research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don't miss your chance to get ahead of the crowd. Use the Simply Wall Street Screener now to spot unique stocks others might overlook.

- Uncover overlooked bargains when you tap into these 908 undervalued stocks based on cash flows, which is packed with potential for growth at attractive entry prices.

- Fuel your portfolio with future-facing business models by analyzing these 26 AI penny stocks, featuring companies making breakthroughs in artificial intelligence.

- Boost your passive income potential by finding these 16 dividend stocks with yields > 3%, a selection of stocks that consistently reward their shareholders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VRT

Vertiv Holdings Co

Designs, manufactures, and services critical digital infrastructure technologies and life cycle services for data centers, communication networks, and commercial and industrial environments in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives